Oman Low GWP Refrigerants Market Overview

- The Oman Low GWP Refrigerants Market is valued at approximately USD 165 million, based on a five-year historical analysis. This growth is primarily driven by increasing environmental regulations and a shift towards sustainable refrigerants that have a lower global warming potential. The rising awareness of climate change and the need for energy-efficient cooling solutions have further propelled the demand for low GWP refrigerants in various sectors. The broader Middle East refrigerants market exceeded USD 145.97 million in 2020 and continues to expand as industries transition towards eco-friendly refrigeration systems.

- Muscat and Dhofar are the dominant regions in the Oman Low GWP Refrigerants Market due to their significant industrial activities and urbanization. Muscat, being the capital, has a higher concentration of commercial and residential buildings requiring efficient cooling solutions. Dhofar, with its agricultural and tourism sectors, also contributes to the demand for refrigeration and air conditioning systems. The Oman Air Conditioner Market, which directly correlates with low GWP refrigerant adoption, was valued at approximately USD 495 million in 2024, indicating robust demand for cooling solutions across the nation.

- The Omani government has implemented regulatory frameworks aligned with international environmental standards to phase out high GWP refrigerants and promote the use of low GWP alternatives. These regulations mandate that new refrigeration and air conditioning systems utilize refrigerants with significantly reduced global warming potential, thereby encouraging manufacturers and consumers to adopt more environmentally friendly options. This regulatory approach aligns with global initiatives such as the Kigali Amendment to the Montreal Protocol, which has been ratified by 134 nations to reduce HFC consumption by 80% over the coming decades.

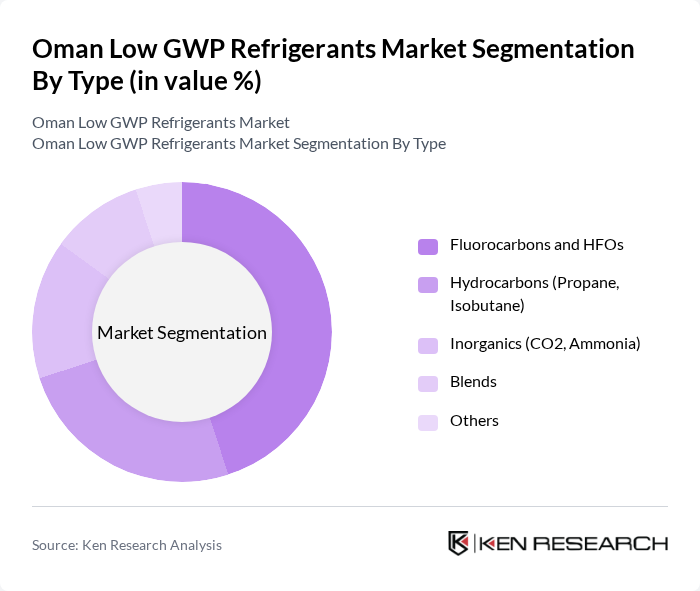

Oman Low GWP Refrigerants Market Segmentation

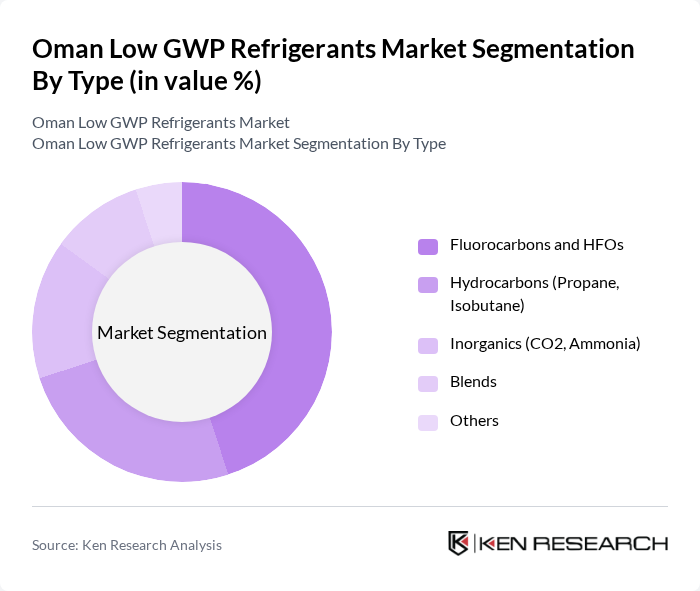

By Type:The market is segmented into various types of refrigerants, including Fluorocarbons and Fluoro-olefins (HFCs and HFOs), Hydrocarbons (Propane, Isobutane), Inorganics (Ammonia, CO2), Blends of Low GWP Refrigerants, and Others. Among these, Fluorocarbons and Fluoro-olefins are currently leading due to their widespread use in commercial and industrial applications. However, Hydrocarbons are gaining significant traction due to their natural origin, lower environmental impact, and excellent thermodynamic properties. Hydrocarbons such as propane and isobutane offer superior energy efficiency and compatibility with existing systems, making them increasingly preferred across industrial refrigeration applications. The increasing regulatory pressure is pushing the market towards more sustainable options.

