Region:Asia

Author(s):Rebecca

Product Code:KRAA6376

Pages:90

Published On:January 2026

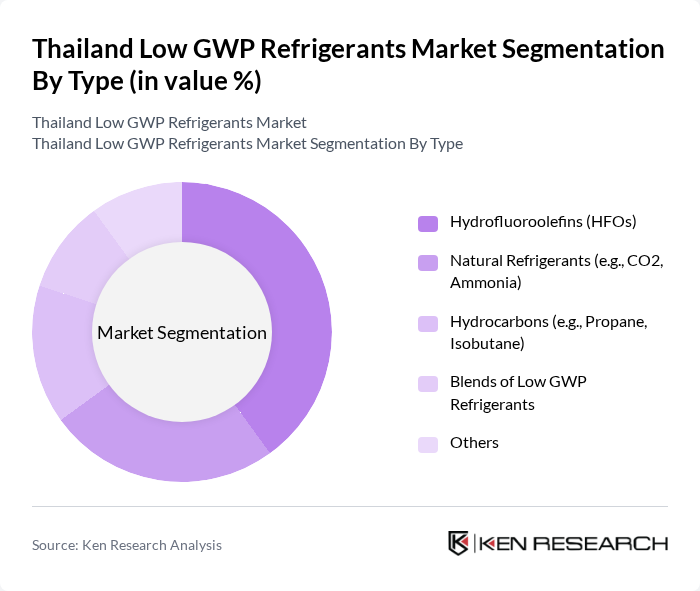

By Type:The market is segmented into Hydrocarbons, HFOs (Hydrofluoroolefins), CO2 (Carbon Dioxide), and Ammonia. Among these, Hydrocarbons are gaining traction due to their low environmental impact and efficiency. HFOs are also popular for their favorable thermodynamic properties, while CO2 is increasingly used in commercial refrigeration applications. Ammonia remains a strong choice in industrial settings due to its efficiency and low GWP.

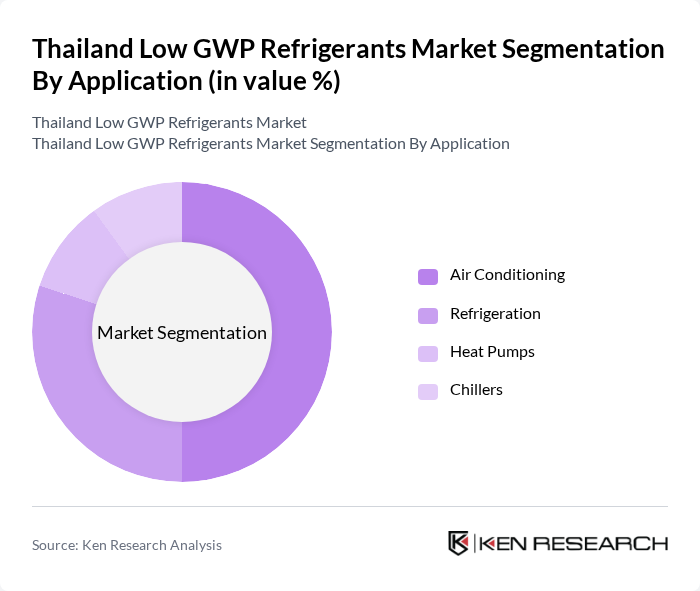

By Application:The applications of low GWP refrigerants include Air Conditioning, Refrigeration, Heat Pumps, and Chillers. Air Conditioning is the leading application segment, driven by the growing demand for energy-efficient cooling solutions in residential and commercial buildings. Refrigeration follows closely, particularly in the food and beverage sector, while Heat Pumps and Chillers are gaining popularity in industrial applications.

The Thailand Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thai Refrigeration Industry Co., Ltd., SCG Chemicals, Daikin Industries (Thailand) Co., Ltd., Mitsubishi Electric Kang Yong Watana Co., Ltd., Gree Electric Appliances, Inc., LG Electronics (Thailand) Co., Ltd., Panasonic Manufacturing (Thailand) Co., Ltd., Honeywell (Thailand) Ltd., Chemours Thailand Co., Ltd., Arkema S.A., A-Gas (Thailand) Co., Ltd., Solvay S.A., Linde Thailand Ltd., Air Products and Chemicals, Inc., Refron Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the low GWP refrigerants market in Thailand appears promising, driven by increasing environmental awareness and regulatory support. As businesses and consumers become more conscious of their carbon footprints, the demand for sustainable refrigeration solutions is expected to rise. Additionally, ongoing technological advancements will likely enhance the efficiency and affordability of low GWP options, making them more attractive to a broader range of users. Collaborative efforts between the government and private sector will further accelerate this transition, fostering a more sustainable refrigeration landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocarbons HFOs (Hydrofluoroolefins) CO2 (Carbon Dioxide) Ammonia |

| By Application | Air Conditioning Refrigeration Heat Pumps Chillers |

| By End-Use | Domestic/Household Refrigeration Commercial Refrigeration Industrial Refrigeration |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 45 | Facility Managers, Procurement Officers |

| HVAC Manufacturers | 35 | Product Development Managers, Sales Directors |

| Cold Chain Logistics Providers | 40 | Operations Managers, Logistics Coordinators |

| Environmental Regulatory Bodies | 20 | Policy Makers, Environmental Analysts |

| End-Users in Food Processing | 50 | Plant Managers, Quality Assurance Heads |

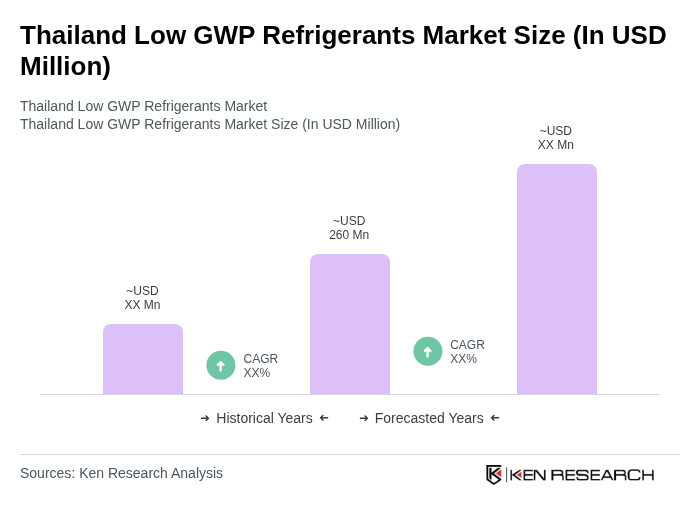

The Thailand Low GWP Refrigerants Market is valued at approximately USD 270 million, reflecting a significant growth trend driven by environmental regulations and the shift towards sustainable refrigerants, particularly R32 in air conditioning systems.