Region:Middle East

Author(s):Dev

Product Code:KRAD7658

Pages:90

Published On:December 2025

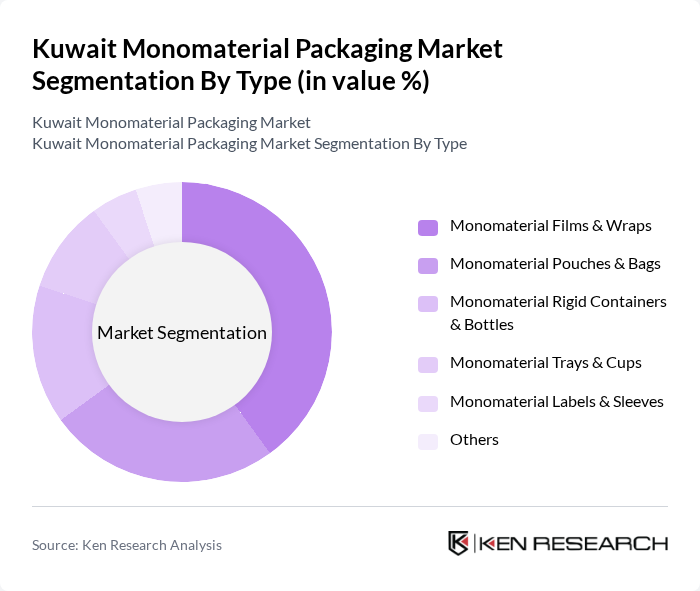

By Type:The market is segmented into various types of monomaterial packaging, including Monomaterial Films & Wraps, Monomaterial Pouches & Bags, Monomaterial Rigid Containers & Bottles, Monomaterial Trays & Cups, Monomaterial Labels & Sleeves, and Others. Among these, Monomaterial Films & Wraps dominate the market due to their versatility and widespread use in various applications.

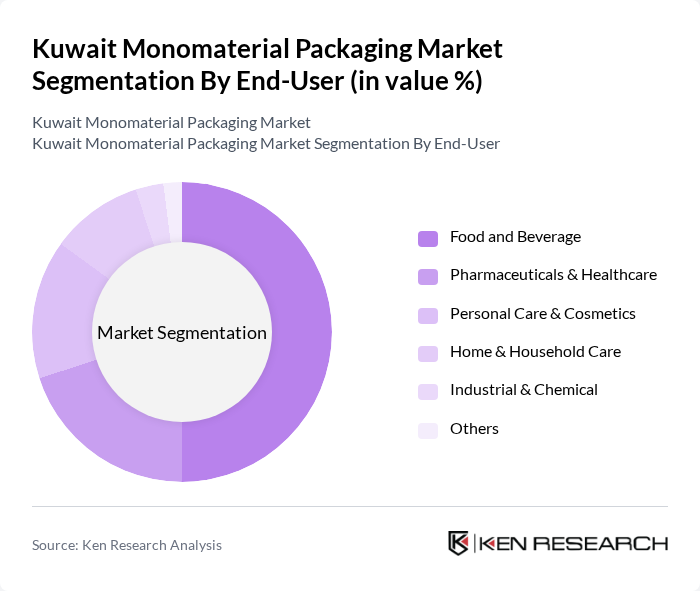

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals & Healthcare, Personal Care & Cosmetics, Home & Household Care, Industrial & Chemical, and Others. The Food and Beverage sector is the leading end-user, driven by the increasing demand for convenient and sustainable packaging solutions.

The Kuwait Monomaterial Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Packing Materials Manufacturing Co. K.S.C. (K-PAK), Gulf Plastic Industries Co. (Kuwait), Kuwait Polyurethane Industries Co., Al Aman Plastic Industries Co., Kuwait United Plastics Industries Co., Al Mowasat Co. for Plastic Industries, Al Taweel Plastic Factory, Green Technology Company for Waste Management & Recycling, Gulf Paper Manufacturing Company K.S.C., Al Mazaya Plastic Industries Co., Al Kharafi Plastic Industries Co., Al Enma’a Plastic Manufacturing Co., Al Sayer Franchising / Packaging & Logistics Division, Kuwait Printing & Packaging Co., Napco National – Kuwait Operations contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait monomaterial packaging market appears promising, driven by increasing government support and consumer demand for sustainable solutions. As businesses adapt to eco-friendly practices, the market is expected to witness significant innovations in packaging design and materials. Additionally, the ongoing shift towards a circular economy will likely encourage the development of new recycling technologies, further enhancing the sustainability of packaging solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Monomaterial Films & Wraps Monomaterial Pouches & Bags Monomaterial Rigid Containers & Bottles Monomaterial Trays & Cups Monomaterial Labels & Sleeves Others |

| By End-User | Food and Beverage Pharmaceuticals & Healthcare Personal Care & Cosmetics Home & Household Care Industrial & Chemical Others |

| By Material | Polyethylene (PE) Monomaterial Polypropylene (PP) Monomaterial Polyethylene Terephthalate (PET) Monomaterial Paper & Paperboard Monomaterial Bioplastic Monomaterial (PLA, PHA, etc.) Others |

| By Distribution Channel | Direct Sales to Brand Owners Converters & Contract Packers Industrial Distributors Others |

| By Application | Primary Retail Packaging Secondary & Transport Packaging Food Service & QSR Packaging Pharmaceutical & Medical Packaging Others |

| By Region | Al Asimah (Kuwait City) Al Ahmadi Hawalli Farwaniya Al Jahra Mubarak Al-Kabeer |

| By Policy Support | Government Subsidies for Sustainable Materials Tax Incentives Linked to Recycling Targets Grants for Monomaterial R&D and Recycling Infrastructure Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Product Development Leads |

| Cosmetics and Personal Care Packaging | 80 | Brand Managers, Supply Chain Coordinators |

| Consumer Goods Packaging | 90 | Marketing Directors, Procurement Specialists |

| Industrial Packaging Solutions | 70 | Operations Managers, Logistics Directors |

| Sustainability Initiatives in Packaging | 60 | Sustainability Officers, Environmental Compliance Managers |

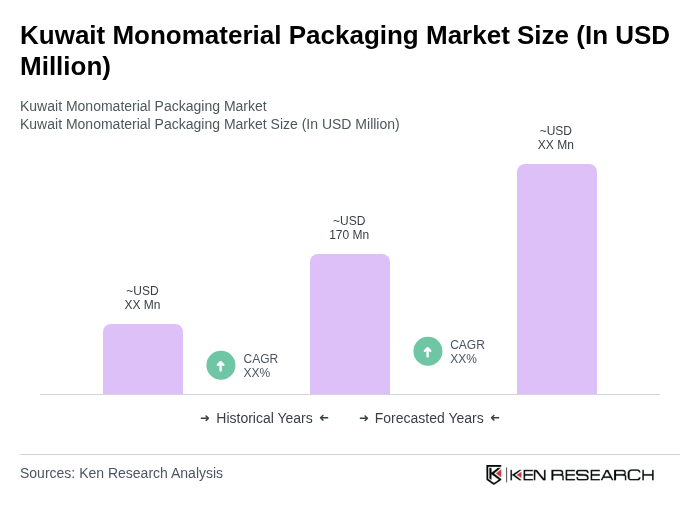

The Kuwait Monomaterial Packaging Market is valued at approximately USD 170 million, reflecting a growing trend towards sustainable packaging solutions and government initiatives aimed at reducing plastic waste.