Morocco Furniture & Interiors Market Overview

- The Morocco Furniture & Interiors Market is valued at USD 1.1 billion, based on a five-year historical analysis. Growth is primarily driven by increasing urbanization, rising disposable incomes, rapid real estate development, and a shift toward modern, multifunctional, and sustainable furnishings. The market continues to see robust demand across both residential and commercial segments, reflecting evolving consumer lifestyles and a greater emphasis on home and workspace aesthetics .

- Key cities such as Casablanca, Marrakech, and Rabat dominate the market due to their economic significance and population density. Casablanca, as the largest city, serves as a commercial hub with a high concentration of furniture retailers and manufacturers. Marrakech’s strong tourism sector drives demand for hospitality furniture, while Rabat, as the capital, supports a growing residential and government market .

- In 2023, the Moroccan government enacted theArrêté du Ministre de l’Industrie, du Commerce, de l’Économie Verte et Numérique n° 3186-20 (2023)issued by the Ministry of Industry, Trade, Green and Digital Economy. This regulation requires all furniture manufacturers to implement eco-friendly production processes and utilize certified sustainable materials, as part of Morocco’s national strategy for environmental sustainability and carbon reduction in industrial sectors. Compliance includes mandatory certification, periodic audits, and minimum thresholds for recycled or renewable content in finished products .

