Region:Central and South America

Author(s):Dev

Product Code:KRAA3552

Pages:82

Published On:September 2025

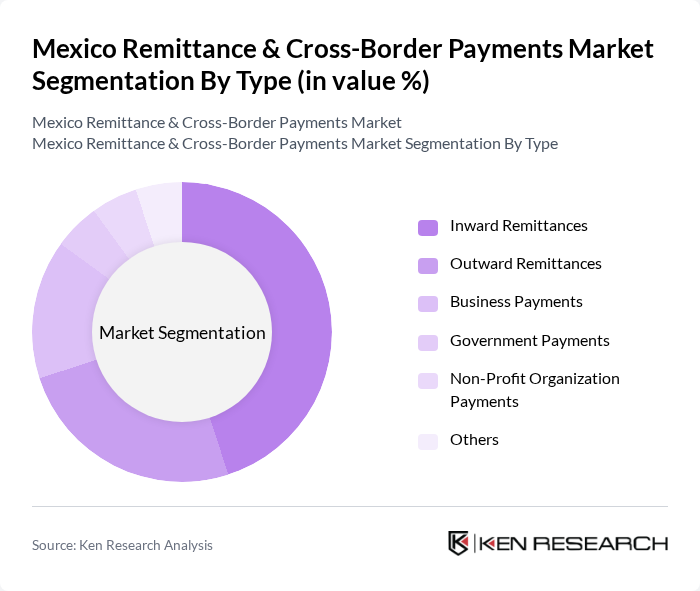

By Type:The market can be segmented into various types, including Inward Remittances, Outward Remittances, Business Payments, Government Payments, Non-Profit Organization Payments, and Others. Each of these segments plays a crucial role in the overall dynamics of the remittance and cross-border payments landscape.Inward remittancesrepresent the largest share, primarily driven by funds sent from the United States to Mexico.Outward remittancesare smaller but growing, reflecting Mexico’s role as both a recipient and sender of cross-border payments.Business paymentsandgovernment paymentsare facilitated by established financial institutions and digital platforms, whilenon-profit organization paymentsandothersaddress niche needs in the sector .

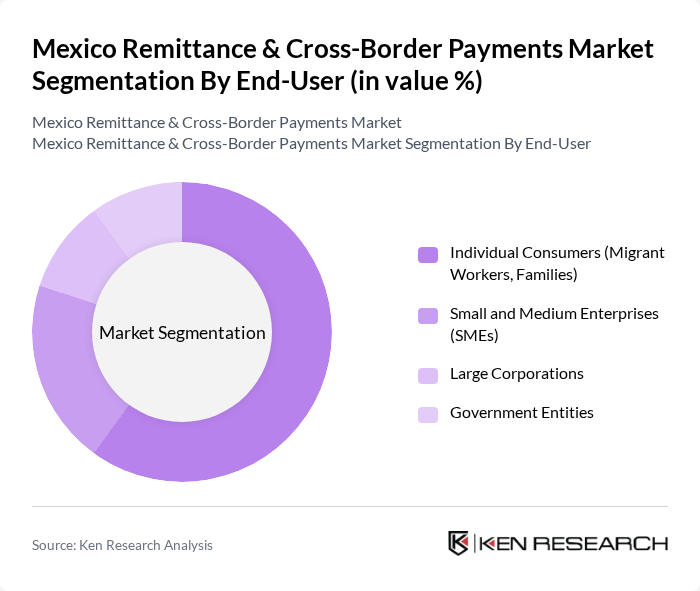

By End-User:The end-user segmentation includes Individual Consumers (Migrant Workers, Families), Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each of these user groups has distinct needs and preferences that influence their choice of remittance and payment services.Individual consumers(primarily migrant workers and their families) are the dominant segment, reflecting the social and economic importance of remittances for household sustenance.SMEsandlarge corporationsutilize cross-border payments for trade and operational needs, whilegovernment entitiesengage in cross-border transfers for public sector obligations .

The Mexico Remittance & Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal, Remitly, Xoom (a PayPal Service), WorldRemit, Wise (formerly TransferWise), Ria Money Transfer, OFX, Azimo, Skrill, Revolut, Payoneer, dLocal, Bitso, Banco Azteca, BBVA México, BanCoppel, Elektra, OXXO contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico remittance and cross-border payments market appears promising, driven by technological advancements and evolving consumer preferences. As digital wallets and mobile payment platforms gain traction, the market is likely to see increased participation from younger demographics. Additionally, the integration of blockchain technology could enhance transaction efficiency and security, addressing existing challenges. Overall, the market is poised for growth, with a focus on improving user experience and reducing transaction costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Remittances Outward Remittances Business Payments Government Payments Non-Profit Organization Payments Others |

| By End-User | Individual Consumers (Migrant Workers, Families) Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | Bank Transfers Money Transfer Operators (MTOs) Mobile Payments / Digital Wallets Cash Pickup Prepaid Cards |

| By Transaction Size | Small Transactions ( |

| By Frequency of Transactions | One-time Transactions Recurring Transactions Seasonal Transactions |

| By Geographic Origin | United States Canada Europe Central & South America Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Remittance Service Users | 150 | Migrants, Family Members Receiving Remittances |

| Money Transfer Operators | 60 | Operations Managers, Compliance Officers |

| Financial Institutions | 50 | Banking Executives, Financial Analysts |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Compliance Experts |

| Technology Providers in Payments | 40 | Product Managers, Technology Officers |

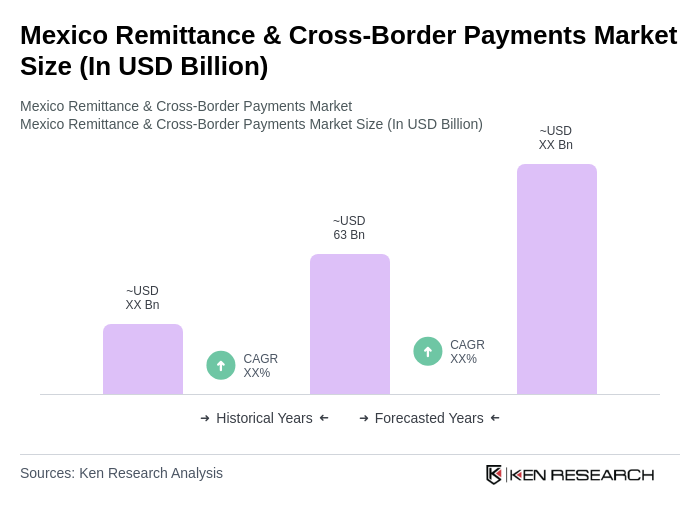

The Mexico Remittance & Cross-Border Payments Market is valued at approximately USD 63 billion, driven by the significant volume of remittances sent by Mexican migrants, particularly from the United States, to support their families back home.