Region:Middle East

Author(s):Dev

Product Code:KRAD7822

Pages:87

Published On:December 2025

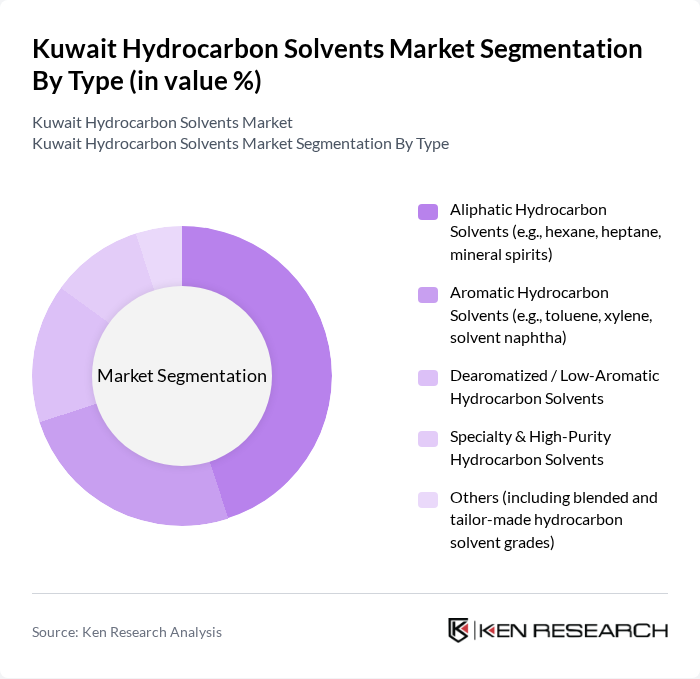

By Type:The hydrocarbon solvents market can be segmented into various types, including Aliphatic Hydrocarbon Solvents, Aromatic Hydrocarbon Solvents, Dearomatized / Low-Aromatic Hydrocarbon Solvents, Specialty & High-Purity Hydrocarbon Solvents, and Others. This structure is consistent with global market classifications, where aliphatic, aromatic, and dearomatized grades represent the core product families. Among these, Aliphatic Hydrocarbon Solvents, such as hexane, heptane, and mineral spirits, generally account for the largest share worldwide due to their extensive use in industrial applications, particularly in paints, coatings, cleaning, and adhesives. In Kuwait, demand for these solvents is driven by their effectiveness in dissolving oils and fats, their compatibility with resin systems, and their role as process and formulation solvents across manufacturing processes in construction, metalworking, and general industry.

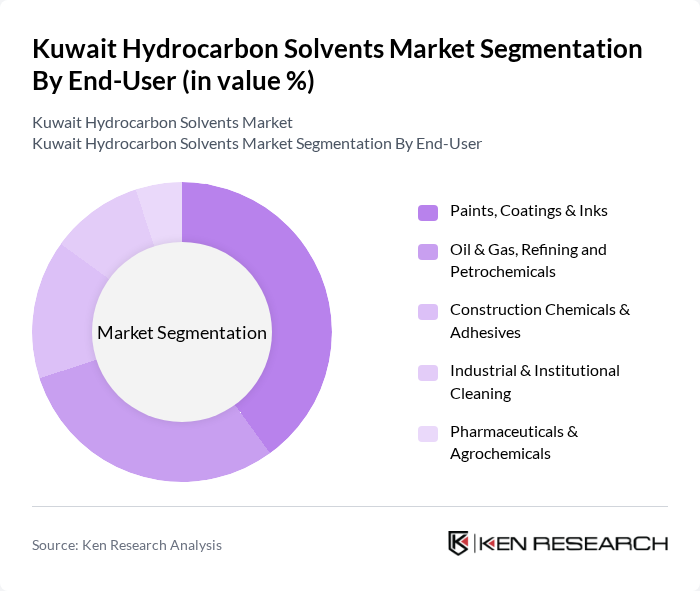

By End-User:The end-user segmentation includes Paints, Coatings & Inks, Oil & Gas, Refining and Petrochemicals, Construction Chemicals & Adhesives, Industrial & Institutional Cleaning, Pharmaceuticals & Agrochemicals, and Others. This breakdown reflects the main consuming sectors highlighted for Kuwait and the wider Middle East solvents market, where paints and coatings, oil and gas, and chemicals are the key demand centers. The Paints, Coatings & Inks segment is the leading end-user, driven by the growing construction and infrastructure pipeline in Kuwait, along with demand from automotive refinishing and industrial maintenance coatings. The demand for high-quality finishes, corrosion protection, and weather-resistant coatings in these sectors significantly boosts the consumption of hydrocarbon solvents, while formulation shifts toward lower-VOC and high-solids systems are gradually reshaping solvent choice and loading levels.

