Region:Middle East

Author(s):Shubham

Product Code:KRAD2607

Pages:90

Published On:January 2026

By Product Type:The product type segmentation includes Prescription Generics, Over-the-Counter (OTC) Generics, Biosimilars, and Others. Prescription Generics account for a significant share of the generic segment, supported by the high prevalence of chronic diseases and the dominance of prescription medicines in Bahrain and the wider Middle East pharmaceutical market. OTC Generics are gaining traction as consumers become more health-conscious and increasingly use pharmacy retail channels for minor ailments. Biosimilars are emerging as a growing segment in line with the broader regional trend toward biologics and cost-effective alternatives for oncology, autoimmune, and other high-cost therapies.

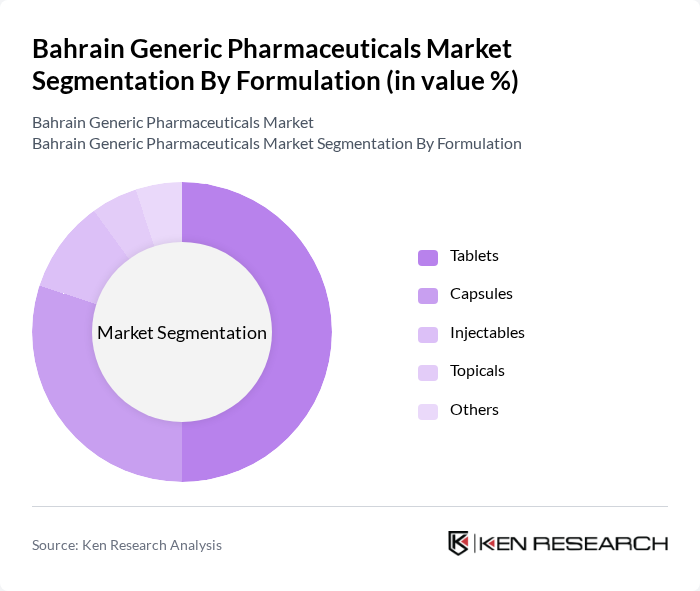

By Formulation:The formulation segmentation includes Tablets, Capsules, Injectables, Topicals, and Others. Tablets are the leading formulation type in line with the overall pharmaceutical market structure, reflecting their convenience, ease of administration, and cost-effectiveness for chronic and acute therapies. Capsules follow, supported by patient preference and improved compliance for certain therapies. Injectables are important for hospital-based care and complex therapies, including oncology and biologics, while topicals are widely used in dermatology and pain management. The "Others" category includes syrups, suspensions, and specialized dosage forms that cater to pediatric, geriatric, and niche therapeutic needs.

The Bahrain Generic Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Pharmaceutical Industries (Julphar), Bahrain Pharma, Aster DM Healthcare, Hikma Pharmaceuticals, Julphar Gulf Pharmaceutical Industries – Bahrain Operations, Bahrain Medical Supplies, United Pharmaceutical Manufacturing Company, Badr Al Samaa Group, Al-Dawaa Pharmacies, Bahrain Specialist Hospital (Pharmacy Services), Royal Bahrain Hospital (Pharmacy Services), Ibn Al-Nafis Hospital (Pharmacy Services), Al-Muhaidib Group, and Regional Multinational Generics Players (e.g., Aspen, Tabuk Pharma) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain generic pharmaceuticals market appears promising, driven by increasing healthcare investments and a growing emphasis on cost-effective treatment options. As the government continues to support local production and regulatory frameworks evolve, opportunities for innovation and market expansion will arise. Additionally, the rising adoption of digital health solutions and e-pharmacies is expected to enhance accessibility, further driving the demand for generic medications in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Generics Over-the-Counter (OTC) Generics Biosimilars Others |

| By Formulation | Tablets Capsules Injectables Topicals Others |

| By Therapeutic Area | Cardiovascular Anti-Infectives Central Nervous System Metabolic & Endocrine (incl. Diabetes) Gastrointestinal Others |

| By Distribution Channel | Retail Pharmacies Hospital Pharmacies Clinics & Health Centers Online Pharmacies Others |

| By End User | Public Sector (MOH & Government Hospitals) Private Hospitals & Clinics Retail Chains & Independent Pharmacies Others |

| By Route of Administration | Oral Parenteral Topical Others |

| By Manufacturing Origin | Locally Manufactured Imported from GCC Imported from Rest of World Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Retail Market | 100 | Pharmacy Owners, Retail Pharmacists |

| Healthcare Provider Insights | 80 | General Practitioners, Specialists |

| Generic Drug Distribution | 70 | Wholesale Distributors, Supply Chain Managers |

| Patient Experience and Preferences | 90 | Patients, Caregivers |

| Regulatory Compliance Feedback | 60 | Regulatory Affairs Managers, Compliance Officers |

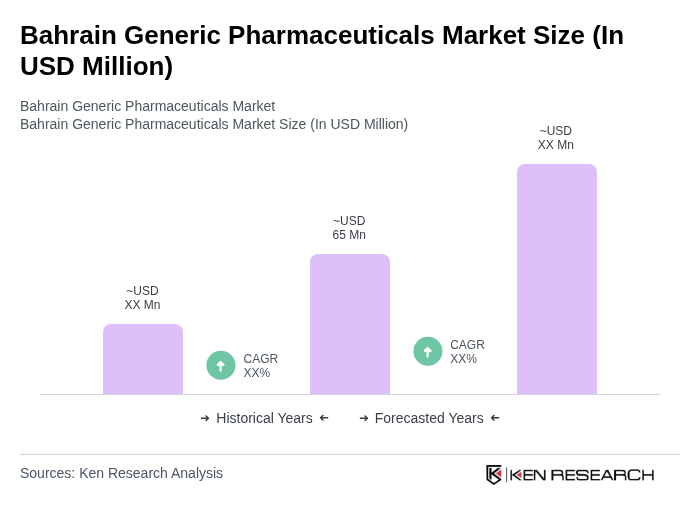

The Bahrain Generic Pharmaceuticals Market is valued at approximately USD 65 million, representing a significant portion of the overall pharmaceutical market in Bahrain, which is around USD 170 million. This growth is driven by the increasing demand for affordable medications.