Region:Asia

Author(s):Geetanshi

Product Code:KRAA4808

Pages:97

Published On:January 2026

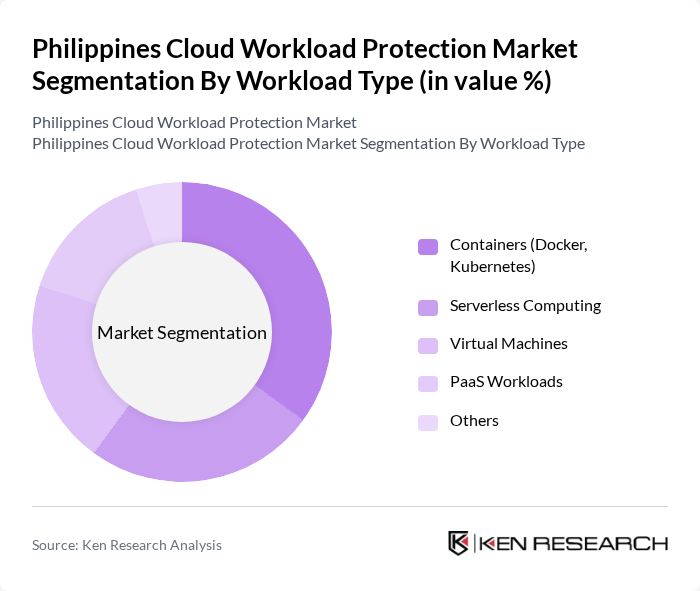

By Workload Type:The workload type segmentation includes Containers (Docker, Kubernetes), Serverless Computing, Virtual Machines, PaaS Workloads, and Others. Among these, Containers (Docker, Kubernetes) are leading the market due to their flexibility and efficiency in managing applications. The growing trend of microservices architecture and the need for scalable solutions are driving the adoption of containerization in enterprises.

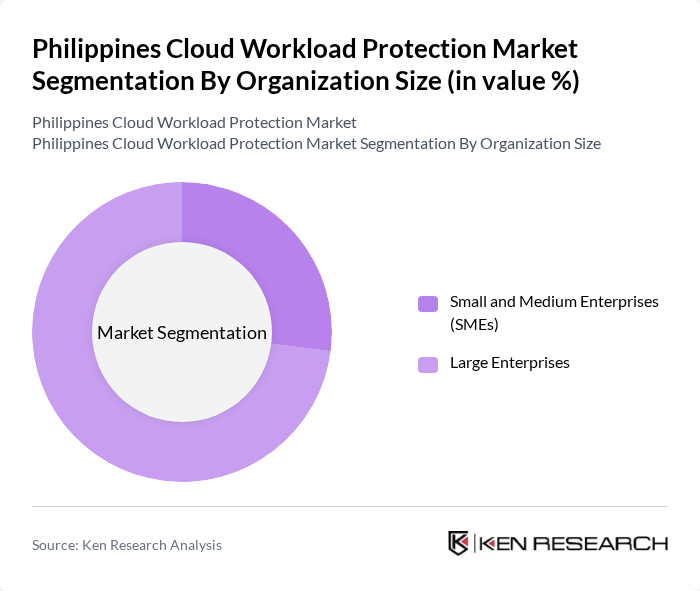

By Organization Size:The organization size segmentation includes Small and Medium Enterprises (SMEs) and Large Enterprises. Large enterprises command a dominant market position, driven by rising cybersecurity threats and stringent regulatory compliance requirements. SMEs are increasingly adopting cloud workload protection solutions due to the affordability and scalability of cloud services. The growing awareness of cybersecurity threats among SMEs is driving their investment in cloud security solutions, making them a significant growth segment in the market.

The Philippines Cloud Workload Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro, Palo Alto Networks, Fortinet, McAfee, IBM Security, Cisco Systems, Check Point Software Technologies, Sophos, Microsoft Azure Security, Amazon Web Services (AWS) Security, Google Cloud Security, Zscaler, CrowdStrike, Broadcom (Symantec), SentinelOne contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines cloud workload protection market appears promising, driven by technological advancements and increasing regulatory pressures. As businesses continue to embrace digital transformation, the integration of artificial intelligence in security solutions is expected to enhance threat detection and response capabilities. Additionally, the rise of managed security service providers will likely offer more accessible and cost-effective solutions, enabling organizations to better protect their cloud environments while navigating compliance challenges.

| Segment | Sub-Segments |

|---|---|

| By Workload Type | Containers (Docker, Kubernetes) Serverless Computing Virtual Machines PaaS Workloads Others |

| By Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Industry Vertical | BFSI Government and Defense Healthcare IT and Telecom Retail Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Service Type | Agent-based Protection Agentless Protection Threat Detection and Response Vulnerability Management Others |

| By Component | Solutions Services |

| By Region | Luzon Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud Security | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 80 | Healthcare IT Directors, Data Privacy Officers |

| Retail Cloud Workload Management | 70 | Operations Managers, IT Administrators |

| Government Cloud Security Initiatives | 60 | Public Sector IT Managers, Cybersecurity Analysts |

| SME Cloud Adoption Trends | 90 | Small Business Owners, IT Consultants |

The Philippines Cloud Workload Protection Market is valued at approximately USD 1.3 billion, driven by the increasing adoption of cloud services, heightened cybersecurity awareness, and regulatory compliance needs among businesses.