Region:Middle East

Author(s):Shubham

Product Code:KRAD2605

Pages:85

Published On:January 2026

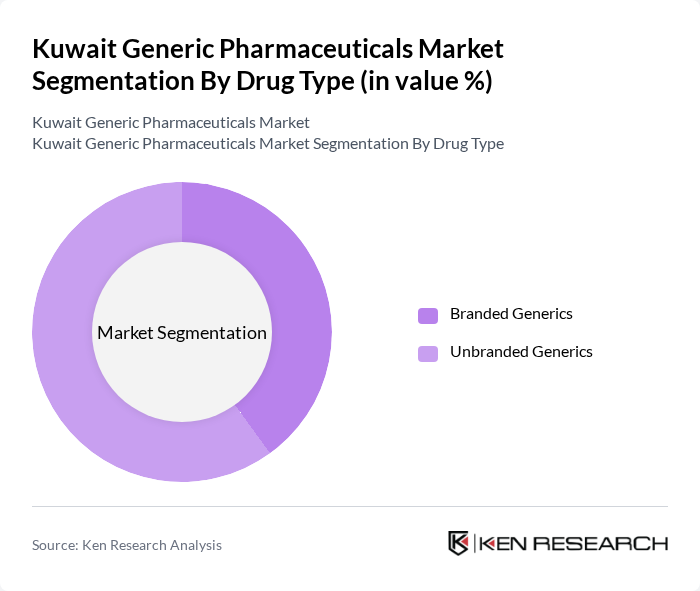

By Drug Type:The market is segmented into Branded Generics and Unbranded Generics, in line with the structure used in regional generic drug analyses. Branded generics are often preferred due to their perceived quality, established manufacturer reputation, and stronger promotion among prescribers, while unbranded generics are gaining traction due to their cost-effectiveness, particularly in chronic therapy areas with high prescription volumes. In Kuwait’s generic pharmaceuticals contract manufacturing segment, branded generics currently account for a larger revenue share; however, unbranded generics are registering faster growth as payers and healthcare providers place greater emphasis on cost containment and formulary optimization. The unbranded generics segment is increasingly relevant in high-burden disease areas where patients and insurers prioritize affordability.

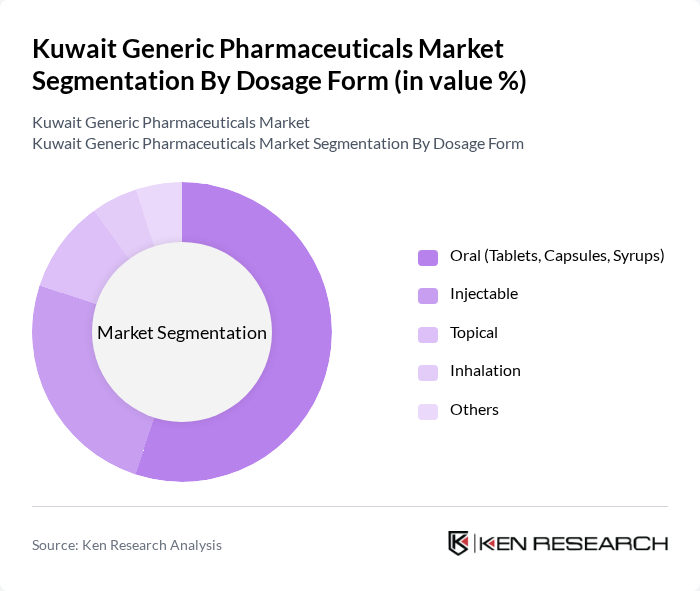

By Dosage Form:The market is categorized into Oral (Tablets, Capsules, Syrups), Injectable, Topical, Inhalation, and Others, which is consistent with the dominant formulation mix in Kuwait’s broader pharmaceutical and generic manufacturing landscape. Oral dosage forms dominate the market due to their convenience, patient preference, and suitability for mass production and chronic disease management, making them the preferred choice among patients and healthcare providers. The injectable segment is also significant, particularly for hospital-based care, critical and acute conditions, and certain chronic therapies requiring parenteral administration. The trend towards self-administration of certain injectables (for example, in diabetes and autoimmune disorders) and the expansion of outpatient and home-care services are expected to further support this segment.

The Kuwait Generic Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Kuwait Pharmaceutical Industries Company (KPI), Gulf Pharmaceutical Industries (Julphar), Hikma Pharmaceuticals, Tabuk Pharmaceuticals, SPIMACO Addwaeih, Bayer Consumer Health / Pharmaceuticals (Kuwait Operations), Pfizer (Kuwait Operations), Novartis (Sandoz / Generics Portfolio in Kuwait), Kuwait Life Sciences Company (KLSC), Al Mulla Group – Healthcare & Pharmaceuticals Division, YIACO Medical Company, Kayan Health Company, Abdi ?brahim ?laç Sanayi ve Ticaret A.?., Neopharma (GCC Operations Including Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Kuwait generic pharmaceuticals market appears promising, driven by increasing healthcare expenditure and government support for generics. As the population ages and chronic diseases rise, the demand for affordable medications will likely intensify. Additionally, advancements in technology and drug development are expected to enhance the efficiency of generic drug production, making it easier for companies to enter the market and meet consumer needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Drug Type | Branded Generics Unbranded Generics |

| By Dosage Form | Oral (Tablets, Capsules, Syrups) Injectable Topical Inhalation Others |

| By Therapeutic Area | Cardiovascular Diseases Anti-Infectives Central Nervous System Disorders Diabetes and Metabolic Disorders Oncology Respiratory Diseases Others |

| By End-User | Public Hospitals and Clinics Private Hospitals and Clinics Retail Pharmacies Online / E-Pharmacies Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Government Procurement / Tenders Wholesalers & Distributors Others |

| By Source of Manufacture | Locally Manufactured Imported |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Sector Insights | 120 | Pharmacy Owners, Pharmacists |

| Healthcare Provider Perspectives | 90 | Doctors, Nurses, Healthcare Administrators |

| Patient Attitudes Towards Generics | 100 | Patients, Caregivers |

| Regulatory Insights | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Market Trends and Forecasts | 70 | Market Analysts, Industry Experts |

The Kuwait Generic Pharmaceuticals Market is valued at approximately USD 1.0 billion, reflecting a significant share within the overall pharmaceutical market and contract manufacturing segment in the country.