Region:Africa

Author(s):Dev

Product Code:KRAB6137

Pages:95

Published On:October 2025

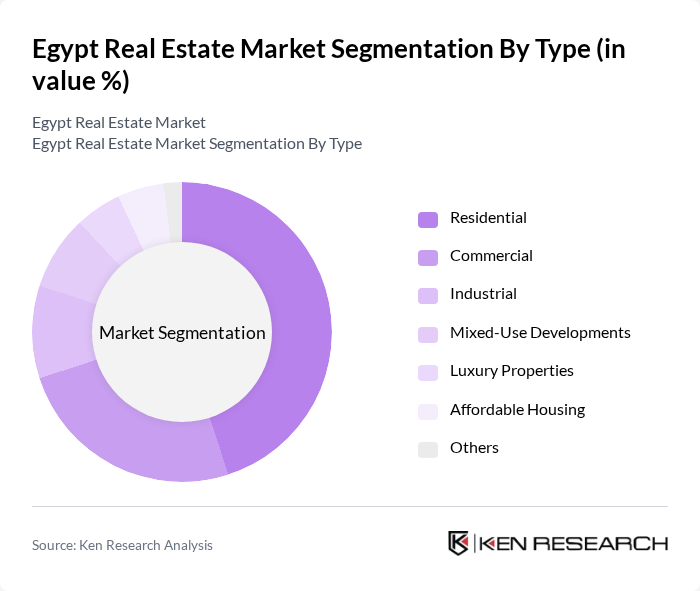

By Type:The Egypt Real Estate Market is segmented into various types, including Residential, Commercial, Industrial, Mixed-Use Developments, Luxury Properties, Affordable Housing, and Others. Among these, the Residential segment is the most dominant, driven by the increasing urban population and the demand for housing solutions. The Commercial segment is also significant, fueled by the growth of businesses and retail spaces in urban areas.

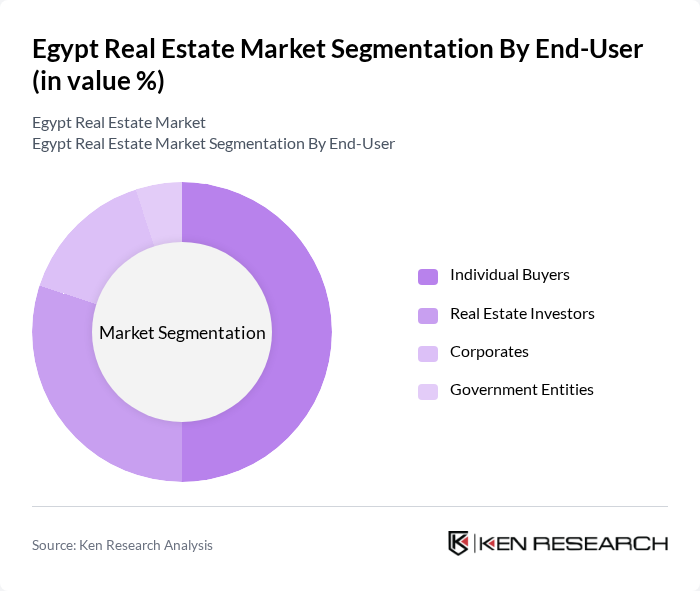

By End-User:The market is also segmented by end-users, including Individual Buyers, Real Estate Investors, Corporates, and Government Entities. Individual Buyers dominate the market, driven by the growing middle class seeking home ownership. Real Estate Investors are increasingly active, capitalizing on the rising property values and rental yields, while Corporates and Government Entities contribute to the demand for commercial and mixed-use developments.

The Egypt Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emaar Misr, Palm Hills Developments, SODIC, Talaat Moustafa Group, Madinet Nasr for Housing and Development, Orascom Development Holding, New Giza, City Edge Developments, Misr Italia Properties, Al Ahly for Real Estate Development, Arab Developers Holding, Hassan Allam Properties, Mountain View, Amer Group, El Nasr Housing and Development contribute to innovation, geographic expansion, and service delivery in this space.

The Egypt real estate market is poised for significant transformation in the coming years, driven by urbanization, government initiatives, and technological advancements. As the population continues to grow, demand for diverse housing options will increase, particularly in urban areas. Additionally, the government's commitment to infrastructure development will enhance connectivity, making previously underdeveloped areas more attractive. The integration of smart technologies and sustainable practices will further shape the market, creating opportunities for innovative real estate solutions and attracting investment.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Commercial Industrial Mixed-Use Developments Luxury Properties Affordable Housing Others |

| By End-User | Individual Buyers Real Estate Investors Corporates Government Entities |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Property Size | Small Scale Medium Scale Large Scale |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties |

| By Development Stage | Pre-Construction Under Construction Completed |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time homebuyers, Investors |

| Commercial Real Estate Developers | 100 | Project Managers, Business Development Executives |

| Real Estate Agents | 80 | Real Estate Brokers, Sales Managers |

| Property Management Firms | 70 | Property Managers, Operations Directors |

| Urban Planning Authorities | 60 | Urban Planners, Policy Makers |

The Egypt Real Estate Market is valued at approximately USD 10 billion, driven by urbanization, population growth, and government initiatives aimed at increasing housing supply and infrastructure development.