Region:Asia

Author(s):Rebecca

Product Code:KRAB4190

Pages:92

Published On:October 2025

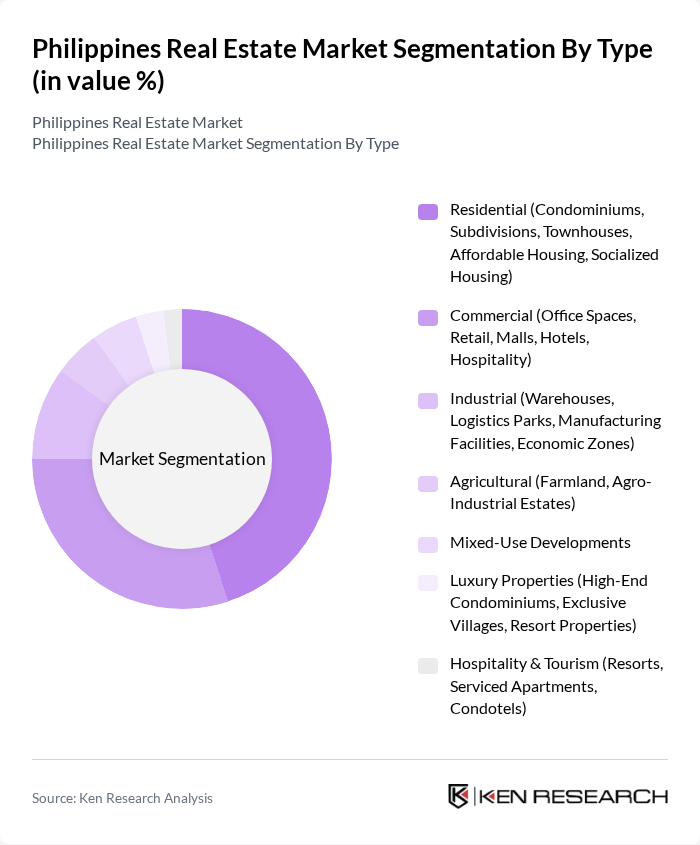

By Type:The real estate market in the Philippines can be segmented into residential, commercial, industrial, agricultural, mixed-use developments, luxury properties, and hospitality & tourism. Each segment caters to distinct consumer needs and investment profiles. Theresidential segment, especially affordable and mid-range housing, has seen significant demand due to population growth, urban migration, and rising household incomes. Thecommercial segmentis thriving, driven by business expansion, growth in the business process outsourcing (BPO) sector, and increased demand for office spaces and retail establishments. Theindustrial segmentis expanding due to logistics, e-commerce, and manufacturing growth, whilemixed-use developmentsare gaining traction for their integration of living, working, and leisure spaces .

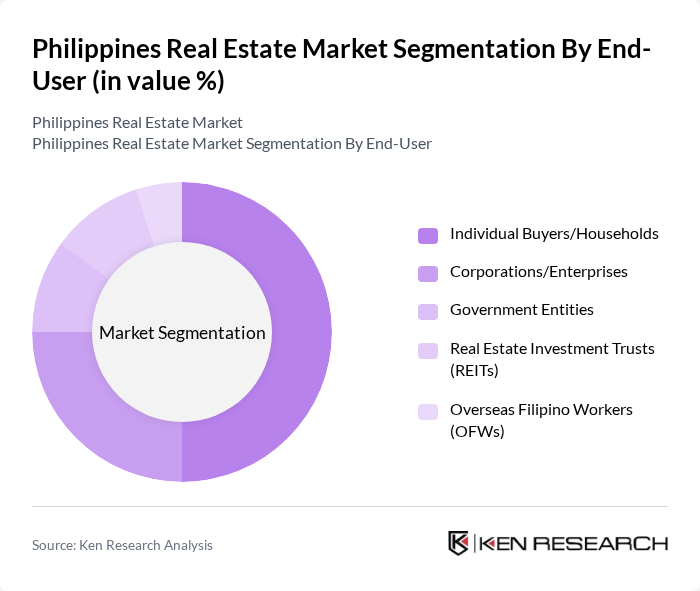

By End-User:The end-users of the real estate market in the Philippines include individual buyers, corporations, government entities, real estate investment trusts (REITs), and overseas Filipino workers (OFWs). Individual buyers are primarily focused on residential properties, while corporations and government entities invest in commercial and industrial spaces. The growing number of OFWs continues to drive demand for housing and investment properties, supported by steady remittance inflows. REITs are gaining traction as a vehicle for property investment, reflecting the maturing capital markets and regulatory support for diversified real estate portfolios .

The Philippines Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Land, Inc., SM Prime Holdings, Inc., Megaworld Corporation, Robinsons Land Corporation, DMCI Homes, Vista Land & Lifescapes, Inc., Federal Land, Inc., Century Properties Group, Inc., Rockwell Land Corporation, Filinvest Land, Inc., DoubleDragon Corporation, Ortigas Land, AboitizLand, Inc., Greenfield Development Corporation, and Cebu Landmasters, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines real estate market is poised for continued growth, driven by urbanization and foreign investment. As infrastructure projects progress, accessibility will improve, enhancing property values. The demand for mixed-use developments and sustainable housing solutions is expected to rise, reflecting changing consumer preferences. Additionally, the increasing focus on digital transformation in real estate transactions will streamline processes, making the market more efficient and attractive to investors and buyers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential (Condominiums, Subdivisions, Townhouses, Affordable Housing, Socialized Housing) Commercial (Office Spaces, Retail, Malls, Hotels, Hospitality) Industrial (Warehouses, Logistics Parks, Manufacturing Facilities, Economic Zones) Agricultural (Farmland, Agro-Industrial Estates) Mixed-Use Developments Luxury Properties (High-End Condominiums, Exclusive Villages, Resort Properties) Hospitality & Tourism (Resorts, Serviced Apartments, Condotels) |

| By End-User | Individual Buyers/Households Corporations/Enterprises Government Entities Real Estate Investment Trusts (REITs) Overseas Filipino Workers (OFWs) |

| By Price Range | Socialized and Economic Housing Affordable/Low-End Properties Mid-Range Properties High-End/Luxury Properties |

| By Location | Metro Manila (NCR) Luzon (ex-NCR) Visayas Mindanao Key Growth Corridors (e.g., Clark, Cebu, Davao, Iloilo) |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Development Stage | Pre-Construction Under Construction Completed/Operational |

| By Financing Type | Bank Loans/Mortgages Equity Financing Government Grants/Subsidies Pag-IBIG Fund/Housing Loans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time homebuyers, Investors |

| Commercial Real Estate Investors | 60 | Property Developers, Investment Managers |

| Real Estate Agents | 50 | Licensed Brokers, Sales Agents |

| Urban Development Planners | 40 | City Planners, Local Government Officials |

| Property Management Firms | 40 | Property Managers, Facility Managers |

The Philippines real estate market is valued at approximately USD 90.5 billion, driven by urbanization, an expanding middle class, and significant foreign investments. This growth reflects the country's economic resilience and ongoing infrastructure development initiatives.