Netherlands Athletic Apparel and Sportswear Market Overview

- The Netherlands Athletic Apparel and Sportswear Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness, a rise in fitness activities, and the popularity of athleisure wear among consumers. The market has seen a significant shift towards sustainable and eco-friendly products, reflecting changing consumer preferences and environmental concerns.

- Key cities such as Amsterdam, Rotterdam, and The Hague dominate the market due to their high population density, active lifestyle culture, and strong retail infrastructure. The urban population's inclination towards fitness and wellness, coupled with a vibrant sports culture, contributes to the robust demand for athletic apparel and sportswear in these regions.

- In 2023, the Dutch government implemented regulations aimed at promoting sustainable practices in the textile industry. This includes a mandate for brands to disclose the environmental impact of their products and to adopt circular economy principles, encouraging recycling and reducing waste in the production of athletic apparel and sportswear.

Netherlands Athletic Apparel and Sportswear Market Segmentation

By Type:The market is segmented into various types, including Performance Apparel, Casual Sportswear, Footwear, Accessories, and Others. Performance Apparel is gaining traction due to the increasing participation in sports and fitness activities, while Casual Sportswear is popular for everyday wear. Footwear, particularly running shoes, is also a significant segment, driven by the growing trend of fitness and outdoor activities. Accessories, including bags and fitness gear, complement the apparel segment, catering to the needs of active consumers.

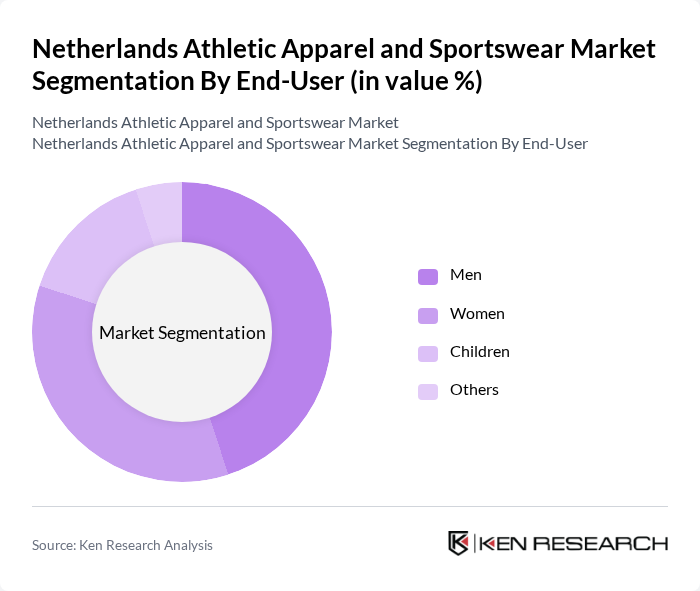

By End-User:The market is categorized into Men, Women, Children, and Others. The men's segment leads the market, driven by a growing interest in fitness and sports. Women’s participation in sports and fitness activities is also on the rise, leading to increased demand for athletic apparel tailored to their needs. The children’s segment is growing as parents invest in quality sportswear for their kids, reflecting a trend towards active lifestyles from a young age.

Netherlands Athletic Apparel and Sportswear Market Competitive Landscape

The Netherlands Athletic Apparel and Sportswear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., ASICS Corporation, New Balance Athletics, Inc., Reebok International Ltd., Lululemon Athletica Inc., Columbia Sportswear Company, The North Face, Inc., H&M Group, Decathlon S.A., Fabletics, Inc., Gymshark Ltd., Athleta, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Netherlands Athletic Apparel and Sportswear Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Netherlands has seen a significant rise in health consciousness, with 68% of the population engaging in regular physical activity as of now. This trend is supported by government initiatives promoting fitness, resulting in a 15% increase in gym memberships over the past two years. The growing awareness of health benefits associated with physical activity is driving demand for athletic apparel, as consumers seek quality products that enhance their performance and comfort during workouts.

- Rise in Participation in Sports Activities:Participation in sports activities has surged, with over 4.5 million people in the Netherlands actively involved in organized sports as of now. This represents a 10% increase from previous years, driven by community programs and local sports clubs. The growing number of participants is fueling demand for specialized athletic apparel, as consumers look for gear that meets their specific needs, from running to team sports, thereby expanding the market significantly.

- Growth of E-commerce Platforms:E-commerce sales in the Netherlands reached €30 billion recently, with online retail for athletic apparel growing by 20% year-on-year. The convenience of online shopping, coupled with the rise of mobile commerce, has made it easier for consumers to access a wide range of athletic apparel. This shift is encouraging brands to invest in digital marketing strategies, enhancing their online presence and driving sales through targeted promotions and personalized shopping experiences.

Market Challenges

- Intense Competition:The athletic apparel market in the Netherlands is characterized by intense competition, with over 200 brands vying for market share. Major players like Nike and Adidas dominate, but numerous local brands are emerging, creating a saturated market. This competition leads to aggressive pricing strategies, making it challenging for smaller brands to establish themselves and maintain profitability, as they struggle to differentiate their products in a crowded marketplace.

- Price Sensitivity Among Consumers:Price sensitivity is a significant challenge, with 60% of consumers indicating that price is a primary factor in their purchasing decisions. Economic factors, such as inflation rates projected at 3.5% for the near future, are influencing consumer behavior, leading to a preference for budget-friendly options. This trend pressures brands to balance quality and affordability, impacting profit margins and complicating marketing strategies aimed at premium product offerings.

Netherlands Athletic Apparel and Sportswear Market Future Outlook

The future of the Netherlands athletic apparel market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are expected to innovate in product offerings, focusing on sustainability and performance. Additionally, the integration of smart technology into apparel is likely to enhance user experience, while the growth of online sales channels will facilitate broader market access. These trends indicate a dynamic landscape that will shape the industry in the near future.

Market Opportunities

- Expansion of Sustainable Apparel:The demand for sustainable athletic apparel is on the rise, with 45% of consumers willing to pay more for eco-friendly products. This trend presents a significant opportunity for brands to innovate and develop sustainable lines, tapping into the growing market segment that prioritizes environmental responsibility and ethical production practices, potentially increasing brand loyalty and market share.

- Growth in Athleisure Trend:The athleisure trend is gaining momentum, with the segment expected to account for €1.2 billion in sales in the near future. This growth is driven by the blending of casual and athletic wear, appealing to consumers seeking versatility in their wardrobe. Brands can capitalize on this trend by offering stylish yet functional apparel that caters to both fitness enthusiasts and everyday wearers, enhancing their market presence.