Region:Middle East

Author(s):Rebecca

Product Code:KRAD7404

Pages:94

Published On:December 2025

By Type:

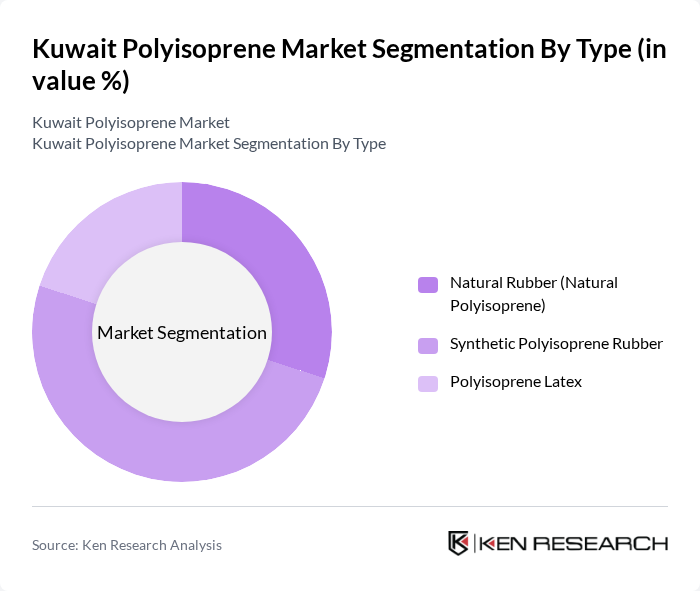

The polyisoprene market is primarily dominated by synthetic polyisoprene rubber, which accounts for a significant share due to its versatility and superior performance in various applications. The automotive industry, in particular, has shown a strong preference for synthetic variants due to their enhanced durability and resistance to wear and tear. Natural rubber, while still relevant, is increasingly being replaced by synthetic options in high-demand sectors, reflecting changing consumer preferences and technological advancements.

In the end-user industry segment, tire and automotive components lead the market, driven by the increasing production of vehicles and the demand for high-performance tires. The medical and healthcare sector follows closely, with a growing need for polyisoprene in gloves and other medical devices, especially in light of recent global health challenges. The industrial rubber goods segment also plays a crucial role, as polyisoprene is essential for manufacturing durable and reliable products.

The Kuwait Polyisoprene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation (KPC), Petrochemical Industries Company K.S.C. (PIC), Equate Petrochemical Company K.S.C.C., Kuwait Aromatics Company Ltd. (KARO), Kuwait Integrated Petroleum Industries Company (KIPIC), Boubyan Petrochemical Company K.S.C., Gulf Cable & Electrical Industries Co. K.S.C., Kuwait Industrial Rubber Co., Gulf Cryo Holding K.S.C.C., National Petroleum Services Company (NAPESCO), Al-Kout Industrial Projects Company K.S.C., Kuwait Foundry Company K.S.C., Kuwait Automotive Imports Co. (KAICO), Al Sayer Holding Co. (Automotive & Tires Division), Ali Alghanim & Sons Automotive Co. contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait polyisoprene market is poised for significant growth, driven by increasing demand across various sectors, particularly automotive and medical devices. As consumer preferences shift towards sustainable and eco-friendly products, manufacturers are likely to innovate and adapt their offerings. Additionally, the rise of e-commerce is expected to enhance distribution channels, making polyisoprene products more accessible. Strategic partnerships and collaborations will further bolster market resilience, positioning the industry for a robust future amid evolving consumer demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Rubber (Natural Polyisoprene) Synthetic Polyisoprene Rubber Polyisoprene Latex |

| By End-User Industry | Tire & Automotive Components Medical & Healthcare (Gloves, Catheters, Other Devices) Industrial Rubber Goods (Belts, Hoses, Seals) Consumer & Household Products Footwear & Sports Goods |

| By Application | Tires & Inner Tubes Medical Gloves & Latex Products Conveyor Belts, Hoses & Technical Rubber Adhesives & Sealants Other Rubber Products |

| By Distribution Channel | Direct Sales to OEMs Industrial Distributors & Traders International Traders / Importers E-Procurement & Online B2B Platforms |

| By Region | Al Asimah (Capital Governorate) Al Ahmadi Al Farwaniyah Al Jahra, Hawalli & Mubarak Al-Kabeer |

| By Product Form | Dry Rubber (Solid Bales, Crumb) Latex (High-Ammonia, Low-Ammonia) Compounded & Masterbatch Grades |

| By Packaging Type | Bulk Packaging (Containers, Big Bags, Drums) Wrapped Bales & Palletized Units Intermediate Bulk Containers (IBCs) & Tankers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 110 | Product Managers, Procurement Specialists |

| Medical Device Manufacturing | 85 | Quality Assurance Managers, R&D Directors |

| Consumer Goods Sector | 95 | Marketing Managers, Supply Chain Analysts |

| Industrial Applications | 75 | Operations Managers, Technical Directors |

| Research Institutions and Academia | 50 | Research Scientists, Professors in Polymer Science |

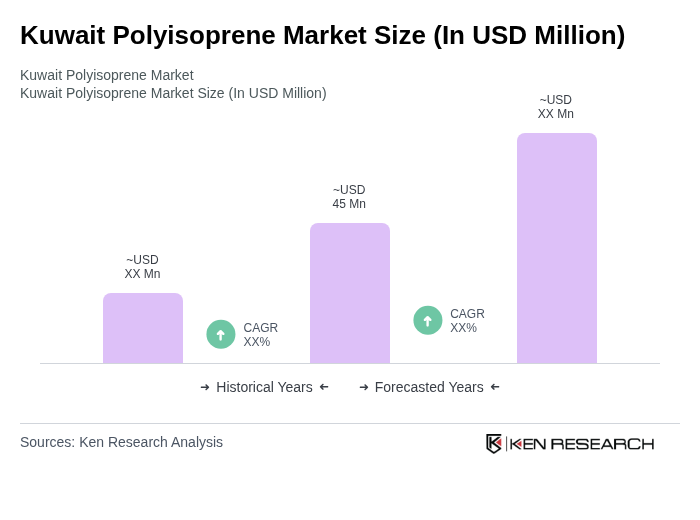

The Kuwait Polyisoprene Market is valued at approximately USD 45 million, reflecting a five-year historical analysis. This valuation is driven by increasing demand across various sectors, particularly automotive, medical, and consumer goods.