Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4160

Pages:87

Published On:January 2026

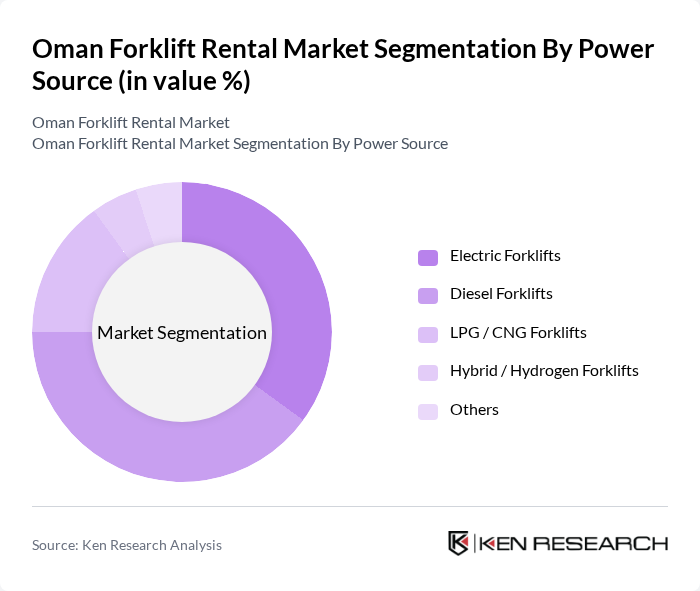

By Power Source:The forklift rental market is segmented by power source into Electric Forklifts, Diesel Forklifts, LPG/CNG Forklifts, Hybrid/Hydrogen Forklifts, and Others. Electric forklifts are gaining traction in Oman, particularly in warehouses, logistics centers, and indoor industrial facilities, due to their lower emissions, reduced noise, and increasingly competitive total cost of ownership supported by advances in lithium?ion battery technology. Diesel forklifts remain popular for heavy?duty outdoor applications in construction sites, ports, and industrial yards where higher load capacities and longer operating times are needed. LPG/CNG forklifts are preferred in industries seeking a balance between indoor and outdoor use with quick refueling, while hybrid and hydrogen options are at an early stage globally but are emerging as sustainable choices in advanced logistics operations and are expected to influence future fleet decisions in Oman.

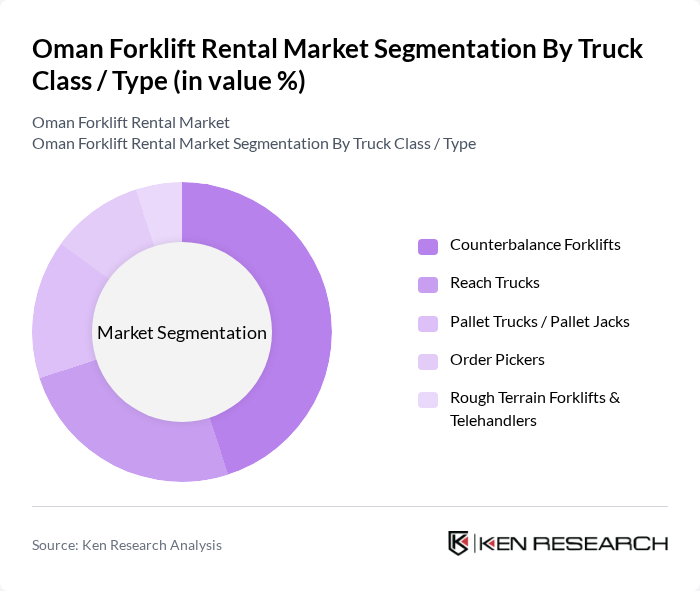

By Truck Class / Type:This segment includes Counterbalance Forklifts, Reach Trucks, Pallet Trucks/Pallet Jacks, Order Pickers, Rough Terrain Forklifts & Telehandlers, and Others. Counterbalance forklifts dominate rental demand due to their versatility across ports, construction sites, manufacturing plants, and general warehousing, aligning with global rental fleet compositions. Reach trucks are preferred in high?bay warehouses and distribution centers in Muscat, Sohar, and Salalah free zones, where narrow?aisle operations and high racking systems are common. Pallet trucks and pallet jacks are widely used for light?duty horizontal movements in retail, FMCG warehousing, and smaller logistics facilities, while order pickers are essential for e?commerce and retail order fulfillment where case? and piece?picking efficiency is critical. Rough terrain forklifts and telehandlers serve specialized applications in construction, oil and gas, and industrial projects in remote or uneven terrain.

