Region:Europe

Author(s):Rebecca

Product Code:KRAA4839

Pages:84

Published On:September 2025

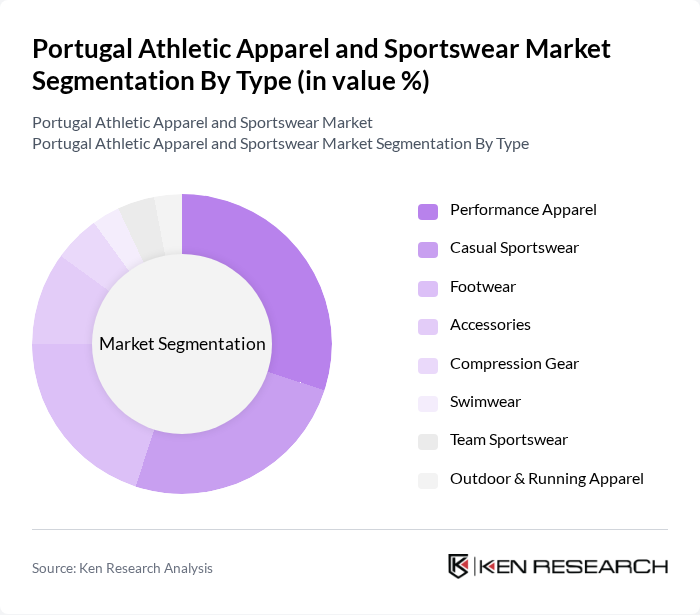

By Type:The market is segmented into Performance Apparel, Casual Sportswear, Footwear, Accessories, Compression Gear, Swimwear, Team Sportswear, and Outdoor & Running Apparel.Performance Apparelleads the market, driven by consumer demand for high-quality, functional clothing that enhances athletic performance.Casual Sportswearis rapidly gaining traction as consumers increasingly seek comfortable and stylish options for everyday wear, reflecting the ongoing athleisure trend.

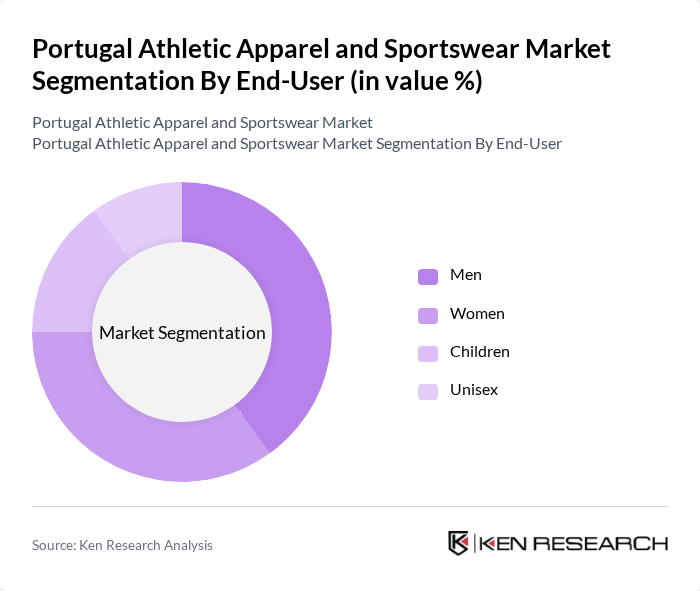

By End-User:The market is segmented by end-user into Men, Women, Children, and Unisex.TheMen’ssegment is currently the largest, supported by a growing interest in fitness and sports among male consumers.Women’sathletic apparel is witnessing robust growth, fueled by increasing participation of women in sports and fitness activities and the surging popularity of athleisure wear.

The Portugal Athletic Apparel and Sportswear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., ASICS Corporation, New Balance Athletics, Inc., Reebok International Ltd., Columbia Sportswear Company, The North Face, Inc., Lululemon Athletica Inc., Decathlon S.A., Skechers USA, Inc., Fila Holdings Corp., H&M Hennes & Mauritz AB, Champion Athleticwear, Sport Zone (Sonae SGPS, S.A.), JD Sports Fashion plc, Oysho (Inditex Group), Sacoor Brothers, Tiffosi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal athletic apparel market appears promising, driven by ongoing trends in health and fitness. As more consumers embrace active lifestyles, the demand for innovative and sustainable products is expected to rise. Additionally, the integration of smart technology into apparel is likely to enhance user experience, attracting tech-savvy consumers. Brands that adapt to these trends while maintaining competitive pricing will likely thrive in this evolving landscape, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Casual Sportswear Footwear Accessories Compression Gear Swimwear Team Sportswear Outdoor & Running Apparel |

| By End-User | Men Women Children Unisex |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Specialty Sports Stores Department Stores Supermarkets/Hypermarkets |

| By Price Range | Premium Mid-range Budget |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Trend-driven Customers |

| By Material | Synthetic Fabrics Natural Fabrics Blended Fabrics Recycled/Sustainable Materials |

| By Occasion | Sports Events Casual Wear Gym and Fitness Outdoor Activities Workwear/Uniforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Athletic Apparel | 120 | Fitness Enthusiasts, Casual Athletes |

| Retail Insights on Sportswear Sales | 60 | Store Managers, Sales Associates |

| Brand Perception and Loyalty | 90 | Brand Loyal Customers, New Users |

| Market Trends in E-commerce for Sportswear | 50 | E-commerce Managers, Digital Marketing Specialists |

| Impact of Sustainability on Purchasing Decisions | 40 | Sustainability Advocates, Eco-conscious Consumers |

The Portugal Athletic Apparel and Sportswear Market is valued at approximately USD 850 million, reflecting a comprehensive analysis of sports apparel and equipment retailing, including athletic apparel, footwear, and accessories.