Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4852

Pages:94

Published On:January 2026

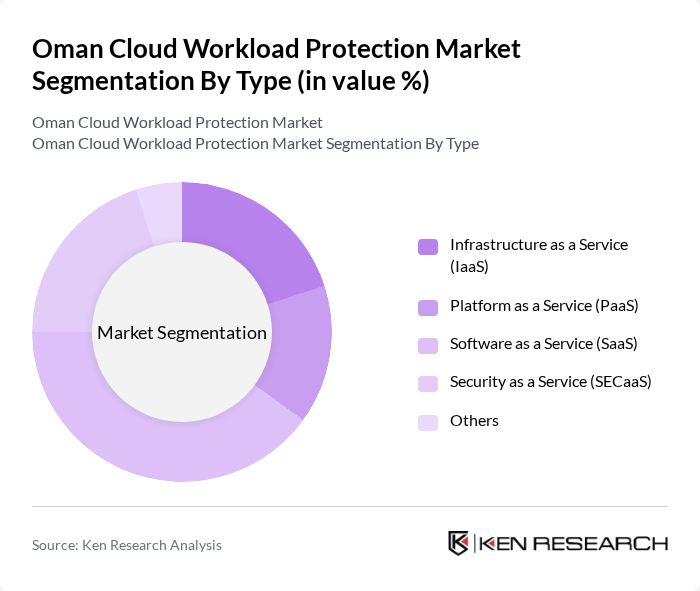

By Type:

The market is segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Security as a Service (SECaaS), and Others. Among these, the Software as a Service (SaaS) segment is dominating the market due to its flexibility, scalability, and cost-effectiveness. Businesses prefer SaaS solutions for their ease of deployment and management, allowing them to focus on core operations while ensuring robust security measures are in place. The increasing trend of remote work and the need for secure access to applications further bolster the demand for SaaS-based cloud workload protection solutions.

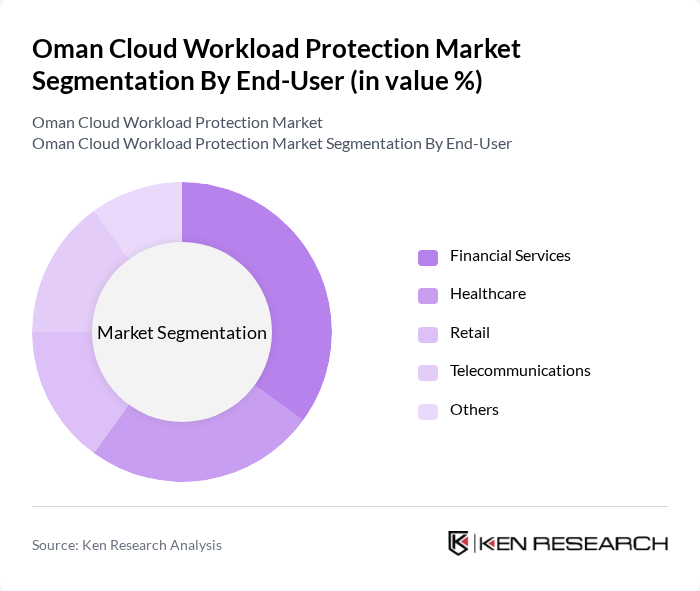

By End-User:

The end-user segmentation includes Financial Services, Healthcare, Retail, Telecommunications, and Others. The Financial Services sector is the leading segment, driven by stringent regulatory requirements and the need for robust security measures to protect sensitive customer data. Financial institutions are increasingly adopting cloud workload protection solutions to mitigate risks associated with data breaches and cyber threats. The growing trend of digital banking and online transactions further emphasizes the importance of securing cloud workloads in this sector.

The Oman Cloud Workload Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, IBM Corporation, Microsoft Corporation, Palo Alto Networks, Check Point Software Technologies, Fortinet, Inc., Trend Micro Incorporated, McAfee Corp., Cisco Systems, Inc., Sophos Ltd., CrowdStrike Holdings, Inc., Zscaler, Inc., Barracuda Networks, Inc., RSA Security LLC, Acronis International GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Cloud Workload Protection Market is poised for significant growth as businesses increasingly recognize the importance of robust security measures. With the anticipated rise in cloud adoption and the ongoing digital transformation, organizations will likely invest heavily in advanced security solutions. Additionally, the government’s focus on enhancing cybersecurity regulations will drive compliance efforts, creating a favorable environment for market players. As a result, the landscape will evolve, emphasizing innovative technologies and strategic partnerships to address emerging threats effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Security as a Service (SECaaS) Others |

| By End-User | Financial Services Healthcare Retail Telecommunications Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Security Type | Network Security Application Security Data Security Endpoint Security Others |

| By Industry Vertical | Government Education Manufacturing Energy and Utilities Others |

| By Service Model | Managed Services Professional Services Consulting Services Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud Security | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 80 | Healthcare IT Directors, Data Protection Officers |

| Government Cloud Initiatives | 70 | Government IT Administrators, Cybersecurity Analysts |

| Education Sector Cloud Adoption | 60 | IT Managers, Educational Technology Coordinators |

| SME Cloud Workload Protection | 90 | Small Business Owners, IT Consultants |

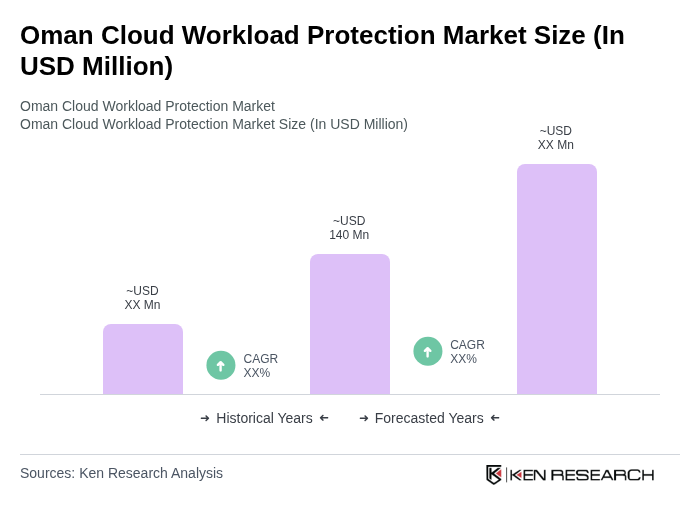

The Oman Cloud Workload Protection Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increased cloud service adoption and heightened cybersecurity awareness among businesses in the region.