Region:Middle East

Author(s):Shubham

Product Code:KRAA8627

Pages:86

Published On:November 2025

By Type:The edible packaging market can be segmented into various types, including edible films, edible coatings, edible wrappers, edible containers, edible sachets & capsules, and others. Among these, edible films and coatings are gaining significant traction due to their versatility and ability to enhance the shelf life of food products. The increasing demand for convenience and ready-to-eat food items is further driving the growth of these subsegments. Recent innovations in composite films and sensory-focused coatings are strengthening consumer engagement and differentiation .

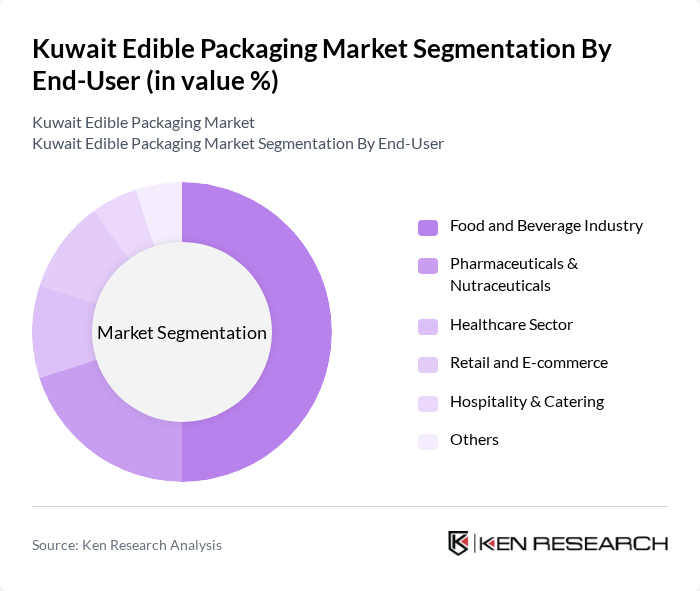

By End-User:The edible packaging market serves various end-user segments, including the food and beverage industry, pharmaceuticals & nutraceuticals, healthcare sector, retail and e-commerce, hospitality & catering, and others. The food and beverage industry is the leading segment, driven by the increasing demand for sustainable packaging solutions that cater to health-conscious consumers and the growing trend of organic and natural products. The pharmaceutical and nutraceutical sectors are also adopting edible packaging for dosage control and safety, while retail and hospitality segments leverage these solutions for branding and waste reduction .

The Kuwait Edible Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Notpla Ltd., Evoware, Monosol (Kuraray Co., Ltd.), WikiCell Designs Inc., Lactips, Nagase Group, Mantrose-Haeuser Co., Inc., Tipa Corp., JRF Technology LLC, Blest Co., Ltd., Devro plc, EnviGreen Biotech, BASF SE, Tate & Lyle PLC, Ingredion Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the edible packaging market in Kuwait appears promising, driven by increasing consumer demand for sustainable solutions and supportive government policies. As awareness of food safety and environmental issues continues to rise, manufacturers are likely to invest more in research and development. Innovations in materials and production processes will enhance the appeal of edible packaging, making it a viable alternative to traditional options. The market is expected to evolve rapidly, with new products and applications emerging to meet consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Edible Films Edible Coatings Edible Wrappers Edible Containers Edible Sachets & Capsules Others |

| By End-User | Food and Beverage Industry Pharmaceuticals & Nutraceuticals Healthcare Sector Retail and E-commerce Hospitality & Catering Others |

| By Material | Plant-based Materials (e.g., starch, cellulose, proteins) Seaweed & Algae-based Materials Polysaccharide-based Materials Lipid-based Materials Protein-based Materials (e.g., gelatin, soy protein, milk protein) Others |

| By Application | Snacks and Confectionery Dairy Products Bakery Products Meat, Poultry & Seafood Fruits & Vegetables Beverage Packaging Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Direct Sales (B2B) Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Eastern Kuwait Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 60 | Production Managers, Quality Assurance Officers |

| Retail Sector Insights | 50 | Store Managers, Product Buyers |

| Consumer Preferences Survey | 120 | General Consumers, Eco-conscious Shoppers |

| Food Packaging Suppliers | 40 | Sales Representatives, Product Development Managers |

| Regulatory Bodies Feedback | 40 | Policy Makers, Environmental Compliance Officers |

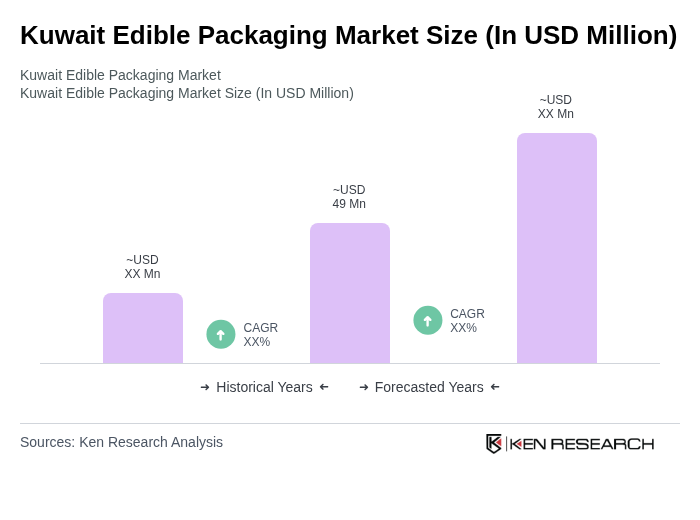

The Kuwait Edible Packaging Market is valued at approximately USD 49 million, reflecting a growing trend towards sustainable and eco-friendly packaging solutions driven by consumer awareness and government regulations.