The Kuwait Hydrocarbon Solvents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait National Petroleum Company (KNPC), Kuwait Petroleum Corporation (KPC), Petrochemical Industries Company K.S.C. (PIC), Kuwait Oil Company (KOC), EQUATE Petrochemical Company K.S.C.C., Boubyan Petrochemical Company K.S.C., Kuwait Paraxylene Production Company K.S.C., Al-Kout Industrial Projects Company K.S.C.P., Kuwait Aromatics Company (KARO), Qurain Petrochemical Industries Company K.S.C.P., United Oil Projects Company K.S.C.P., Al-Zour Refinery (KIPIC – Kuwait Integrated Petroleum Industries Company), Burgan One Commercial & Chemical Co., Al-Sayer Chemical Co., Gulf Cryo Holding K.S.C. (for associated industrial and specialty solvent handling) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait hydrocarbon solvents market is poised for growth, driven by increasing demand from key sectors such as automotive and construction. The shift towards sustainable practices will likely accelerate the development of eco-friendly solvents, aligning with global trends. Additionally, technological advancements in production processes will enhance efficiency and reduce costs. As Kuwait continues to invest in infrastructure and industrial expansion, the market is expected to adapt, presenting opportunities for innovation and collaboration among local industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Aliphatic Hydrocarbon Solvents (e.g., hexane, heptane, mineral spirits) Aromatic Hydrocarbon Solvents (e.g., toluene, xylene, solvent naphtha) Dearomatized / Low-Aromatic Hydrocarbon Solvents Specialty & High-Purity Hydrocarbon Solvents Others (including blended and tailor-made hydrocarbon solvent grades) |

| By End-User | Paints, Coatings & Inks Oil & Gas, Refining and Petrochemicals Construction Chemicals & Adhesives Industrial & Institutional Cleaning Pharmaceuticals & Agrochemicals Others (automotive, packaging, metalworking, etc.) |

| By Application | Paints, Varnishes & Coatings Formulation Degreasing, Parts Washing & Metal Cleaning Adhesives, Sealants & Printing Inks Extraction & Process Solvents (oil, petrochemicals and specialty chemicals) Others (diluents, carrier fluids, and miscellaneous process uses) |

| By Distribution Channel | Direct Sales by Refiners & Producers Local Chemical Distributors & Traders Regional Trading Houses & Re-exporters Online & E-Procurement Platforms |

| By Packaging Type | Steel & Composite Drums IBCs & Intermediate Bulk Handling Bulk Tanker & Iso-tank Supply Small Packs (?25L cans and pails) |

| By Region | Al-Asimah (Kuwait City & Shuwaikh industrial area) Al-Ahmadi (refining and petrochemical hub) Al-Farwaniyah & Al-Jahra (industrial and logistics corridors) Hawalli, Mubarak Al-Kabeer & Others |

| By Regulatory Compliance | ISO 9001 & ISO 14001 Certifications Kuwait Environment Public Authority (EPA) Requirements GCC / International Safety & VOC Standards Others (REACH, GHS labelling and customer-specific standards) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Solvent Usage | 120 | Production Managers, Chemical Engineers |

| Automotive Coatings Sector | 100 | Quality Control Managers, Procurement Specialists |

| Household Cleaning Products | 80 | Product Development Managers, Marketing Executives |

| Paints and Coatings Industry | 110 | Technical Directors, Supply Chain Managers |

| Research and Development Insights | 70 | R&D Scientists, Innovation Managers |

The Kuwait Hydrocarbon Solvents Market is valued at approximately USD 160 million, reflecting its share in the broader Middle East solvents market and the global hydrocarbon solvents industry, driven by demand from various sectors such as paints, coatings, and petrochemicals.