Region:Asia

Author(s):Rebecca

Product Code:KRAA6382

Pages:92

Published On:January 2026

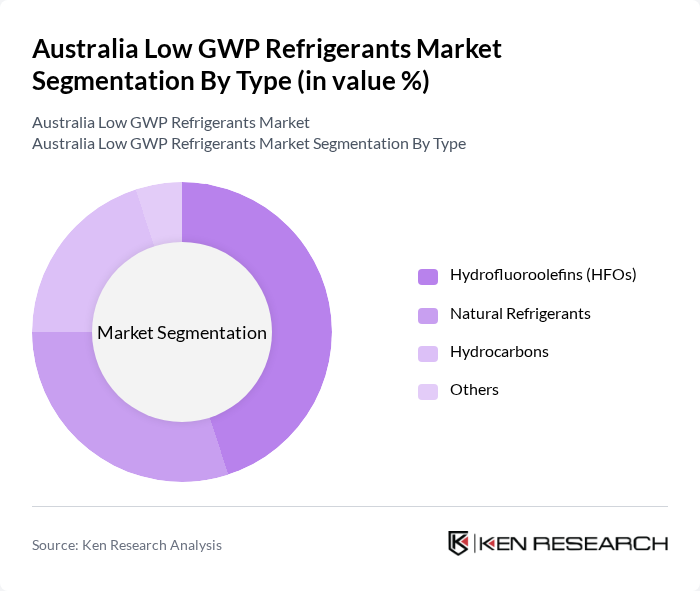

By Type:The market is segmented into three main types: Inorganics, Hydrocarbons, and Fluorocarbons. Each type serves different applications and end-users, with varying levels of adoption based on environmental regulations and consumer preferences. Hydrocarbons, in particular, have gained traction due to their low environmental impact and efficiency.

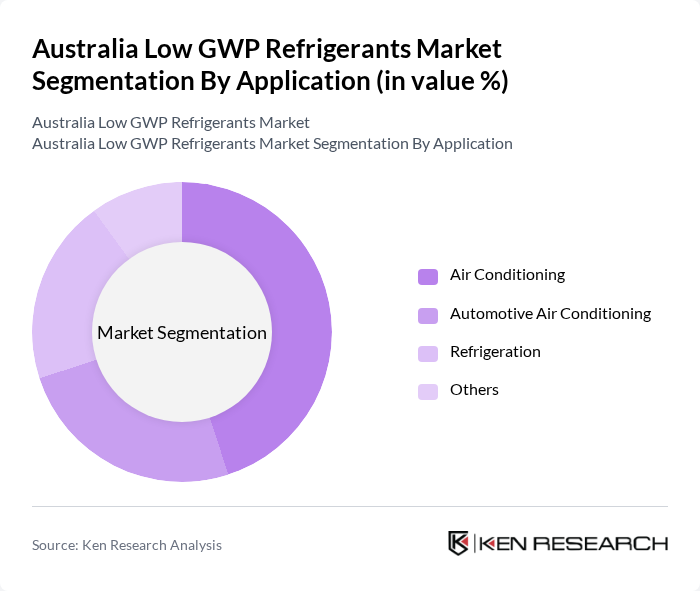

By Application:The applications of low GWP refrigerants include Air Conditioning, Automotive Air Conditioning, Refrigeration, and Others. The air conditioning segment is the largest due to the increasing demand for energy-efficient cooling solutions in residential and commercial buildings, while automotive air conditioning is also growing as manufacturers seek to comply with environmental regulations.

The Australia Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Chemours Company, Arkema S.A., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Johnson Controls International plc, Carrier Global Corporation, GEA Group AG, A-Gas International, BOC Limited, Refricenter, Koura Global, Solvay S.A., Linde plc, Air Products and Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia low GWP refrigerants market appears promising, driven by increasing environmental awareness and technological innovations. As businesses seek to comply with stringent regulations, the demand for low GWP solutions is expected to rise significantly. Additionally, the integration of smart technologies in refrigeration systems will enhance efficiency and sustainability. With ongoing investments in research and development, the market is likely to witness the emergence of new refrigerant solutions that align with both environmental goals and economic viability.

| Segment | Sub-Segments |

|---|---|

| By Type | Inorganics Hydrocarbons Fluorocarbons |

| By Application | Air Conditioning Automotive Air Conditioning Refrigeration Others |

| By End-User | Residential Commercial Industrial Others |

| By Region | New South Wales Victoria Queensland Western Australia Australian Capital Territory Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 100 | Facility Managers, Refrigeration Technicians |

| Residential HVAC Contractors | 80 | HVAC Installers, Service Technicians |

| Automotive Industry Stakeholders | 60 | Automotive Engineers, Parts Managers |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Environmental Scientists |

| Manufacturers of Low GWP Refrigerants | 70 | Product Development Managers, Sales Directors |

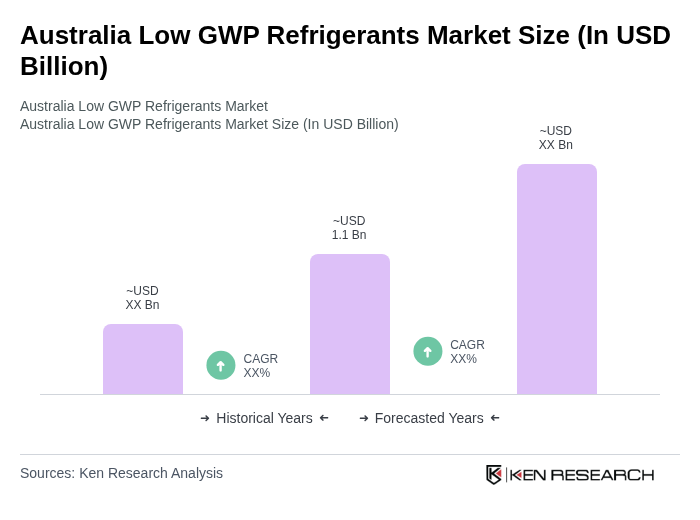

The Australia Low GWP Refrigerants Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by regulatory pressures and increased consumer awareness regarding environmental sustainability.