USA Athletic Apparel and Sportswear Market Overview

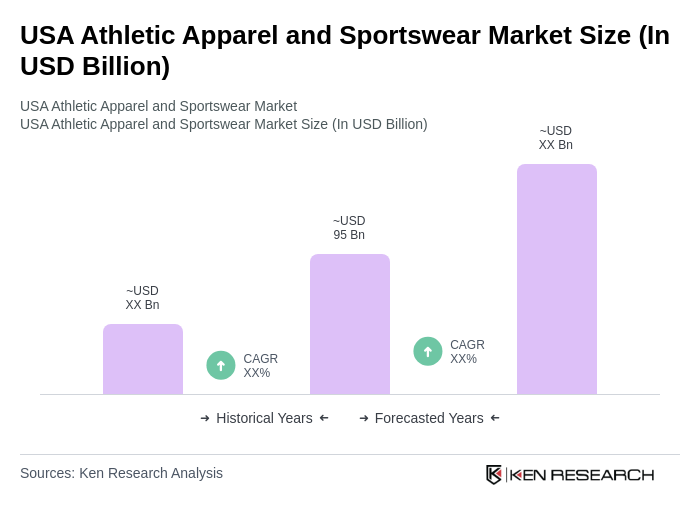

- The USA Athletic Apparel and Sportswear Market is valued at USD 95 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness, the rise of athleisure trends, and a growing emphasis on fitness and wellness among consumers. The market has seen a significant uptick in demand for both performance and casual wear, reflecting a shift in lifestyle choices.

- Key players in this market include major cities such as New York, Los Angeles, and Chicago, which dominate due to their large populations, diverse consumer bases, and strong retail infrastructures. These urban centers are also hubs for fitness culture, with numerous gyms, sports events, and a high concentration of athletic brands, further driving market growth.

- In 2023, the USA government implemented regulations aimed at promoting sustainable practices within the athletic apparel industry. This includes guidelines for manufacturers to reduce waste and increase the use of recycled materials in their products, thereby encouraging eco-friendly production methods and enhancing the overall sustainability of the market.

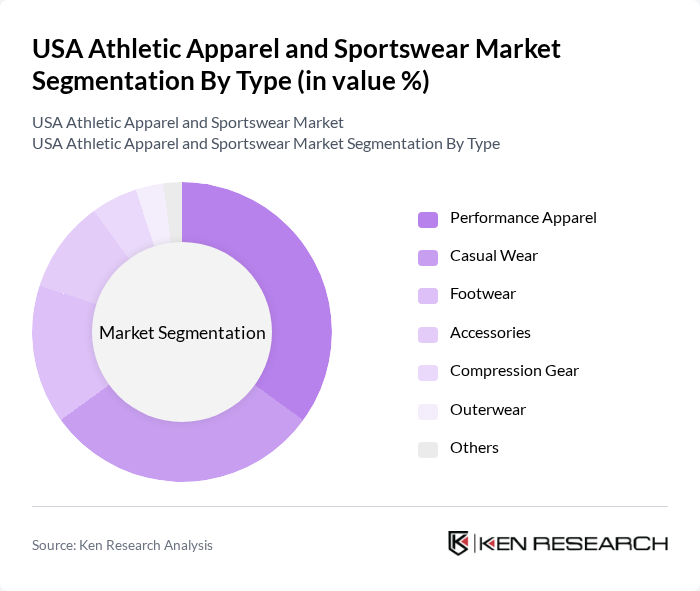

USA Athletic Apparel and Sportswear Market Segmentation

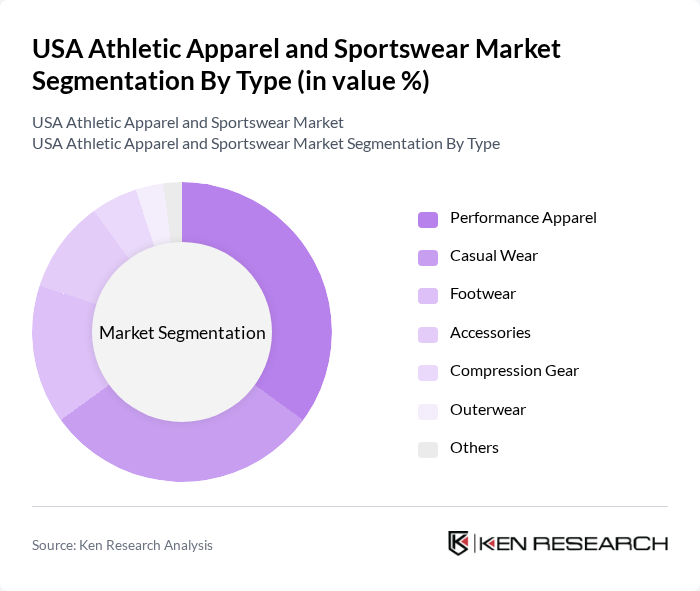

By Type:The athletic apparel and sportswear market is segmented into various types, including Performance Apparel, Casual Wear, Footwear, Accessories, Compression Gear, Outerwear, and Others. Among these, Performance Apparel is currently the leading sub-segment, driven by the increasing participation in sports and fitness activities. Consumers are increasingly seeking high-quality, functional clothing that enhances their performance during workouts. Casual Wear is also gaining traction as athleisure becomes a staple in everyday fashion, appealing to a broader audience beyond just athletes.

