Region:Asia

Author(s):Shubham

Product Code:KRAD2609

Pages:95

Published On:January 2026

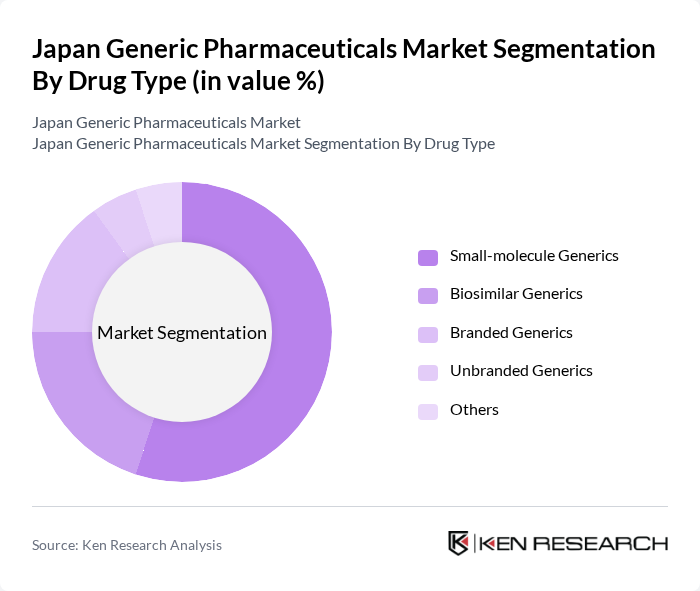

By Drug Type:The market is segmented into various drug types, including small-molecule generics, biosimilar generics, branded generics, unbranded generics, and others. Small-molecule generics represent the largest share of the generic segment, consistent with the dominance of conventional small-molecule drugs in the broader Japanese pharmaceutical market and their extensive use in managing chronic conditions. The increasing focus on cost-effective treatment options, particularly for long-term therapies in an aging population, has led to a surge in the production and prescription of these generics, making them a preferred choice for both healthcare providers and patients.

By Therapeutic Area:The therapeutic areas covered in the market include cardiovascular, oncology, central nervous system, anti-infectives, gastrointestinal, respiratory, and others. The cardiovascular segment is a leading application area for generics in Japan, reflecting the high prevalence of hypertension, dyslipidemia, and other cardiovascular diseases in an aging society and the need for long-term, cost-effective pharmacotherapy. Oncology, central nervous system disorders, and anti-infectives also represent major segments where patent expiries and cost-containment policies encourage the use of generics and biosimilars, and where hospital and retail pharmacies play a key role in driving generic substitution.

The Japan Generic Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sawai Pharmaceutical Co., Ltd., Nichi-Iko Pharmaceutical Co., Ltd., Towa Pharmaceutical Co., Ltd., Nippon Chemiphar Co., Ltd., Meiji Seika Pharma Co., Ltd., Nichi-Iko Group (Elmed Eisai Co., Ltd., others), Daiichi Sankyo Espha Co., Ltd., Takeda Pharmaceutical Company Limited (Generics & Off-patent Portfolio), Astellas Pharma Inc. (Generics & Off-patent Portfolio), Pfizer Japan Inc. (Generics/Off-patent), Teva Pharmaceutical Industries Ltd. / Teva Takeda Pharma Ltd., Sandoz K.K., Kyowa Kirin Co., Ltd. (Generic/Biosimilar Portfolio), Chugai Pharmaceutical Co., Ltd. (Biosimilars & Off-patent), Otsuka Pharmaceutical Co., Ltd. (Generics & Affiliates) contribute to innovation, geographic expansion, and service delivery in this space, with several of these companies highlighting generic drug demand growth and industry restructuring opportunities in their strategic disclosures.

The future of the Japan generic pharmaceuticals market appears promising, driven by ongoing government support and an increasing focus on cost-effective healthcare solutions. As the aging population continues to grow, the demand for generics is expected to rise significantly. Additionally, advancements in digital health technologies and personalized medicine are likely to reshape the market landscape, enhancing patient engagement and treatment outcomes while promoting the adoption of generics in various therapeutic areas.

| Segment | Sub-Segments |

|---|---|

| By Drug Type | Small-molecule Generics Biosimilar Generics Branded Generics Unbranded Generics Others |

| By Therapeutic Area | Cardiovascular Oncology Central Nervous System Anti-infectives Gastrointestinal Respiratory Others |

| By Route of Administration | Oral Parenteral (Injectables) Topical Inhalation Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Wholesalers/Distributors Others |

| By Prescription Type | Prescription (Rx) Generics Over-the-Counter (OTC) Generics Hospital-only Formulary Generics Others |

| By Source | Domestically Manufactured Imported Contract Manufactured (CMO/CDMO) Others |

| By Region | Kanto Kansai/Kinki Chubu (Central) Kyushu-Okinawa Tohoku Chugoku Hokkaido Shikoku |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmacy Sector Insights | 120 | Pharmacy Owners, Pharmacists |

| Healthcare Provider Perspectives | 100 | Doctors, Healthcare Administrators |

| Generic Drug Manufacturers | 80 | Product Managers, Regulatory Affairs Specialists |

| Patient Experience Surveys | 100 | Patients using generic medications, Caregivers |

| Market Access and Pricing Strategies | 60 | Market Access Managers, Pricing Analysts |

The Japan Generic Pharmaceuticals Market is valued at approximately USD 12.0 billion, driven by the increasing demand for cost-effective medication alternatives and government initiatives promoting generic drug utilization, which now accounts for around 80% of prescription volume at pharmacies.