Region:Middle East

Author(s):Rebecca

Product Code:KRAA6380

Pages:87

Published On:January 2026

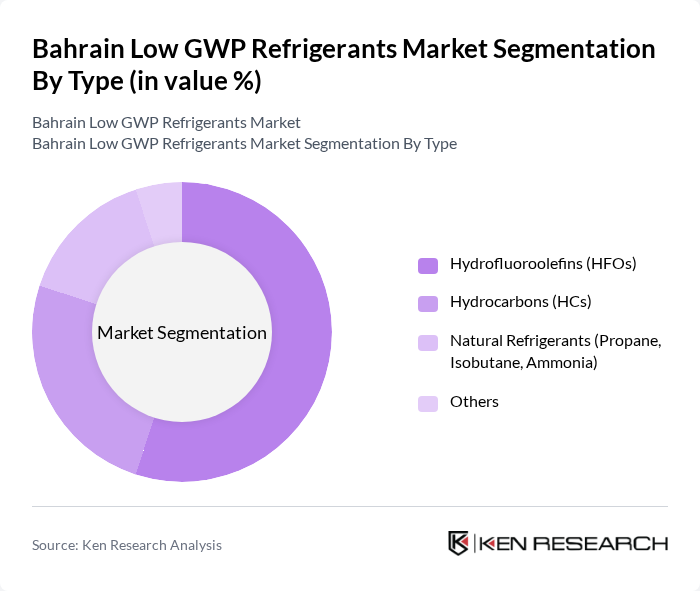

By Type:The market is segmented into various types of refrigerants, including Hydrofluoroolefins (HFOs), Natural Refrigerants (CO2, Ammonia), Hydrocarbons (Propane, Isobutane), Synthetic Fluorocarbons, and Blends. Among these, Hydrofluoroolefins (HFOs) are currently dominating the market due to their low environmental impact and efficiency in cooling applications. The increasing regulatory pressure to phase out high GWP refrigerants has led to a significant shift towards HFOs, which are favored for their performance and lower carbon footprint.

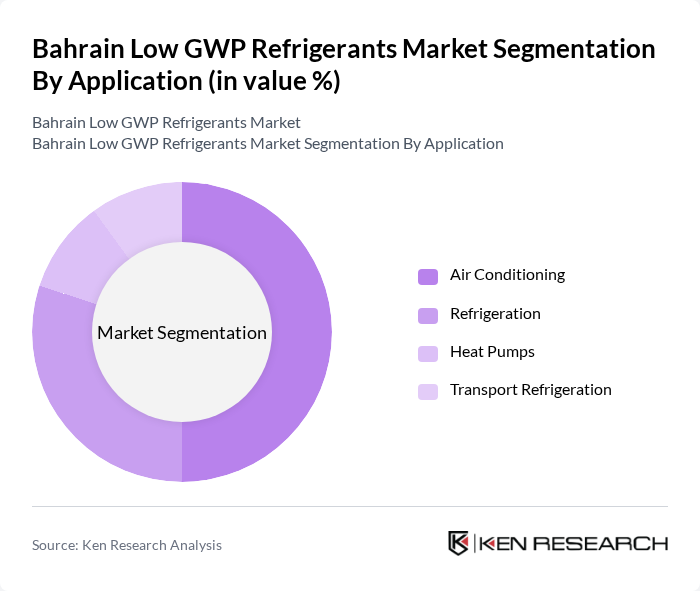

By Application:The applications of low GWP refrigerants include Air Conditioning, Refrigeration, Heat Pumps, and Transport Refrigeration. The Air Conditioning segment is leading the market, driven by the growing demand for energy-efficient cooling solutions in residential and commercial buildings. The increasing temperatures in the region and the need for sustainable cooling options have made air conditioning the primary application for low GWP refrigerants.

The Bahrain Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Cryo, A-Gas, Honeywell, Chemours, Arkema, Daikin, Mitsubishi Electric, Carrier, Emerson, Johnson Controls, Bitzer, Panasonic, Lennox International, Trane Technologies, and Bahrain Sustainable Refrigeration contribute to innovation, geographic expansion, and service delivery in this space.

The future of the low GWP refrigerants market in Bahrain appears promising, driven by increasing environmental awareness and regulatory pressures. As businesses adapt to stringent regulations, the demand for low GWP solutions is expected to rise significantly. Furthermore, technological innovations and government incentives will likely enhance the market landscape, encouraging investments in sustainable refrigeration practices. The focus on energy efficiency and climate change mitigation will continue to shape the industry, fostering a robust environment for growth and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrofluoroolefins (HFOs) Natural Refrigerants (CO2, Ammonia) Hydrocarbons (Propane, Isobutane) Synthetic Fluorocarbons Blends |

| By Application | Air Conditioning Refrigeration Heat Pumps Transport Refrigeration |

| By End-User | Residential Commercial Industrial (Food Processing, Pharmaceuticals) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 120 | Facility Managers, Procurement Officers |

| Residential Air Conditioning Systems | 80 | Homeowners, HVAC Technicians |

| Industrial Refrigeration Applications | 70 | Operations Managers, Plant Engineers |

| Regulatory Compliance Insights | 50 | Environmental Compliance Officers, Policy Makers |

| Market Trends and Innovations | 90 | Industry Analysts, Research Scientists |

The Bahrain Low GWP Refrigerants Market is valued at approximately USD 15 million, reflecting a growing trend towards sustainable refrigerants with lower global warming potential, driven by environmental regulations and increasing demand for energy-efficient cooling solutions.