Region:Asia

Author(s):Geetanshi

Product Code:KRAA4949

Pages:96

Published On:January 2026

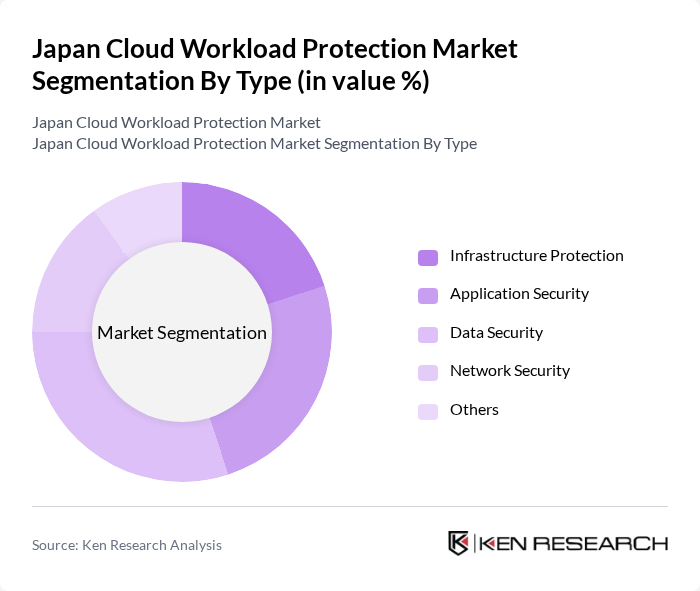

By Type:

The subsegments under this category include Infrastructure Protection, Application Security, Data Security, Network Security, and Others. Among these, Data Security is currently dominating the market due to the increasing volume of sensitive data being processed in cloud environments. Organizations are prioritizing data protection to comply with stringent regulations and to mitigate risks associated with data breaches. The rising trend of remote work and digital transformation has further amplified the need for robust data security solutions, making it a critical focus area for businesses.

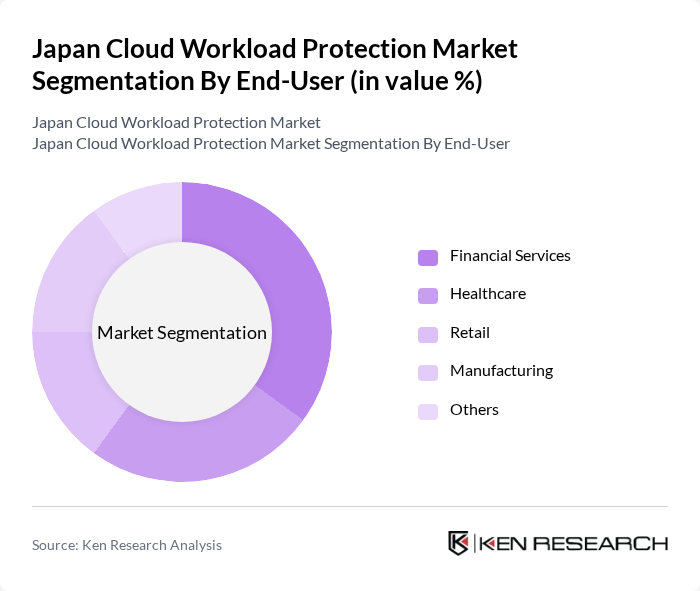

By End-User:

This category includes Financial Services, Healthcare, Retail, Manufacturing, and Others. The Financial Services sector is leading the market, driven by the stringent regulatory requirements for data protection and the high value of sensitive financial data. Financial institutions are increasingly adopting cloud workload protection solutions to safeguard customer information and ensure compliance with regulations such as the Financial Instruments and Exchange Act. The growing trend of digital banking and online transactions further necessitates robust security measures in this sector.

The Japan Cloud Workload Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trend Micro, Fujitsu, NEC Corporation, NTT Security, Hitachi Systems, SoftBank Technology, CyberAgent, A10 Networks, SCSK Corporation, Secureworks, Palo Alto Networks, Cisco Systems, IBM Japan, Microsoft Japan, Amazon Web Services (AWS) Japan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan Cloud Workload Protection Market appears promising, driven by the increasing integration of advanced technologies such as artificial intelligence and machine learning. These innovations are expected to enhance threat detection and response capabilities, making security solutions more effective. Additionally, as businesses continue to embrace multi-cloud strategies, the demand for comprehensive protection across diverse environments will grow, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure Protection Application Security Data Security Network Security Others |

| By End-User | Financial Services Healthcare Retail Manufacturing Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) Others |

| By Industry Vertical | Government Education Telecommunications Energy Others |

| By Security Type | Threat Detection Incident Response Compliance Management Others |

| By Region | Kanto Kansai Chubu Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud Security | 100 | IT Security Managers, Compliance Officers |

| Healthcare Data Protection | 80 | Chief Information Officers, Data Protection Officers |

| Manufacturing Cloud Workload Solutions | 70 | Operations Managers, IT Directors |

| Retail Sector Cloud Adoption | 90 | eCommerce Managers, IT Security Analysts |

| Government Cloud Security Initiatives | 60 | Policy Makers, IT Security Consultants |

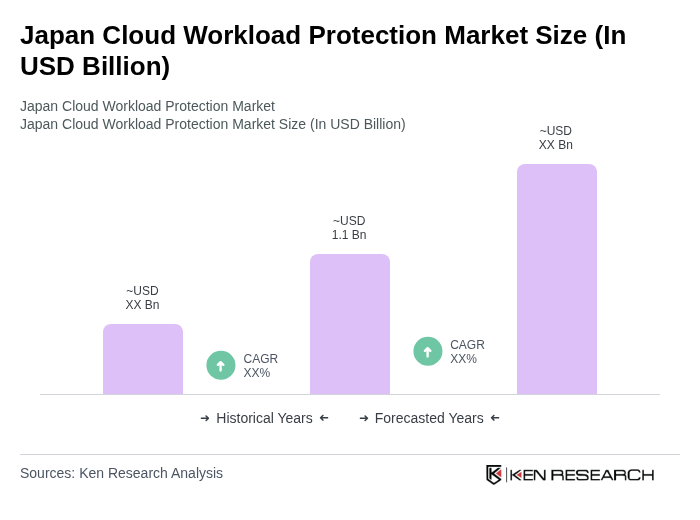

The Japan Cloud Workload Protection Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased cloud service adoption, cybersecurity awareness, and compliance with data protection regulations.