Region:Middle East

Author(s):Rebecca

Product Code:KRAA6378

Pages:80

Published On:January 2026

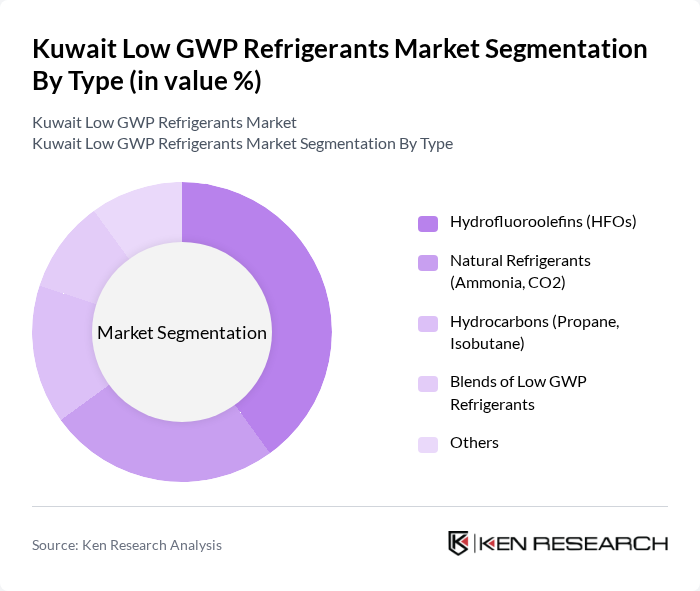

By Type:The market is segmented into various types of refrigerants, including Hydrofluoroolefins (HFOs), Natural Refrigerants (Ammonia, CO2), Hydrocarbons (Propane, Isobutane), Blends, and Others. Among these, Hydrofluoroolefins (HFOs) are gaining traction due to their low GWP and efficiency, making them a preferred choice for many applications. Natural refrigerants are also popular due to their environmental benefits and superior heat transfer properties, while hydrocarbons are favored for their cost-effectiveness and high-efficiency performance in industrial applications.

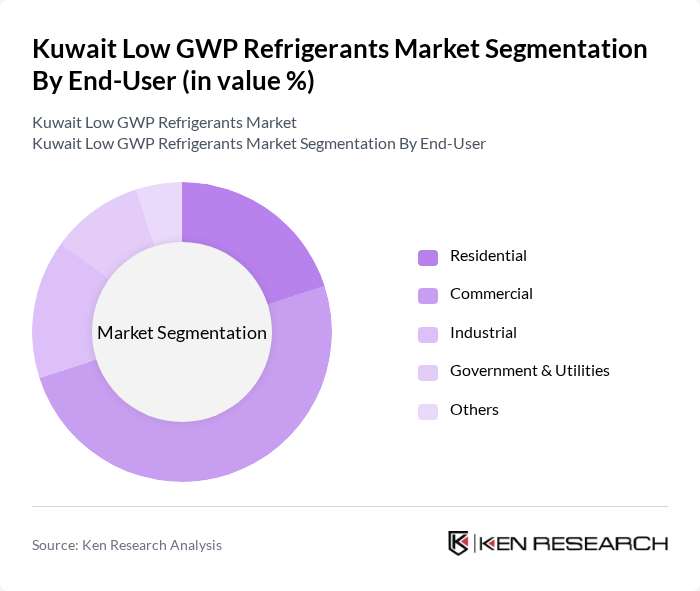

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The residential sector is the largest consumer of low GWP refrigerants, driven by the increasing demand for energy-efficient air conditioning systems amid extreme summer temperatures. The commercial sector follows closely, with businesses seeking sustainable solutions to meet regulatory requirements and enhance their environmental image.

The Kuwait Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Chemours Company, Arkema S.A., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Carrier Global Corporation, Johnson Controls International plc, GEA Group AG, Emerson Electric Co., A-Gas International, Solvay S.A., Linde plc, BOC Group, Arkema S.A., Koura Global contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait low GWP refrigerants market appears promising, driven by a combination of regulatory support and technological advancements. As Kuwait continues to prioritize environmental sustainability, the adoption of low GWP refrigerants is expected to accelerate. In future, the market is likely to witness a significant shift towards natural refrigerants and energy-efficient systems, supported by government incentives and increased consumer awareness. This evolving landscape will create a robust framework for sustainable refrigeration practices in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrofluoroolefins (HFOs) Natural Refrigerants (Ammonia, CO2) Hydrocarbons (Propane, Isobutane) Blends Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Air Conditioning Refrigeration Heat Pumps Chillers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Eastern Kuwait |

| By Regulatory Compliance | Local Standards International Standards Certification Requirements Others |

| By Market Maturity | Emerging Growth Mature Declining Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 100 | Facility Managers, Procurement Specialists |

| Residential HVAC Installers | 80 | HVAC Technicians, Business Owners |

| Industrial Refrigerant Suppliers | 70 | Sales Managers, Product Development Engineers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 60 | Academic Researchers, Industry Analysts |

The Kuwait Low GWP Refrigerants Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by environmental regulations and a shift towards sustainable refrigerants with lower global warming potential.