Region:Europe

Author(s):Rebecca

Product Code:KRAB1792

Pages:94

Published On:October 2025

By Type:The market is segmented into various types of educational offerings, including Online Courses, In-Person Training, Blended Learning Programs, Corporate Workshops, Certification Programs, Coaching and Mentoring, Custom E-Learning Solutions, Game-Based Learning, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, catering to the needs of a diverse workforce. The adoption of AI-driven personalization and adaptive learning platforms is further accelerating the growth of online and blended learning formats .

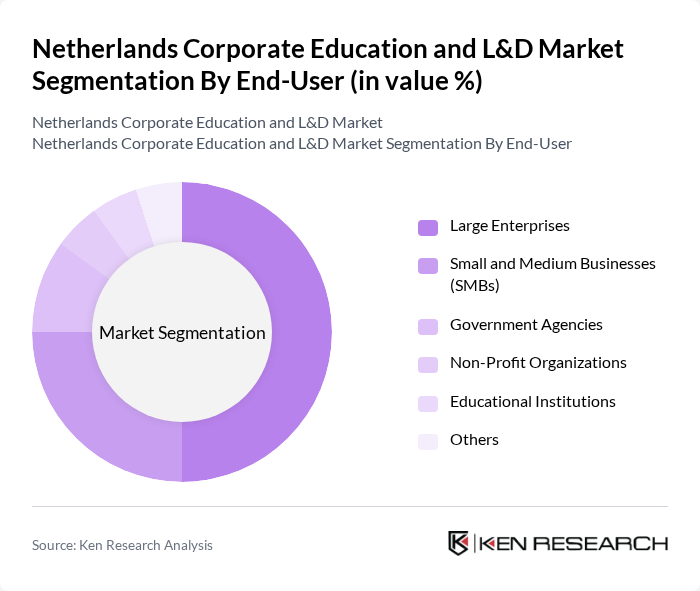

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Businesses (SMBs), Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Large Enterprises dominate the market due to their substantial training budgets and the need for comprehensive employee development programs to maintain competitive advantage. SMBs are increasingly investing in digital learning solutions to enhance workforce skills and remain agile in a competitive environment .

The Netherlands Corporate Education and L&D Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCOI Opleidingen, LOI (Leidse Onderwijsinstellingen), Skillsoft, Coursera, Udemy Business, Schouten & Nelissen, The Learning Network, Springest, Learnit Training, TNO (Nederlandse Organisatie voor Toegepast Natuurwetenschappelijk Onderzoek), Inholland Academy, Erasmus University Rotterdam, Nyenrode Business University, Open Universiteit Nederland, AOG School of Management, Digital Bricks, Pluralsight, LinkedIn Learning, EdX, Khan Academy contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Netherlands corporate education and L&D market appears promising, driven by ongoing investments in technology and a commitment to workforce development. As companies increasingly adopt blended learning models, the integration of AI and data analytics will enhance training effectiveness. Furthermore, the emphasis on soft skills training is expected to grow, aligning with the evolving needs of the labor market. This dynamic environment will likely foster innovation and collaboration among training providers, ensuring that educational offerings remain relevant and impactful.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses In-Person Training Blended Learning Programs Corporate Workshops Certification Programs Coaching and Mentoring Custom E-Learning Solutions Game-Based Learning Others |

| By End-User | Large Enterprises Small and Medium Businesses (SMBs) Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Industry Sector | Technology Healthcare Finance Manufacturing Retail Hospitality Public Sector Others |

| By Learning Format | Virtual Instructor-Led Training Self-Paced Learning Mobile Learning Microlearning Rapid E-Learning Others |

| By Duration | Short Courses (Less than 1 Month) Medium Courses (1-3 Months) Long Courses (More than 3 Months) Others |

| By Delivery Method | Online Delivery On-Site Delivery Hybrid Delivery Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 100 | L&D Managers, Training Coordinators |

| Employee Skill Development Initiatives | 80 | HR Managers, Talent Development Specialists |

| Digital Learning Platforms | 60 | IT Managers, E-learning Developers |

| Leadership Development Programs | 50 | Executive Coaches, Program Directors |

| Compliance Training | 40 | Compliance Officers, Risk Management Executives |

The Netherlands Corporate Education and L&D Market is valued at approximately USD 4.5 billion, reflecting a significant growth driven by the increasing demand for upskilling and reskilling in the workforce, particularly in technology and digital sectors.