Region:Asia

Author(s):Rebecca

Product Code:KRAA6377

Pages:88

Published On:January 2026

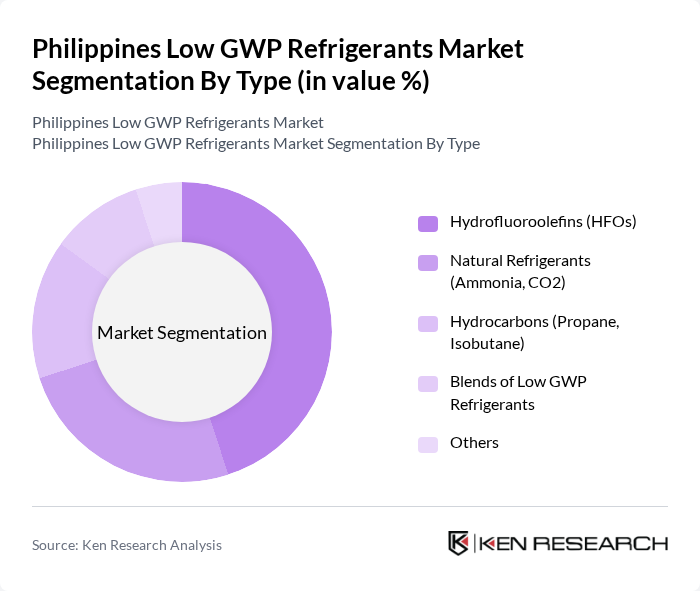

By Type:The market is segmented into various types of low GWP refrigerants, including Hydrofluoroolefins (HFOs), Natural Refrigerants (Ammonia, CO2), Hydrocarbons (Propane, Isobutane), Blends of Low GWP Refrigerants, and Others. Among these, Hydrofluoroolefins (HFOs) are gaining traction due to their low environmental impact and efficiency in cooling applications. Natural refrigerants are also popular, especially in industrial settings, due to their eco-friendliness and availability. The increasing regulatory pressure to phase out high-GWP refrigerants is further propelling the adoption of these alternatives.

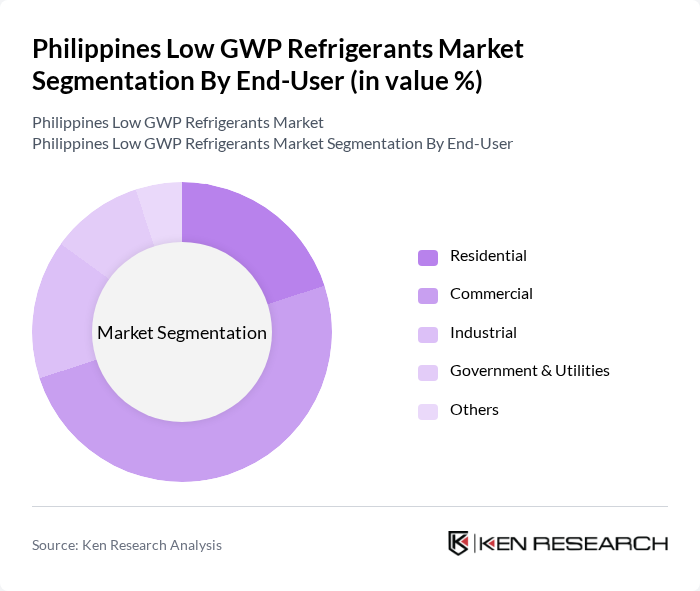

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The residential sector is the largest consumer of low GWP refrigerants, driven by the increasing installation of energy-efficient air conditioning systems in homes. The commercial sector follows closely, with businesses seeking to reduce operational costs and comply with environmental regulations. Industrial applications are also significant, particularly in food processing and cold storage, where efficient refrigeration is crucial.

The Philippines Low GWP Refrigerants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Philippines, Inc., Mitsubishi Electric Philippines, Carrier Philippines, Gree Electric Appliances, Inc., Panasonic Manufacturing Philippines Corporation, LG Electronics Philippines, Inc., Emerson Climate Technologies, Honeywell Philippines, Chemours Philippines, Arkema Philippines, A-Gas Philippines, R-1234yf Solutions, Solvay Specialty Polymers, Refron, Inc., A-Gas Americas contribute to innovation, geographic expansion, and service delivery in this space.

The future of the low GWP refrigerants market in the Philippines appears promising, driven by increasing environmental awareness and regulatory support. As the government intensifies its commitment to sustainability, businesses are likely to invest in low GWP technologies, enhancing energy efficiency and reducing emissions. Additionally, the integration of smart technologies in refrigeration systems is expected to streamline operations, further promoting the adoption of eco-friendly refrigerants. This trend will likely create a robust market environment for innovative solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrofluoroolefins (HFOs) Natural Refrigerants (Ammonia, CO2) Hydrocarbons (Propane, Isobutane) Blends of Low GWP Refrigerants Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Air Conditioning Refrigeration Heat Pumps Chillers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Luzon Visayas Mindanao Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| By Market Maturity | Emerging Growth Mature Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Refrigeration Users | 75 | Facility Managers, Procurement Officers |

| Residential Air Conditioning Market | 120 | Homeowners, HVAC Technicians |

| Industrial Refrigeration Applications | 60 | Plant Managers, Operations Directors |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Environmental Consultants |

| HVAC Contractors and Service Providers | 95 | Business Owners, Technical Managers |

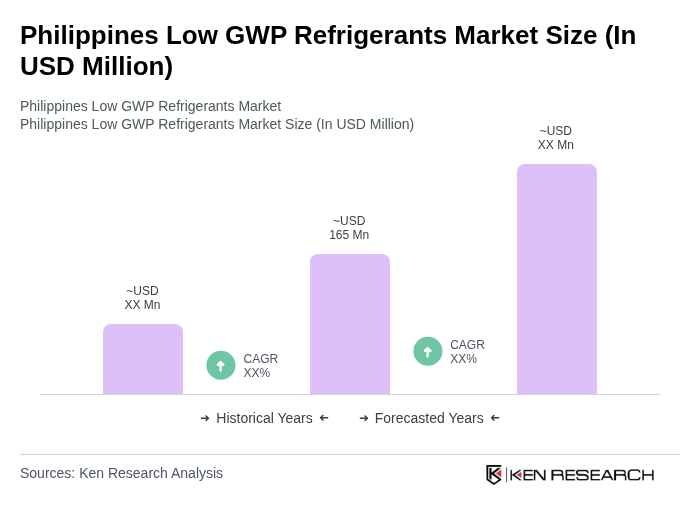

The Philippines Low GWP Refrigerants Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by environmental regulations and the increasing adoption of sustainable refrigerants like R32 in air conditioning systems.