Region:Middle East

Author(s):Shubham

Product Code:KRAD5388

Pages:88

Published On:December 2025

By Product Type:The product type segmentation includes various categories that cater to different networking needs. The primary subsegments are Core Routers, Edge/Access Routers, Ethernet Switches (Layer 2), Multilayer/Data Center Switches (Layer 3+), Master Control Switchers (Broadcast & Media), Network Security & Session Border Controllers, and Others (Industrial & Ruggedized Devices). Each of these subsegments plays a crucial role in the overall market dynamics, reflecting the mix of service provider backbone networks, enterprise campus/data center environments, broadcast control rooms, and industrial communications in Kuwait.

The Core Routers segment is currently dominating the market due to the increasing demand for high-capacity data transmission and the need for efficient routing in large networks operated by telecom service providers and major enterprises. These routers are essential for telecom operators and large enterprises that require reliable and fast internet connectivity, including 5G backhaul, international gateways, and MPLS/IP backbone services. The rise in data traffic, driven by cloud computing, OTT and video streaming services, and IoT applications, has further propelled the adoption of core routers. Additionally, advancements in technology such as software-defined networking, segment routing, and higher-speed interfaces (100G/400G) have led to the development of more efficient and powerful core routers, making them a preferred choice for many organizations modernizing their networks.

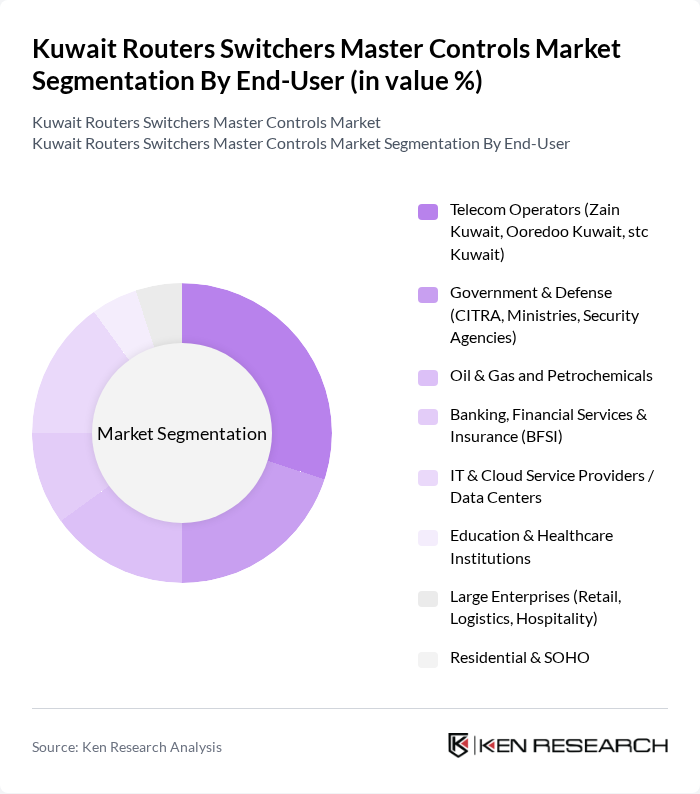

By End-User:The end-user segmentation encompasses various sectors that utilize routers and switches for their networking needs. Key subsegments include Telecom Operators, Government & Defense, Oil & Gas and Petrochemicals, Banking, Financial Services & Insurance (BFSI), IT & Cloud Service Providers/Data Centers, Education & Healthcare Institutions, Large Enterprises (Retail, Logistics, Hospitality), and Residential & SOHO. Each of these sectors has unique requirements that drive the demand for specific networking solutions, such as carrier-grade IP/MPLS for telecom, ruggedized and secure networks for oil and gas, low-latency and compliant infrastructure for BFSI, and scalable leaf–spine architectures for data centers.

The Telecom Operators segment leads the market due to the continuous expansion of mobile and internet services in Kuwait and the need to upgrade transport networks for 4G and 5G, fixed broadband, and international connectivity. With the increasing number of subscribers and the demand for high-speed internet, telecom operators are investing heavily in upgrading their infrastructure, including IP core, aggregation, and access routers and carrier Ethernet switches. This trend is further supported by government initiatives aimed at enhancing digital connectivity and e-government services across the country. The focus on 5G technology, edge computing, and the Internet of Things (IoT) is also driving the need for advanced networking solutions in this sector, including low-latency, high-throughput, and security-integrated platforms.