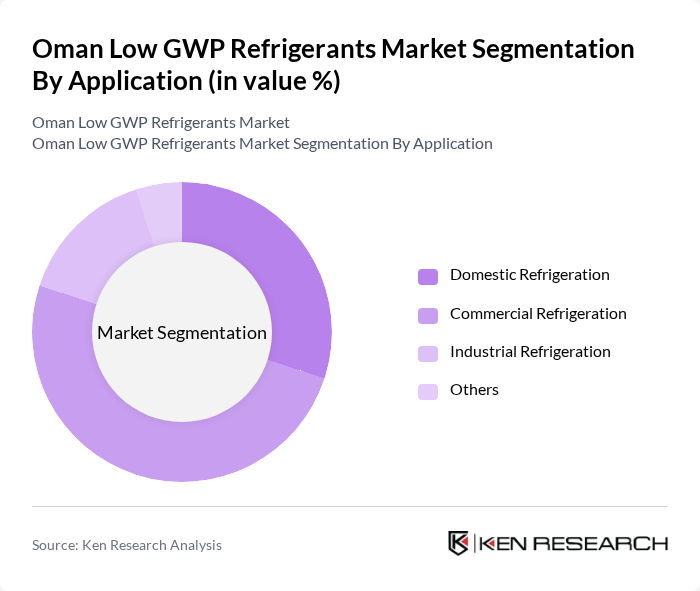

By Application:The applications of low GWP refrigerants include Domestic Refrigeration, Commercial Refrigeration, Industrial Refrigeration, Transport Refrigeration, and Others. Domestic Refrigeration is the leading application segment, driven by the increasing number of households and the demand for energy-efficient cooling solutions. Commercial Refrigeration follows closely, supported by the growth of retail and food service sectors. The industrial sector is also expanding, with a focus on sustainable practices and the adoption of natural refrigerants like ammonia, which offers superior heat transfer properties and thermodynamic efficiency.

Oman Low GWP Refrigerants Market Competitive Landscape

The Oman Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Chemours Company, Arkema S.A., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Johnson Controls International plc, Carrier Global Corporation, GEA Group AG, A-Gas International, Solvay S.A., Koura Global, Linde plc, BOC Group, Air Products and Chemicals, Inc., Mexichem (now Orbia) contribute to innovation, geographic expansion, and service delivery in this space.

Oman Low GWP Refrigerants Market Industry Analysis

Growth Drivers

- Increasing Environmental Regulations:The Omani government has implemented stringent environmental regulations aimed at reducing greenhouse gas emissions. In future, Oman is expected to allocate approximately OMR 60 million towards initiatives that promote low GWP refrigerants. This regulatory push is driven by the need to comply with international agreements, such as the Kigali Amendment, which mandates a phasedown of high GWP refrigerants, thereby creating a favorable environment for low GWP alternatives.

- Rising Demand for Energy-Efficient Solutions:The demand for energy-efficient refrigeration solutions in Oman is projected to increase significantly, with energy consumption in the refrigeration sector expected to reach 1,500 GWh in future. This surge is driven by both commercial and residential sectors seeking to reduce operational costs and enhance energy efficiency. The adoption of low GWP refrigerants aligns with this trend, as they often provide better energy performance, further driving market growth.

- Technological Advancements in Refrigeration:The refrigeration industry in Oman is witnessing rapid technological advancements, with investments in innovative low GWP refrigerant technologies expected to exceed OMR 40 million in future. These advancements include the development of more efficient compressors and heat exchangers that utilize low GWP refrigerants. As manufacturers adopt these technologies, the overall efficiency and performance of refrigeration systems improve, fostering greater market acceptance and growth.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to the adoption of low GWP refrigerants in Oman is the high initial investment required for new systems. The upfront costs for transitioning to low GWP technologies can be as high as OMR 20,000 for commercial installations. This financial burden often deters businesses from making the switch, despite the long-term savings associated with energy efficiency and regulatory compliance.

- Limited Availability of Low GWP Alternatives:The market for low GWP refrigerants in Oman faces challenges due to the limited availability of suitable alternatives. Currently, only a handful of low GWP refrigerants are commercially available, with imports accounting for over 80% of the market supply. This scarcity can lead to supply chain disruptions and increased costs, hindering the widespread adoption of these environmentally friendly options.

Oman Low GWP Refrigerants Market Future Outlook

The future of the low GWP refrigerants market in Oman appears promising, driven by increasing environmental awareness and regulatory pressures. As the government intensifies its commitment to sustainability, investments in low GWP technologies are expected to rise. Additionally, the growing cold chain sector, projected to expand by 25% in future, will further drive demand for efficient refrigeration solutions. This evolving landscape presents opportunities for innovation and collaboration among industry stakeholders, paving the way for a more sustainable future.

Market Opportunities

- Expansion of Refrigeration Applications:The expansion of refrigeration applications across various sectors, including food and pharmaceuticals, presents a significant opportunity. With the cold chain sector expected to grow by 25% in future, there is a rising demand for low GWP refrigerants that can meet stringent efficiency and environmental standards, thereby enhancing market potential.

- Government Incentives for Green Technologies:The Omani government is likely to introduce incentives for businesses adopting green technologies, including low GWP refrigerants. These incentives could include tax breaks or subsidies, making it financially attractive for companies to transition to environmentally friendly refrigerants, thus stimulating market growth and innovation.