Region:Asia

Author(s):Geetanshi

Product Code:KRAA4164

Pages:91

Published On:January 2026

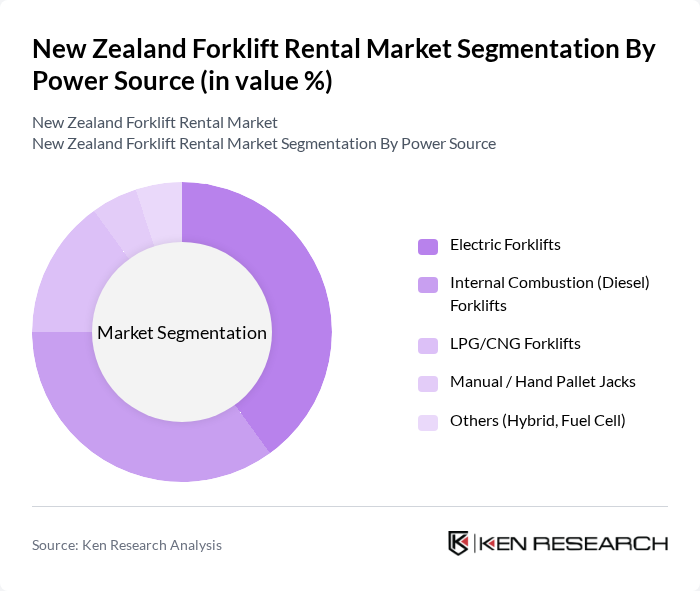

By Power Source:The power source segmentation of the forklift rental market includes Electric Forklifts, Internal Combustion (Diesel) Forklifts, LPG/CNG Forklifts, Manual / Hand Pallet Jacks, and Others (Hybrid, Fuel Cell). Electric Forklifts are gaining popularity due to their environmental benefits, compliance with indoor emission requirements, lower noise levels, and reduced operating costs in warehousing and logistics applications. Internal Combustion Forklifts remain widely used in heavy-duty, outdoor, and construction-related applications where higher load capacities and longer operating times are required. The demand for LPG/CNG Forklifts is also increasing as businesses look for alternative fuel options that offer lower emissions than conventional diesel while maintaining similar performance. Manual / Hand Pallet Jacks are essential for smaller operations and last?meter movements within warehouses and retail stores, and the Others category includes emerging technologies like hybrid and fuel cell forklifts, which are gradually entering advanced logistics and high?throughput environments.

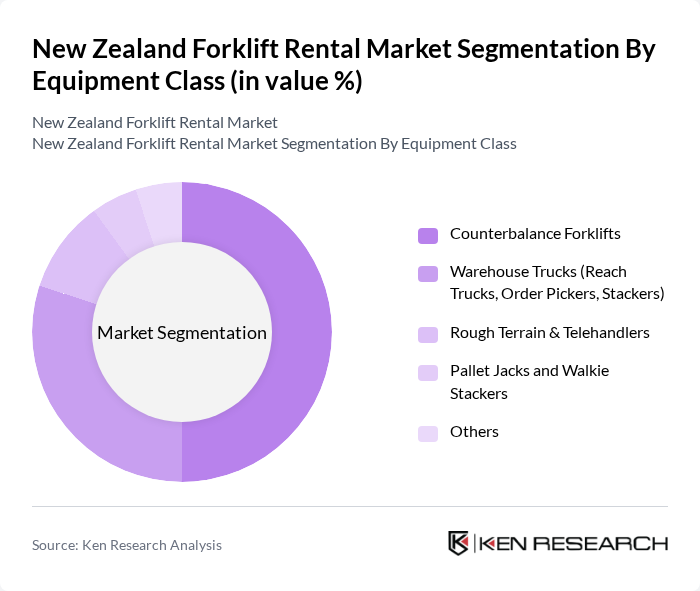

By Equipment Class:The equipment class segmentation includes Counterbalance Forklifts, Warehouse Trucks (Reach Trucks, Order Pickers, Stackers), Rough Terrain & Telehandlers, Pallet Jacks and Walkie Stackers, and Others. Counterbalance Forklifts dominate the rental market due to their versatility, ability to operate in both indoor and outdoor environments, and suitability for a wide range of palletized loads across manufacturing, logistics, and general warehousing. Warehouse Trucks (such as reach trucks, order pickers, and stackers) are essential for efficient high?bay storage, narrow?aisle operations, and e?commerce fulfillment centers where rapid order picking and vertical storage optimization are critical. Rough Terrain Forklifts and Telehandlers are crucial for construction, agriculture, and infrastructure projects where uneven ground conditions and extended reach are required. Pallet Jacks and Walkie Stackers are popular for smaller operations, back?of?store logistics, and short?distance movements, and the Others category includes specialized equipment tailored for niche applications such as very narrow aisle trucks, high?capacity forklifts, and container handlers.

The New Zealand Forklift Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hirepool, Youngman Richardson & Co., CablePrice (NZ) Ltd, Caliber Hire, NZ Forklift Hire, TSL Forklifts, All Lift Forklifts & Access Equipment, TCM Forklifts New Zealand, Crown Equipment New Zealand, Toyota Material Handling New Zealand, Manitou New Zealand, Hyster-Yale Group (Hyster & Yale brands), Linde Material Handling New Zealand, Mitsubishi Forklift Trucks, Doosan Industrial Vehicle contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand forklift rental market is poised for significant growth, driven by increasing automation and the adoption of flexible rental agreements. As businesses seek to optimize their operations, the integration of IoT technologies will enhance efficiency and safety in material handling. Furthermore, the shift towards electric forklifts aligns with sustainability goals, presenting opportunities for rental companies to expand their offerings. Overall, the market is expected to adapt to evolving customer needs and technological advancements, ensuring a dynamic landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Power Source | Electric Forklifts Internal Combustion (Diesel) Forklifts LPG/CNG Forklifts Manual / Hand Pallet Jacks Others (Hybrid, Fuel Cell) |

| By Equipment Class | Counterbalance Forklifts Warehouse Trucks (Reach Trucks, Order Pickers, Stackers) Rough Terrain & Telehandlers Pallet Jacks and Walkie Stackers Others |

| By Application | Warehousing & Logistics Manufacturing Construction & Infrastructure Retail & Wholesale Trade Food & Beverage and Cold Chain Others |

| By Rental Duration | Short-term Rentals (up to 1 month) Medium-term Rentals (1–12 months) Long-term Rentals (above 12 months) Project-based / Seasonal Rentals |

| By Load Capacity | Below 3 Tons –5 Tons –10 Tons Above 10 Tons |

| By Region | Auckland & Upper North Island Central & Lower North Island (including Wellington) South Island (including Christchurch & Dunedin) Other Regions |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Rental & Equipment Management Outsourcers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Forklift Rentals | 100 | Project Managers, Site Supervisors |

| Warehouse Operations | 80 | Warehouse Managers, Inventory Control Specialists |

| Manufacturing Industry Usage | 70 | Production Managers, Operations Directors |

| Logistics and Distribution Centers | 90 | Logistics Coordinators, Supply Chain Managers |

| Retail Sector Forklift Needs | 60 | Retail Operations Managers, Facility Managers |

The New Zealand Forklift Rental Market is valued at approximately USD 55 million, reflecting a steady growth driven by increased demand for efficient material handling solutions across various sectors, including construction, manufacturing, and logistics.