Region:Middle East

Author(s):Dev

Product Code:KRAA8404

Pages:82

Published On:November 2025

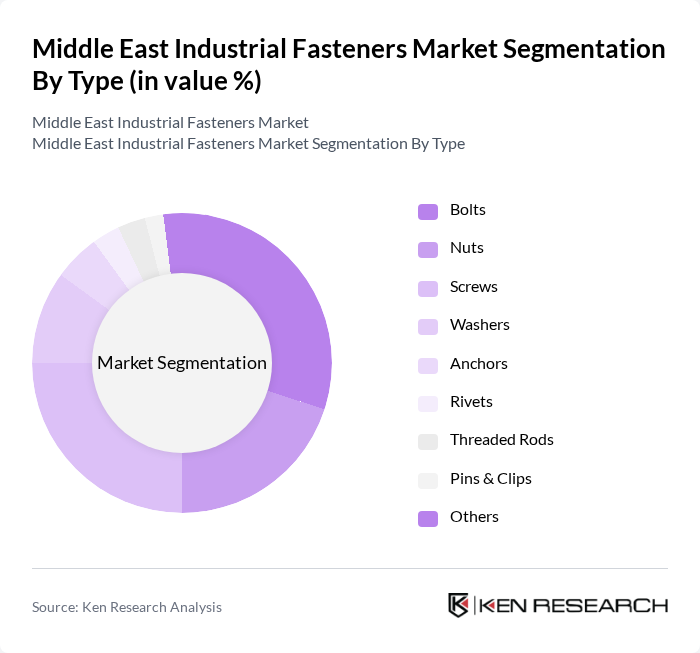

By Type:The market is segmented into bolts, nuts, screws, washers, anchors, rivets, threaded rods, pins & clips, and others. Bolts and screws are the most widely used due to their versatility, strength, and suitability for high-load applications. Demand for these fasteners is driven by construction, automotive, and industrial machinery sectors, where reliability and structural integrity are critical. Increasing adoption of advanced coatings and high-performance materials is further shaping product preferences.

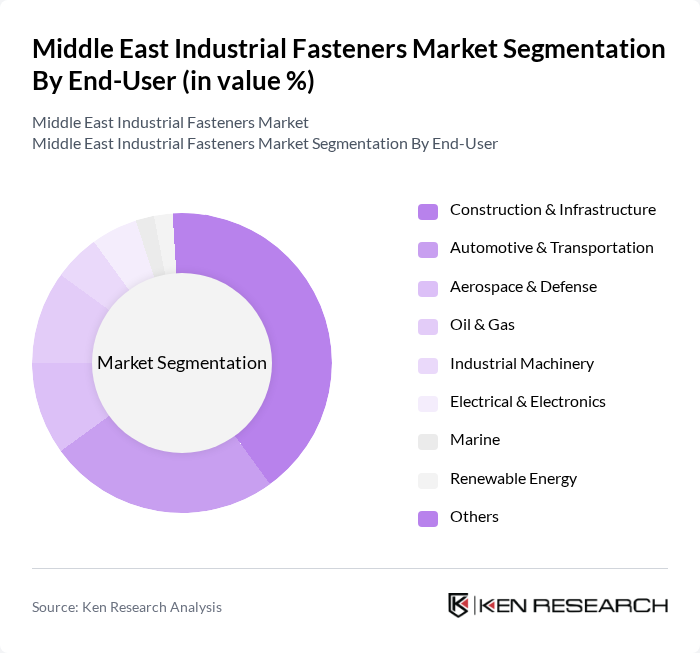

By End-User:The industrial fasteners market serves construction & infrastructure, automotive & transportation, aerospace & defense, oil & gas, industrial machinery, electrical & electronics, marine, renewable energy, and other sectors. Construction & infrastructure is the largest consumer, driven by ongoing mega-projects, urban development, and government investments. Automotive and aerospace sectors are rapidly growing end-users, with demand for lightweight and high-strength fasteners. Renewable energy and marine applications are emerging as important segments, requiring corrosion-resistant and durable fastening solutions.

The Middle East Industrial Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Drees Industrial & Trading Company (Saudi Arabia), Hilti Corporation (Liechtenstein), Würth Group (Germany), ITW (Illinois Tool Works) (USA), Stanley Black & Decker (USA), Bossard Group (Switzerland), SFS Group (Switzerland), Bulten AB (Sweden), Nucor Fastener (USA), APM Hexseal (USA), PennEngineering (USA), Arconic Inc. (USA), Hassan Al-Mutawa Trading Group (UAE), Al Qatami Fasteners (Kuwait), and Al Shahin Metal Industries (Saudi Arabia) contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East industrial fasteners market is poised for significant growth, driven by ongoing investments in infrastructure and industrialization. As the region continues to diversify its economy, the demand for innovative and high-quality fasteners will rise. Additionally, the integration of smart technologies and sustainable practices in manufacturing will shape the future landscape. Companies that adapt to these trends and invest in R&D will likely gain a competitive edge, ensuring long-term success in this evolving market.

| Segment | Sub-Segments |

|---|---|

| By Type | Bolts Nuts Screws Washers Anchors Rivets Threaded Rods Pins & Clips Others |

| By End-User | Construction & Infrastructure Automotive & Transportation Aerospace & Defense Oil & Gas Industrial Machinery Electrical & Electronics Marine Renewable Energy Others |

| By Material | Carbon Steel Stainless Steel Alloy Steel Aluminum Brass Plastic & Composites Others |

| By Coating Type | Zinc Coated Galvanized Black Oxide Phosphate Coated Hot-Dip Galvanized Others |

| By Distribution Channel | Direct Sales Distributors & Dealers Online Retail/E-commerce Industrial Supply Stores Others |

| By Application | Structural Applications Mechanical Assemblies Electrical Installations Piping & Plumbing HVAC Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Turkey Levant Region (Jordan, Lebanon, Iraq, Syria) North Africa (Egypt, Algeria, Morocco, Tunisia, Libya) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Fastener Usage | 60 | Project Managers, Site Engineers |

| Automotive Manufacturing Fastener Requirements | 45 | Production Supervisors, Quality Control Managers |

| Aerospace Fastener Specifications | 40 | Design Engineers, Compliance Officers |

| Oil & Gas Sector Fastener Applications | 40 | Procurement Managers, Operations Directors |

| General Manufacturing Fastener Trends | 50 | Supply Chain Managers, Product Development Leads |

The Middle East Industrial Fasteners Market is valued at approximately USD 2.2 billion, driven by growth in construction, automotive, aerospace, and renewable energy sectors, along with advancements in fastener materials and digital supply chain solutions.