Region:Europe

Author(s):Dev

Product Code:KRAB6091

Pages:87

Published On:October 2025

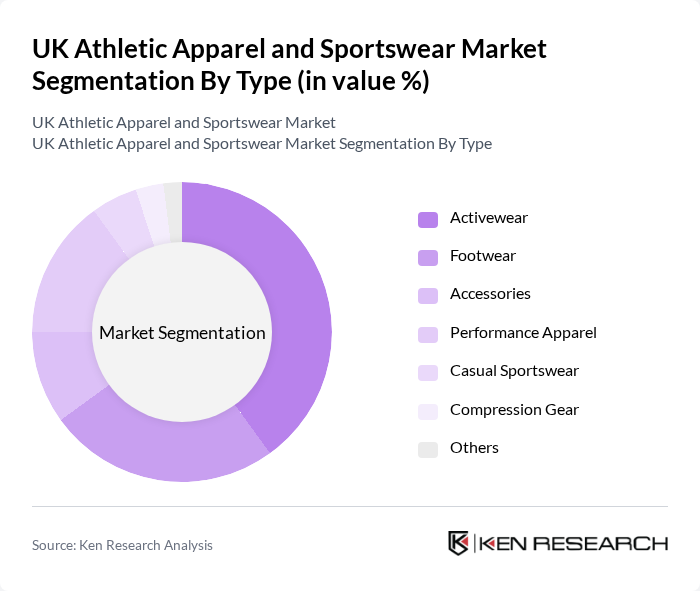

By Type:The market is segmented into various types, including Activewear, Footwear, Accessories, Performance Apparel, Casual Sportswear, Compression Gear, and Others. Among these, Activewear is the leading sub-segment, driven by the increasing trend of fitness and wellness among consumers. The demand for versatile clothing that can be worn both in and out of the gym has surged, making Activewear a dominant force in the market.

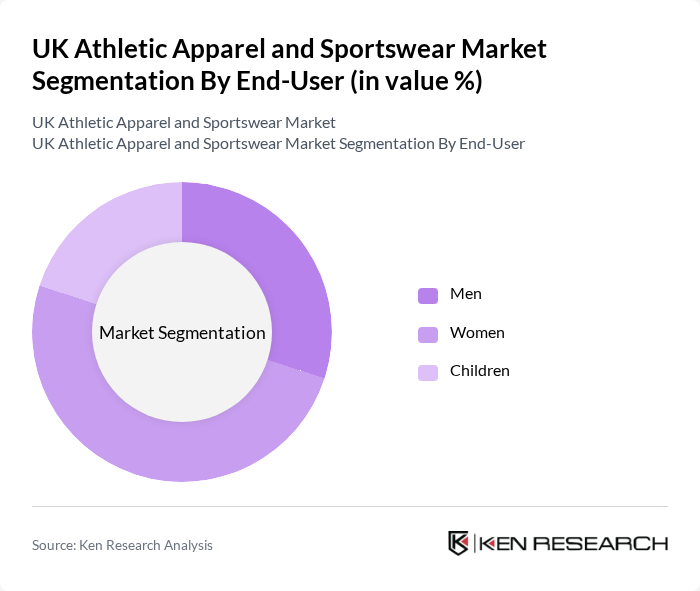

By End-User:The market is categorized into Men, Women, and Children. The Women’s segment is currently the most significant, reflecting the growing participation of women in sports and fitness activities. Brands are increasingly targeting female consumers with tailored products, which has led to a surge in demand for women’s athletic apparel.

The UK Athletic Apparel and Sportswear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Puma SE, New Balance Athletics, Inc., ASICS Corporation, Lululemon Athletica Inc., Gymshark Ltd., Reebok International Ltd., Columbia Sportswear Company, The North Face, Inc., Fabletics, Inc., Sweaty Betty Ltd., Decathlon S.A., H&M Group contribute to innovation, geographic expansion, and service delivery in this space.

The UK athletic apparel market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The integration of sustainable practices and innovative materials will likely shape product offerings, appealing to environmentally conscious consumers. Additionally, the rise of digital platforms and direct-to-consumer sales models will enhance accessibility and engagement. As brands adapt to these trends, they will be better positioned to capture market share and meet the demands of a diverse consumer base in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Activewear Footwear Accessories Performance Apparel Casual Sportswear Compression Gear Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Discount Stores Others |

| By Price Range | Premium Mid-range Budget |

| By Fabric Type | Cotton Polyester Nylon Spandex Others |

| By Occasion | Gym and Fitness Running Outdoor Activities Everyday Wear |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Athletic Apparel | 150 | Fitness Enthusiasts, Casual Athletes |

| Retail Insights on Sportswear Sales | 100 | Store Managers, Retail Buyers |

| Brand Perception Studies | 80 | Marketing Executives, Brand Managers |

| Trends in E-commerce for Sportswear | 120 | E-commerce Managers, Digital Marketing Specialists |

| Performance Needs of Athletes | 70 | Professional Athletes, Coaches |

The UK Athletic Apparel and Sportswear Market is valued at approximately USD 10 billion, reflecting a significant growth trend driven by increased health consciousness and the popularity of athleisure wear among consumers.