Region:Asia

Author(s):Dev

Product Code:KRAA1644

Pages:93

Published On:August 2025

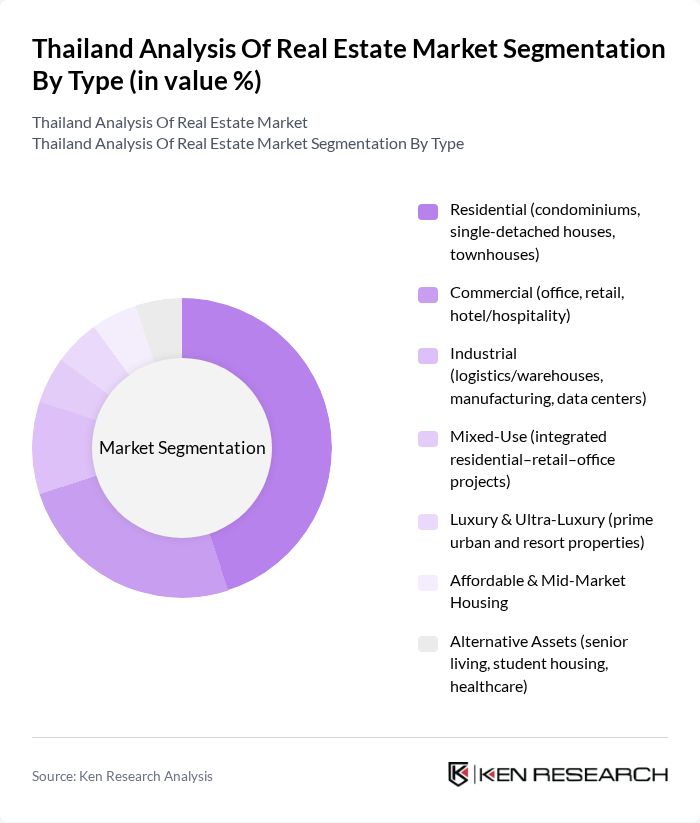

By Type:The real estate market in Thailand can be segmented into various types, including residential, commercial, industrial, mixed-use, luxury & ultra-luxury, affordable & mid-market housing, and alternative assets. Among these, the residential segment, particularly condominiums and townhouses, has shown significant growth due to urban migration and the increasing demand for housing in metropolitan areas. The commercial segment, including office and retail spaces, is also expanding, driven by the growth of businesses and tourism.

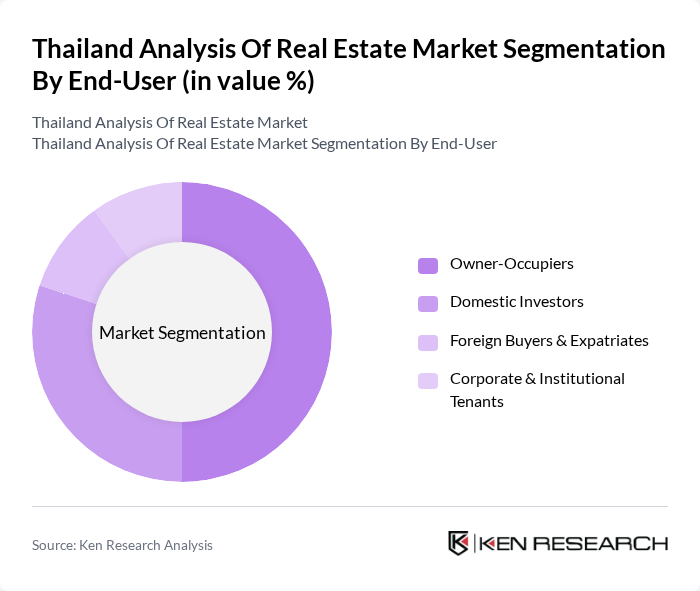

By End-User:The end-user segmentation of the real estate market includes owner-occupiers, domestic investors, foreign buyers & expatriates, and corporate & institutional tenants. The owner-occupier segment is currently the largest, driven by the increasing number of young professionals and families seeking home ownership. Domestic investors are also significant, capitalizing on the growing property market, while foreign buyers are attracted to Thailand's favorable investment climate and lifestyle.

The Thailand Analysis Of Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sansiri Public Company Limited, Property Perfect Public Company Limited, Ananda Development Public Company Limited, Land and Houses Public Company Limited, Supalai Public Company Limited, Central Pattana Public Company Limited, Major Development Public Company Limited, Pruksa Holding Public Company Limited, L.P.N. Development Public Company Limited, AP (Thailand) Public Company Limited, Origin Property Public Company Limited, SC Asset Corporation Public Company Limited, Quality Houses Public Company Limited, Raimon Land Public Company Limited, Asset World Corporation Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's real estate market appears promising, driven by ongoing urbanization and increasing foreign investment. As the government continues to invest in infrastructure, the demand for residential and commercial properties is expected to rise. Additionally, the integration of technology in real estate transactions and a focus on sustainable development will likely shape the market landscape. However, addressing regulatory challenges and economic volatility will be crucial for maintaining investor confidence and ensuring long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential (condominiums, single-detached houses, townhouses) Commercial (office, retail, hotel/hospitality) Industrial (logistics/warehouses, manufacturing, data centers) Mixed-Use (integrated residential–retail–office projects) Luxury & Ultra-Luxury (prime urban and resort properties) Affordable & Mid-Market Housing Alternative Assets (senior living, student housing, healthcare) |

| By End-User | Owner-Occupiers Domestic Investors Foreign Buyers & Expatriates Corporate & Institutional Tenants |

| By Region | Bangkok Metropolitan Region (BMR) Eastern Economic Corridor (Chonburi, Rayong, Chachoengsao) Northern Cluster (Chiang Mai and vicinity) Southern Tourism Hubs (Phuket, Krabi) Eastern Seaboard Tourism (Pattaya/Chonburi) |

| By Investment Source | Domestic Capital Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government & State Enterprise Projects |

| By Policy Support | Buyer & Mortgage Support (LTV, subsidies) Tax Incentives (BOI, EEC privileges) Zoning & Regulatory Facilitation Green Building & Energy-Efficient Incentives |

| By Sales Channel | Direct Developer Sales Agents & Brokerages Online Property Portals |

| By Price Range | Entry-Level (mass market) Mid-Range High-End & Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 120 | First-time Homebuyers, Investors |

| Commercial Real Estate Investors | 90 | Real Estate Fund Managers, Corporate Buyers |

| Real Estate Agents | 80 | Licensed Real Estate Brokers, Sales Agents |

| Property Developers | 70 | Project Managers, Development Executives |

| Real Estate Market Analysts | 60 | Market Researchers, Economic Analysts |

The Thailand real estate market is valued at approximately USD 95 billion, driven by urbanization, foreign investment, and a growing middle class seeking home ownership. This valuation is based on a comprehensive five-year historical analysis of market trends.