Region:Central and South America

Author(s):Shubham

Product Code:KRAB1176

Pages:91

Published On:October 2025

By Product:The product segmentation of the market includes therapeutics and diagnostics. The therapeutics segment is further divided into vaccines, parasiticides, anti-infectives, medical feed additives, and other therapeutics. The diagnostics segment includes immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, and other diagnostics. The therapeutics segment is currently leading the market due to the increasing focus on preventive healthcare, the rising incidence of zoonotic diseases, and the growing adoption of pharmaceutical products for both companion and food-producing animals. Diagnostics is also experiencing rapid growth, driven by technological advancements and the need for early disease detection .

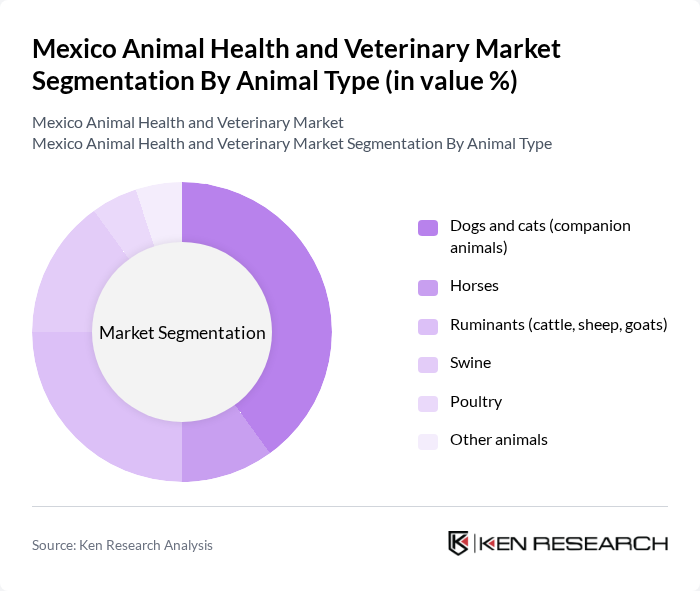

By Animal Type:This segmentation includes dogs and cats (companion animals), horses, ruminants (cattle, sheep, goats), swine, poultry, and other animals. The companion animals segment is the largest due to the increasing trend of pet ownership, the growing willingness of pet owners to spend on veterinary care, and the expansion of pet insurance. The livestock segment is also significant, driven by the need for health management in food-producing animals and the implementation of preventive healthcare measures to ensure food safety and productivity .

The Mexico Animal Health and Veterinary Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Merck Animal Health (MSD Salud Animal México), Elanco Animal Health, Boehringer Ingelheim Animal Health, Ceva Santé Animale, Virbac México, Vetoquinol México, IDEXX Laboratories, Neogen Corporation, Phibro Animal Health Corporation, Alltech México, Kemin Industries, Laboratorios Karizoo México, Laboratorios Tornel, PetIQ contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico Animal Health and Veterinary Market appears promising, driven by increasing pet ownership and advancements in veterinary technology. As consumer awareness of animal health rises, the demand for preventive care and innovative veterinary solutions is expected to grow. Additionally, the integration of telemedicine will enhance access to veterinary services, particularly in underserved areas. These trends indicate a shift towards more comprehensive animal health management, fostering a healthier pet population and improved livestock productivity.

| Segment | Sub-Segments |

|---|---|

| By Product | Therapeutics Vaccines Parasiticides Anti-infectives Medical feed additives Other therapeutics Diagnostics Immunodiagnostic tests Molecular diagnostics Diagnostic imaging Clinical chemistry Other diagnostics |

| By Animal Type | Dogs and cats (companion animals) Horses Ruminants (cattle, sheep, goats) Swine Poultry Other animals |

| By End-User | Pet owners Livestock farmers Veterinary hospitals and clinics Research institutions Others |

| By Distribution Channel | Veterinary hospitals & clinics Retail sales (pharmacies, pet stores) Online retailers Direct sales Others |

| By Region | Northern Mexico Central Mexico Southern Mexico Baja California Others |

| By Price Range | Low-cost products Mid-range products Premium products Others |

| By Application | Preventive care Treatment of diseases Surgical procedures Diagnostic testing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 120 | Veterinarians, Clinic Managers |

| Animal Feed Suppliers | 80 | Sales Managers, Product Development Specialists |

| Livestock Farmers | 100 | Farm Owners, Livestock Managers |

| Pet Owners | 80 | Pet Owners |

| Regulatory Bodies | 40 | Policy Makers, Veterinary Inspectors |

The Mexico Animal Health and Veterinary Market is valued at approximately USD 3.1 billion, reflecting significant growth driven by increased pet ownership, awareness of animal health, and the expanding livestock sector.