The Oman Forklift Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Auto & Machinery Company (FAMCO), General Engineering Services Co. L.L.C (Genserv), Zubair Automotive Group, Saud Bahwan Group, Al-Bahar (Caterpillar Dealer), Sarooj Construction & Equipment Rental, Muscat Overseas Group, Azzan Group / Azzan Equipment Rental, Al Fairuz Trading & Contracting Co. L.L.C., Oasis Trading & Equipment Rental, Galfar Engineering & Contracting SAOG, MB Holding Company LLC (including MB Plant & Equipment), Al-Taher Group, Towell Group (Equipment & Rental Division), Other Local Forklift Rental Operators contribute to innovation, geographic expansion, and service delivery in this space.

The Oman forklift rental market is poised for significant growth, driven by increasing investments in infrastructure and the expansion of the logistics sector. As companies continue to prioritize operational efficiency, the shift towards rental services is expected to accelerate. Additionally, technological advancements in forklift design and the integration of IoT for fleet management will enhance operational capabilities. These trends indicate a robust future for the forklift rental market, with opportunities for innovation and expansion in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Power Source | Electric Forklifts Diesel Forklifts LPG / CNG Forklifts Hybrid / Hydrogen Forklifts Others |

| By Truck Class / Type | Counterbalance Forklifts Reach Trucks Pallet Trucks / Pallet Jacks Order Pickers Rough Terrain Forklifts & Telehandlers Others |

| By End-Use Industry | Warehousing and Logistics Construction and Infrastructure Manufacturing (Industrial & Automotive) Retail & Wholesale Trade Oil & Gas and Petrochemicals Ports, Free Zones and Mining Others |

| By Rental Duration | Short-term Rental (up to 6 months) Medium-term Rental (6–24 months) Long-term / Contract Rental (above 24 months) |

| By Payload Capacity | Up to 3 tons to 5 tons to 10 tons Above 10 tons Others |

| By Region | Muscat Salalah Sohar Nizwa Duqm & Other Regions |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Corporations Government & Public Sector Entities Logistics & Rental Aggregators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Forklift Usage | 100 | Site Managers, Equipment Rental Coordinators |

| Manufacturing Sector Equipment Rental | 80 | Production Managers, Operations Managers |

| Logistics and Warehousing Forklift Demand | 90 | Warehouse Managers, Supply Chain Managers |

| Retail Sector Forklift Utilization | 70 | Inventory Managers, Logistics Supervisors |

| Government and Infrastructure Projects | 60 | Project Managers, Procurement Officers |

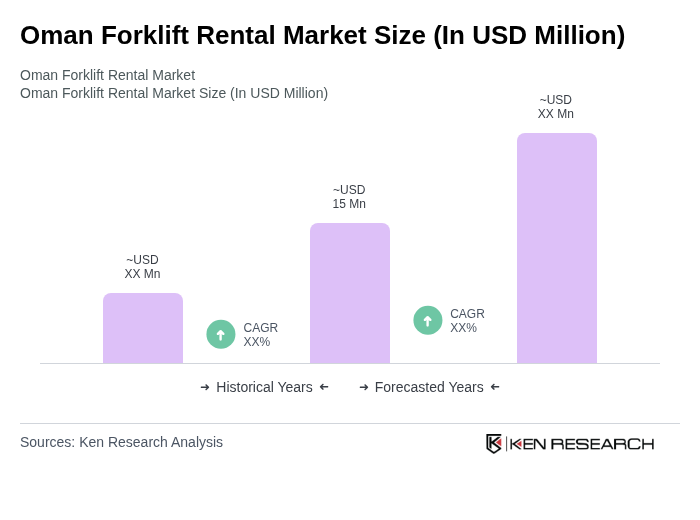

The Oman Forklift Rental Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for material handling solutions across various sectors, including construction, logistics, and manufacturing.