Region:Asia

Author(s):Geetanshi

Product Code:KRAD0157

Pages:86

Published On:August 2025

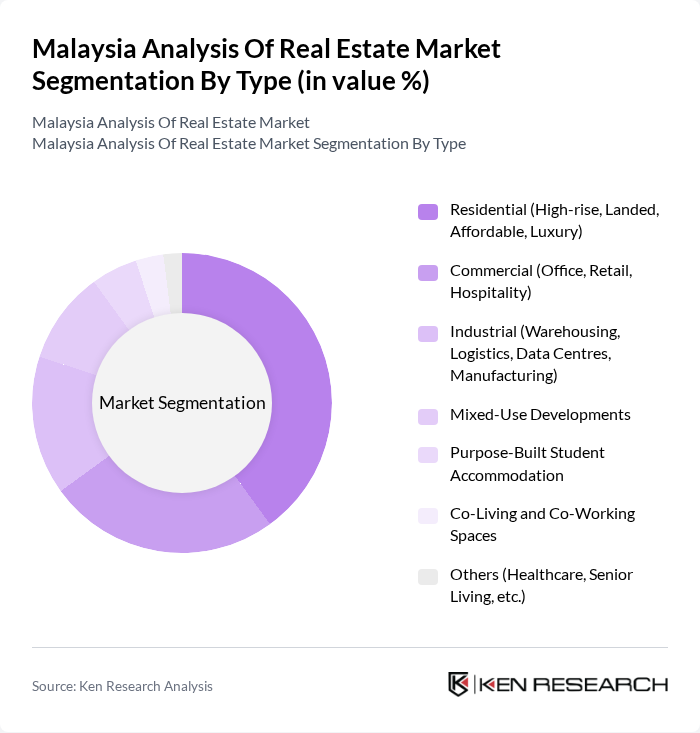

By Type:The real estate market in Malaysia can be segmented into residential, commercial, industrial, mixed-use developments, purpose-built student accommodation, co-living and co-working spaces, and others. Theresidential segmentremains the most dominant, particularly high-rise and affordable housing, driven by increasing urban population, government housing affordability programs, and evolving lifestyle preferences. The commercial segment is supported by demand for flexible office spaces and retail, while industrial properties benefit from logistics, warehousing, and data centre growth. Mixed-use developments are gaining traction in urban centres, and alternative segments such as co-living, co-working, and student accommodation are expanding due to demographic shifts and changing work patterns .

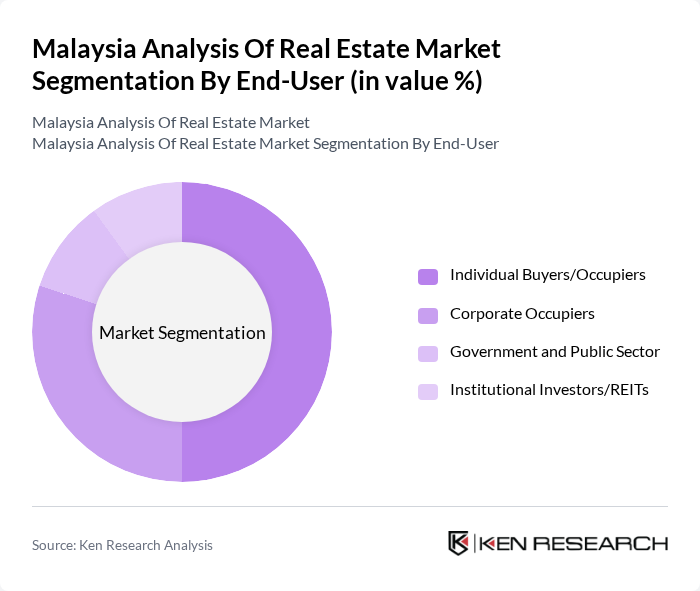

By End-User:The end-user segmentation of the real estate market includes individual buyers/occupiers, corporate occupiers, government and public sector, and institutional investors/REITs. Individual buyers continue to show strong demand for affordable and high-rise housing, supported by government initiatives and stable financing conditions. Corporate occupiers are increasingly seeking flexible and sustainable office solutions, reflecting new work patterns and ESG priorities. Government and public sector investments focus on infrastructure and social housing, while institutional investors and REITs are active in commercial and industrial segments .

The Malaysia Analysis Of Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sunway Berhad, S P Setia Berhad, IOI Properties Group Berhad, UEM Sunrise Berhad, Mah Sing Group Berhad, Eco World Development Group Berhad, Gamuda Berhad, Berjaya Land Berhad, Tropicana Corporation Berhad, Paramount Corporation Berhad, KSL Holdings Berhad, LBS Bina Group Berhad, YTL Corporation Berhad, Malaysian Resources Corporation Berhad (MRCB), Sime Darby Property Berhad contribute to innovation, geographic expansion, and service delivery in this space.

The Malaysian real estate market is poised for a transformative phase, driven by urbanization and technological advancements. As the government continues to invest in infrastructure, the demand for residential and commercial properties is expected to rise. Additionally, the integration of smart technologies in property management will enhance operational efficiency. However, addressing regulatory challenges and affordability issues will be crucial for sustaining growth. Overall, the market is likely to evolve, presenting new opportunities for innovation and investment in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential (High-rise, Landed, Affordable, Luxury) Commercial (Office, Retail, Hospitality) Industrial (Warehousing, Logistics, Data Centres, Manufacturing) Mixed-Use Developments Purpose-Built Student Accommodation Co-Living and Co-Working Spaces Others (Healthcare, Senior Living, etc.) |

| By End-User | Individual Buyers/Occupiers Corporate Occupiers Government and Public Sector Institutional Investors/REITs |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants and Incentives |

| By Property Size | Small Scale (Below 1,000 sq ft) Medium Scale (1,000 - 3,000 sq ft) Large Scale (Above 3,000 sq ft) |

| By Location | Klang Valley (Kuala Lumpur & Selangor) Johor (including Iskandar Malaysia, Forest City) Penang (including George Town, Bayan Lepas) Other Urban Areas Suburban Areas Rural Areas |

| By Financing Type | Bank Loans Cash Purchases Mortgage Financing Islamic Financing |

| By Policy Support | Government Subsidies (e.g., PR1MA, MADANI Housing) Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time Homebuyers, Investors |

| Commercial Real Estate Stakeholders | 60 | Property Managers, Business Owners |

| Real Estate Developers | 40 | Project Managers, Marketing Directors |

| Real Estate Agents | 80 | Sales Agents, Brokers |

| Investors in Real Estate Funds | 50 | Institutional Investors, High Net-Worth Individuals |

The Malaysia real estate market is valued at approximately USD 54 billion, driven by factors such as GDP growth, urbanization, rising disposable incomes, and a growing population, which collectively enhance demand for various property types across the country.