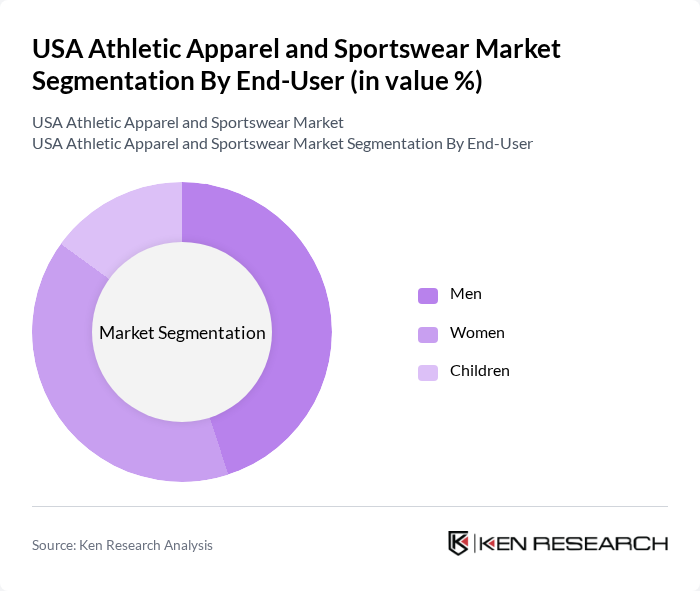

By End-User:The market is also segmented by end-user demographics, including Men, Women, and Children. The Men's segment is currently the largest, driven by a growing interest in fitness and sports among male consumers. Women’s participation in sports and fitness activities has also surged, leading to a significant increase in demand for women's athletic apparel. The Children’s segment is expanding as parents increasingly prioritize active lifestyles for their kids, contributing to the overall growth of the market.

USA Athletic Apparel and Sportswear Market Competitive Landscape

The USA Athletic Apparel and Sportswear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, Lululemon Athletica Inc., New Balance Athletics, Inc., Columbia Sportswear Company, ASICS Corporation, Reebok International Ltd., Champion (Hanesbrands Inc.), Fabletics, Inc., Gymshark Ltd., Athleta (Gap Inc.), Dick's Sporting Goods, Inc., Skechers USA, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

USA Athletic Apparel and Sportswear Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The USA has seen a significant rise in health consciousness, with 78% of adults engaging in regular physical activity as of 2023. This trend is supported by the CDC, which reported that physical activity levels have increased by 10% over the past five years. As consumers prioritize fitness, the demand for athletic apparel has surged, leading to a projected increase in sales of athletic wear, which reached $55 billion in future, reflecting a robust market growth trajectory.

- Rise of Athleisure Trend:The athleisure trend has transformed casual wear, with the market for athleisure apparel valued at approximately $40 billion in future. According to a report by NPD Group, 67% of consumers now wear athletic clothing for everyday activities, not just workouts. This shift has driven brands to innovate and expand their athleisure lines, contributing to a 15% annual growth rate in this segment, as consumers seek comfort and style in their clothing choices.

- Technological Advancements in Fabric:Innovations in fabric technology have significantly enhanced athletic apparel performance. The global market for smart textiles is projected to reach $6 billion by future, driven by advancements in moisture-wicking, breathability, and durability. Companies like Nike and Under Armour are investing heavily in R&D, with Nike allocating $1.2 billion annually to develop new materials. These advancements not only improve user experience but also attract tech-savvy consumers looking for high-performance gear.

Market Challenges

- Intense Competition:The athletic apparel market is characterized by fierce competition, with over 200 brands vying for market share. Major players like Nike, Adidas, and Under Armour dominate, holding approximately 60% of the market. This intense rivalry leads to aggressive pricing strategies, making it challenging for smaller brands to establish a foothold. As a result, many emerging companies struggle to differentiate themselves, impacting their growth potential in a saturated market.

- Supply Chain Disruptions:The athletic apparel industry faces significant supply chain challenges, exacerbated by global events such as the COVID-19 pandemic. In 2023, 40% of companies reported delays in sourcing materials, leading to increased production costs. The World Bank noted that shipping costs have risen by 350% since 2020, impacting profit margins. These disruptions hinder timely product launches and can lead to inventory shortages, affecting overall sales performance in the market.

USA Athletic Apparel and Sportswear Market Future Outlook

The USA athletic apparel market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As health consciousness rises, brands are expected to innovate further, integrating smart technology into their products. Additionally, the focus on sustainability will likely shape product development, with eco-friendly materials gaining traction. Companies that adapt to these trends and invest in digital marketing strategies will be well-positioned to capture emerging consumer segments and expand their market presence.

Market Opportunities

- Growth in Women's Athletic Apparel:The women's athletic apparel segment is projected to grow significantly, with sales reaching $25 billion in future. This growth is driven by increasing participation in sports and fitness activities among women, supported by initiatives promoting female empowerment in sports. Brands that focus on this demographic can capitalize on the expanding market and enhance their product offerings to meet specific needs.

- Sustainable and Eco-friendly Products:The demand for sustainable athletic apparel is on the rise, with 60% of consumers willing to pay more for eco-friendly products. The market for sustainable apparel is expected to reach $12 billion by future. Companies that prioritize sustainability in their production processes and materials can attract environmentally conscious consumers, creating a competitive advantage in the evolving market landscape.