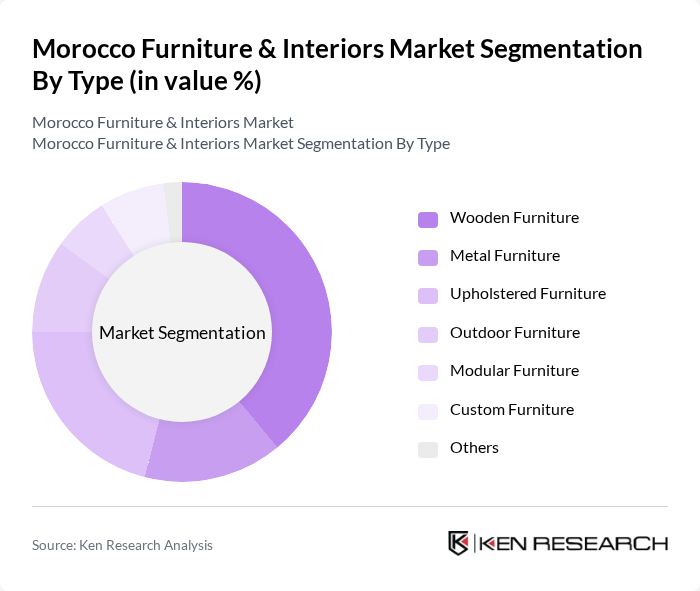

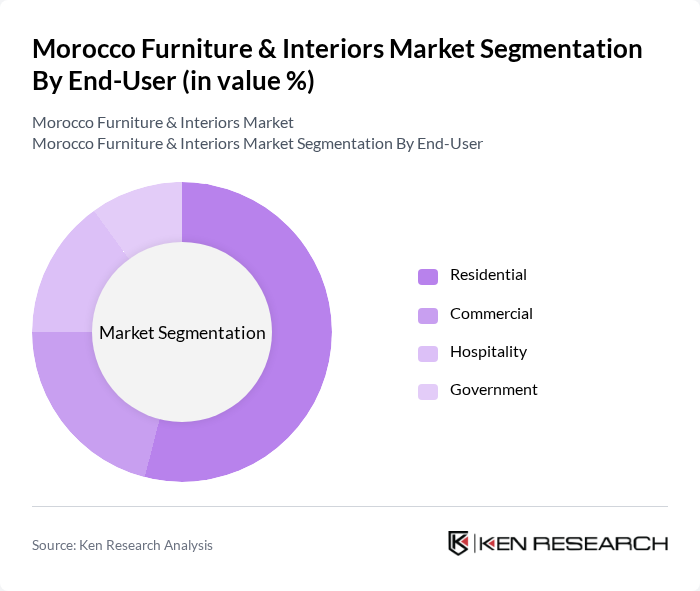

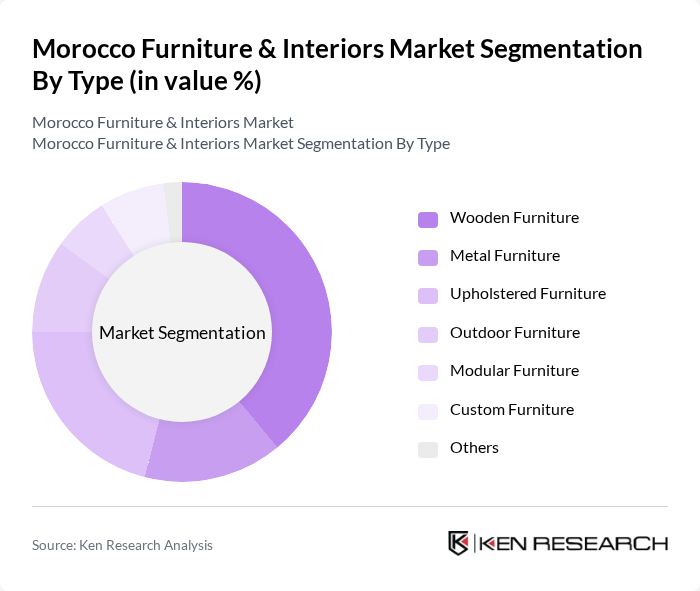

Morocco Furniture & Interiors Market Segmentation

By Type:The furniture market is segmented into various types, including wooden furniture, metal furniture, upholstered furniture, outdoor furniture, modular furniture, custom furniture, and others. Wooden furniture remains the leading segment, valued for its traditional appeal, durability, and alignment with Moroccan cultural preferences. Demand for custom and modular furniture is increasing, driven by urban consumers seeking personalized and space-efficient solutions. The market also reflects a growing interest in sustainable and multifunctional designs, particularly among younger demographics and urban households .

By End-User:The market is segmented by end-user into residential, commercial, hospitality, and government sectors. The residential segment leads, propelled by increased home ownership, renovation activity, and a focus on home comfort and aesthetics. The hospitality sector is expanding, underpinned by Morocco’s thriving tourism industry and the need for high-quality, stylish furniture in hotels and restaurants. Commercial and government demand is also robust, supported by ongoing investments in office and public infrastructure .

Morocco Furniture & Interiors Market Competitive Landscape

The Morocco Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, JYSK, Conforama, Maisons du Monde, Al Khaima, Mobiliers du Monde, Mobilia, Bricorama, L'Atelier du Meuble, Meubles et Décorations, La Maison du Meuble, Mobilier Maroc, Meubles de France, Meubles et Design, Mobiliers de Luxe contribute to innovation, geographic expansion, and service delivery in this space.

Morocco Furniture & Interiors Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in Morocco is accelerating, with the urban population projected to reach 64% in future, up from 58% in 2020. This shift is driving demand for furniture and interior solutions as urban dwellers seek to furnish their homes. The World Bank estimates that urban areas contribute approximately 75% of the national GDP, highlighting the economic importance of urbanization in stimulating the furniture market.

- Rising Disposable Incomes:Morocco's GDP per capita is expected to rise to approximately $4,000 in future, reflecting a growing middle class with increased purchasing power. As disposable incomes rise, consumers are more willing to invest in quality furniture and home decor. The IMF projects a steady economic growth rate of 3.5% annually, further supporting consumer spending in the furniture sector.

- Expansion of E-commerce Platforms:The e-commerce sector in Morocco is projected to grow to over $1 billion in future, driven by increased internet penetration and smartphone usage. This growth facilitates easier access to furniture products, allowing consumers to explore a wider range of options. The Moroccan government’s initiatives to enhance digital infrastructure are expected to further boost online sales, making it a significant growth driver for the furniture market.

Market Challenges

- High Import Tariffs:Morocco imposes import tariffs on furniture that can reach up to 30%, significantly increasing costs for foreign manufacturers. This high tariff structure limits the competitiveness of imported goods, making it challenging for local retailers to offer diverse product ranges. The World Trade Organization has noted that such tariffs can hinder market growth by restricting access to international suppliers and innovative designs.

- Limited Local Manufacturing Capacity:The local furniture manufacturing sector in Morocco is constrained, with only about 20% of the market being locally produced. This limitation is due to outdated production techniques and insufficient investment in technology. According to the Moroccan Ministry of Industry, the country needs to invest approximately $200 million to modernize its manufacturing facilities, which is crucial for enhancing competitiveness and meeting domestic demand.

Morocco Furniture & Interiors Market Future Outlook

The Morocco furniture market is poised for significant transformation, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize sustainability, manufacturers are likely to innovate with eco-friendly materials. Additionally, the expansion of e-commerce will reshape purchasing behaviors, making furniture more accessible. The hospitality sector's growth will further stimulate demand for quality furnishings, while local artisans may gain traction as consumers seek unique, handcrafted products that reflect Moroccan culture and craftsmanship.

Market Opportunities

- Growth in Eco-Friendly Furniture:The demand for eco-friendly furniture is on the rise, with an estimated market value of $300 million in future. Consumers are increasingly seeking sustainable options, prompting manufacturers to innovate with recycled materials and sustainable sourcing practices. This trend presents a lucrative opportunity for businesses to differentiate themselves in a competitive market.

- Expansion of the Hospitality Sector:Morocco's hospitality sector is projected to grow by 5% annually, driven by increased tourism. This growth creates a substantial opportunity for furniture suppliers to cater to hotels and restaurants seeking quality furnishings. The government’s investment in tourism infrastructure, estimated at over $1 billion, will further enhance demand for stylish and durable furniture solutions in the hospitality industry.