The Kuwait Routers Switchers Master Controls Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Huawei Technologies Co., Ltd., Juniper Networks, Inc., Arista Networks, Inc., Hewlett Packard Enterprise (HPE) / Aruba Networking, Nokia Corporation (IP & Optical Networks), ZTE Corporation, Fortinet, Inc., Extreme Networks, Inc., Ubiquiti Inc., TP-Link Technologies Co., Ltd., D-Link Corporation, MikroTik SIA, Allied Telesis Holdings K.K., Ciena Corporation contribute to innovation, geographic expansion, and service delivery in this space, offering portfolios that span core and edge routing, campus and data center switching, Wi?Fi, and integrated security.

The Kuwait Routers Switchers Master Controls Market is poised for significant transformation as the government continues to invest in digital infrastructure and smart city initiatives. With the anticipated growth in IoT devices and the rollout of 5G networks, the demand for advanced networking solutions will escalate. Companies that embrace software-defined networking and integrate AI into their operations will likely gain a competitive edge. Furthermore, partnerships with global technology firms could enhance local capabilities, fostering innovation and driving market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Core Routers Edge / Access Routers Ethernet Switches (Layer 2) Multilayer / Data Center Switches (Layer 3+) Master Control Switchers (Broadcast & Media) Network Security & Session Border Controllers Others (Industrial & Ruggedized Devices) |

| By End-User | Telecom Operators (Zain Kuwait, Ooredoo Kuwait, stc Kuwait) Government & Defense (CITRA, Ministries, Security Agencies) Oil & Gas and Petrochemicals Banking, Financial Services & Insurance (BFSI) IT & Cloud Service Providers / Data Centers Education & Healthcare Institutions Large Enterprises (Retail, Logistics, Hospitality) Residential & SOHO |

| By Application | Service Provider Backbone & Aggregation Networks Enterprise Campus & Branch Networking Data Center & Cloud Interconnect Industrial & OT Networks (Utilities, Oilfields) Broadcast Playout, Master Control & Contribution Smart City & Public Safety Networks |

| By Deployment Model | On-Premises Hardware Virtual / Software-Defined (NFV, SDN) Managed Network Services Hybrid (On-Prem + Cloud-Managed) |

| By Industry Vertical | Telecommunications & Internet Service Providers Government, Public Sector & Smart City Projects Oil & Gas, Energy & Utilities Banking & Financial Services Healthcare & Education Media, Broadcast & Entertainment Transportation & Logistics Retail & Hospitality |

| By Geographic Cluster within Kuwait | Kuwait City & Capital Governorate Al Farwaniya & Al Jahra (Industrial & Logistics Corridors) Hawalli & Mubarak Al-Kabeer (Residential & Commercial Hubs) Southern Economic Zone & Port Projects (e.g., Al Ahmadi, Shuwaikh, Shuaiba) |

| By Ownership & Procurement Model | Direct Purchase (Capex) Leasing & Network-as-a-Service (NaaS) Public Sector Tenders & Framework Contracts Public–Private Partnership (PPP) & Concession-Based Deployments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Network Solutions | 90 | IT Managers, Network Architects |

| Telecommunications Service Providers | 80 | Operations Directors, Product Managers |

| Government Infrastructure Projects | 60 | Project Managers, Procurement Officers |

| Residential Broadband Services | 70 | Customer Service Managers, Sales Executives |

| IoT Connectivity Solutions | 50 | Technology Consultants, Business Development Managers |

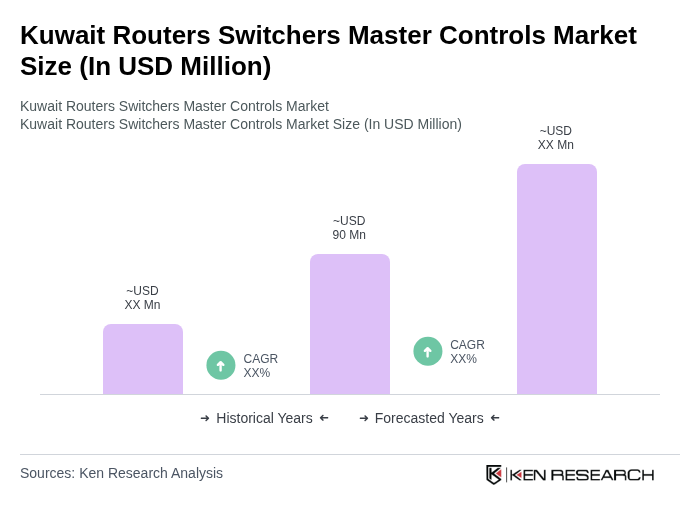

The Kuwait Routers Switchers Master Controls Market is valued at approximately USD 90 million, reflecting a robust demand driven by high-speed internet connectivity, data center expansion, and smart city initiatives under Kuwait Vision 2035.