Region:Asia

Author(s):Shubham

Product Code:KRAD2608

Pages:99

Published On:January 2026

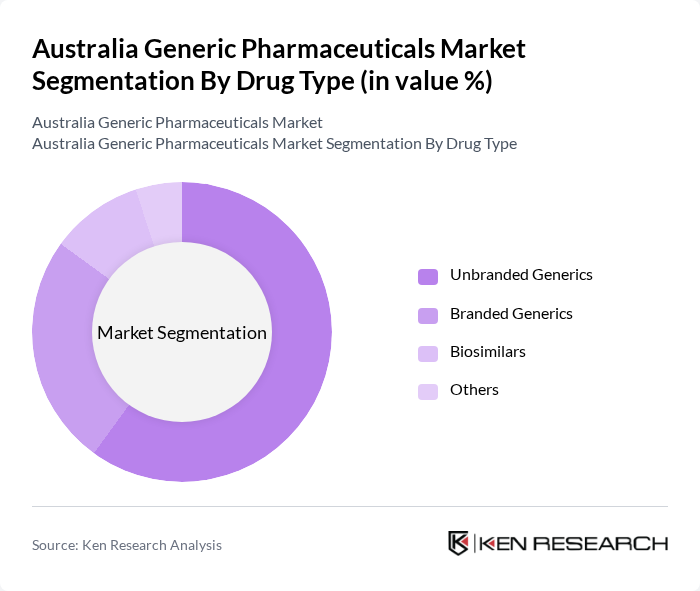

By Drug Type:The market is segmented into Unbranded Generics, Branded Generics, Biosimilars, and Others. Unbranded generics dominate the market in terms of prescription volume on the PBS, driven by mandatory or encouraged generic substitution at the pharmacy level and strong price competition after patent expiry. The increasing focus on cost containment in healthcare has led to a surge in the adoption of unbranded generics, which offer the same therapeutic benefits as their originator counterparts at a lower price, particularly in high-volume classes such as cardiovascular, central nervous system, diabetes, and respiratory therapies. Branded generics and biosimilars are also gaining traction, particularly in therapeutic areas such as oncology, rheumatology, and autoimmune diseases, where complex molecules and biologic therapies are increasingly subject to biosimilar competition and where payers seek further savings.

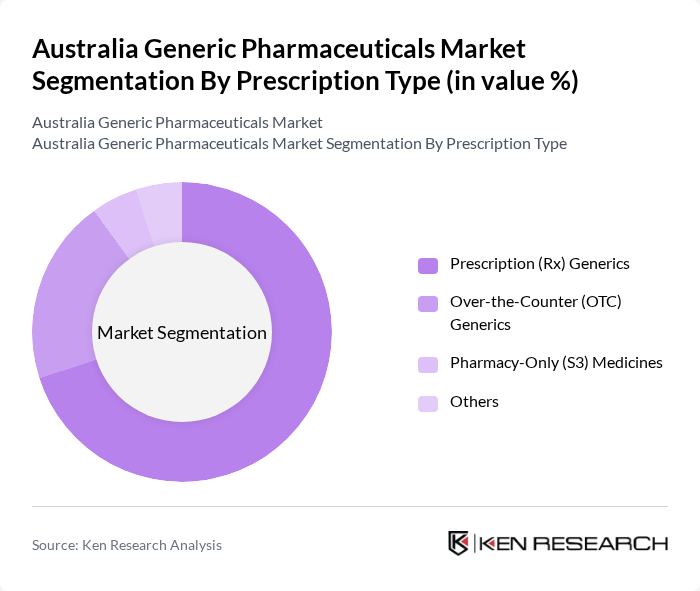

By Prescription Type:The market is categorized into Prescription (Rx) Generics, Over-the-Counter (OTC) Generics, Pharmacy-Only (S3) Medicines, and Others. Prescription generics hold the largest share, supported by the high burden of chronic diseases such as cardiovascular disorders, diabetes, respiratory diseases, and cancer, and by PBS-reimbursed prescribing patterns that favor cost-effective generic alternatives. OTC generics are also witnessing growth as consumers become more health-conscious, increasingly use self-care products, and seek affordable alternatives for common ailments such as pain, allergy, and gastrointestinal conditions, particularly in supermarket and pharmacy chains. The pharmacy-only segment (Schedule 3, Pharmacist Only Medicines) is expanding in line with regulatory up-scheduling and down-scheduling decisions that enable certain medicines to be supplied without a prescription under pharmacist supervision, increasing access to cost-effective generic options and further boosting the market.

The Australia Generic Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apotex Pty Ltd, Viatris (including legacy Mylan), Sandoz Australia, Teva Pharmaceutical Industries Ltd, Fresenius Kabi Australia, Arrotex Pharmaceuticals (including Sigma Healthcare generics portfolio), Pfizer Australia – Generics & Established Products, Viatris (Hospira injectable generics portfolio), AFT Pharmaceuticals, Generic Health Pty Ltd, Biocon Biologics (Biosimilars), Sun Pharmaceutical Industries Ltd, Hetero Labs Ltd, Dr. Reddy’s Laboratories Ltd, and other emerging domestic and regional generic players contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian generic pharmaceuticals market appears promising, driven by ongoing demographic changes and government support. As the population ages and healthcare costs continue to rise, the demand for affordable medications is expected to grow. Additionally, advancements in digital health technologies and telehealth services are likely to enhance access to generic drugs, further expanding their market presence. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Drug Type | Unbranded Generics Branded Generics Biosimilars Others |

| By Prescription Type | Prescription (Rx) Generics Over-the-Counter (OTC) Generics Pharmacy-Only (S3) Medicines Others |

| By Route of Administration | Oral Parenteral (Injectable) Topical Inhalation Others |

| By Therapeutic Class | Cardiovascular Central Nervous System Anti-infectives Oncology Respiratory Gastrointestinal & Metabolic Musculoskeletal Others |

| By End-User | Public Hospitals Private Hospitals Retail Community Pharmacies Online Pharmacies / E-Pharmacy Clinics & Day Surgery Centres Others |

| By Distribution Channel | Direct Tender / Institutional Sales Pharmaceutical Wholesalers Pharmacy Banner Groups Online Platforms Others |

| By Region | Australian Capital Territory & New South Wales Victoria & Tasmania Queensland Northern Territory & South Australia Western Australia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Retail Sector | 120 | Pharmacy Owners, Pharmacists |

| Generic Drug Manufacturers | 90 | Production Managers, Quality Assurance Heads |

| Healthcare Providers | 80 | General Practitioners, Specialists |

| Pharmaceutical Distributors | 70 | Supply Chain Managers, Sales Directors |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Australia Generic Pharmaceuticals Market is valued at approximately AUD 7.5 billion, reflecting a significant growth driven by the demand for cost-effective medication alternatives and government initiatives promoting affordable healthcare solutions.