Region:Asia

Author(s):Geetanshi

Product Code:KRAA6376

Pages:100

Published On:January 2026

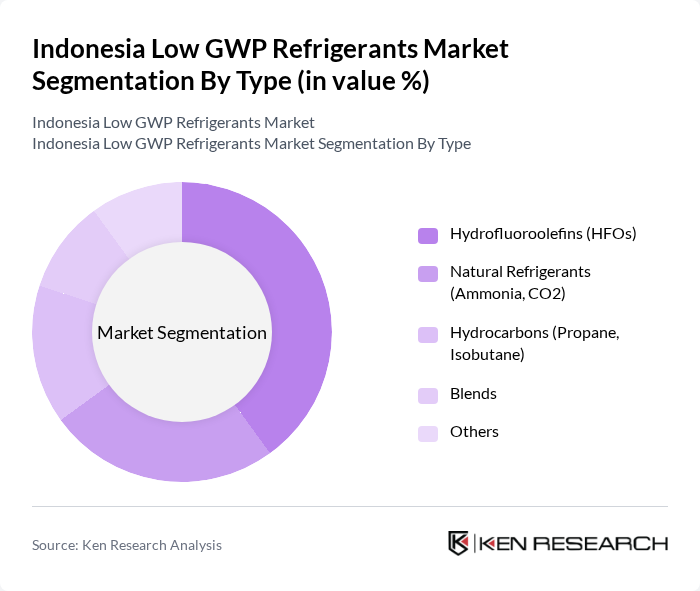

By Type:The market is segmented into various types of refrigerants, including Hydrofluoroolefins (HFOs), Natural Refrigerants (Ammonia, CO2), Hydrocarbons (Propane, Isobutane), Blends, and Others. Among these, Hydrofluoroolefins (HFOs) are gaining traction due to their low environmental impact and efficiency. Natural refrigerants are also popular due to their sustainability and minimal global warming potential. R32 blends continue to lead adoption in new residential and light commercial air conditioning.

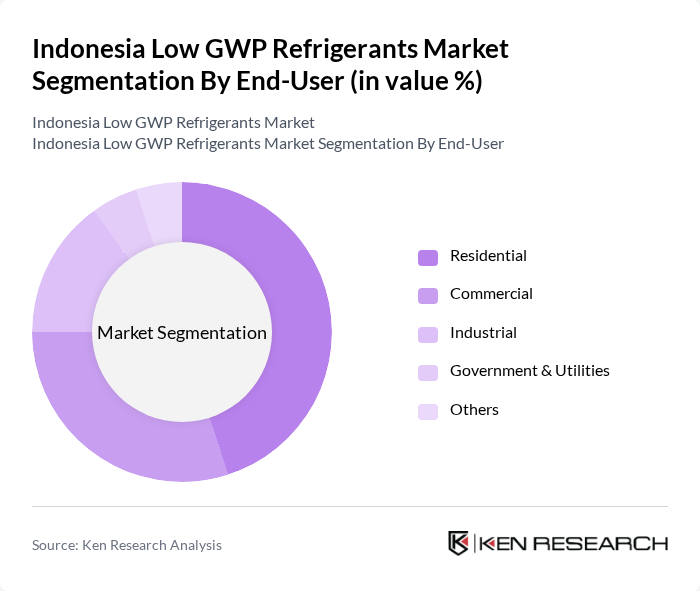

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The residential sector is the largest consumer of low GWP refrigerants, driven by the increasing adoption of energy-efficient air conditioning systems. The commercial sector follows closely, with businesses seeking sustainable solutions to meet regulatory requirements and consumer preferences, including upgrades in shopping centres and hospitals.

The Indonesia Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Daikin Air Conditioning Indonesia, PT. Refrigeration Indonesia, PT. AHI Indonesia, PT. Chemours Indonesia, PT. Honeywell Indonesia, PT. Arkema Indonesia, PT. Mitsubishi Electric Indonesia, PT. LG Electronics Indonesia, PT. Panasonic Gobel Indonesia, PT. Gree Electric Appliances Indonesia, PT. Samsung Electronics Indonesia, PT. Emerson Electric Indonesia, PT. Trane Indonesia, PT. Sanyo Indonesia, PT. Carrier Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the low GWP refrigerants market in Indonesia appears promising, driven by increasing environmental awareness and regulatory support. As the government intensifies its efforts to phase out high-GWP refrigerants, the market is expected to see a significant shift towards sustainable alternatives in future. Additionally, advancements in technology and growing consumer demand for energy-efficient solutions will further propel market growth. The integration of IoT in refrigeration systems is anticipated to enhance operational efficiency, making low GWP refrigerants more attractive to various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrofluoroolefins (HFOs) Natural Refrigerants (Ammonia, CO2) Hydrocarbons (Propane, Isobutane) Blends Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Air Conditioning Refrigeration Heat Pumps Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Java Sumatra Bali and Nusa Tenggara Kalimantan Sulawesi Others |

| By Technology | Vapor Compression Absorption Thermoelectric Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 75 | Facility Managers, Procurement Officers |

| HVAC System Manufacturers | 65 | Product Development Engineers, Sales Managers |

| Environmental Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| End-Users in Food & Beverage Sector | 60 | Operations Managers, Quality Assurance Heads |

| Research Institutions Focused on Refrigeration | 50 | Research Scientists, Academic Professors |

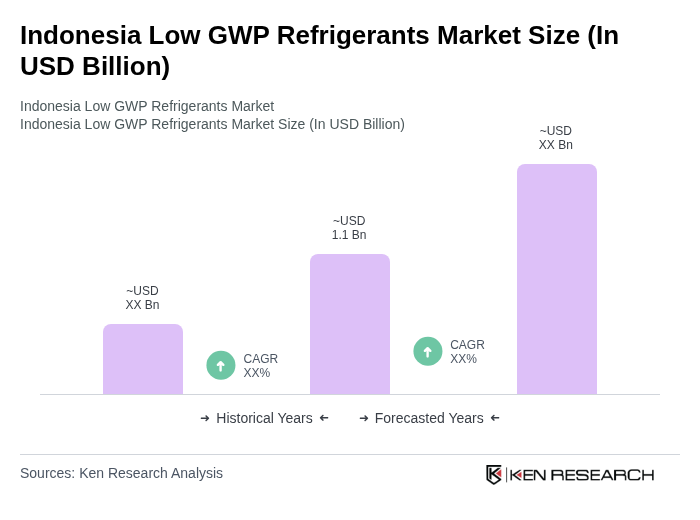

The Indonesia Low GWP Refrigerants Market is valued at approximately USD 1.1 billion, driven by increasing environmental regulations and a shift towards sustainable cooling solutions, particularly the adoption of R32 in residential and light commercial air conditioning systems.