Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4159

Pages:95

Published On:January 2026

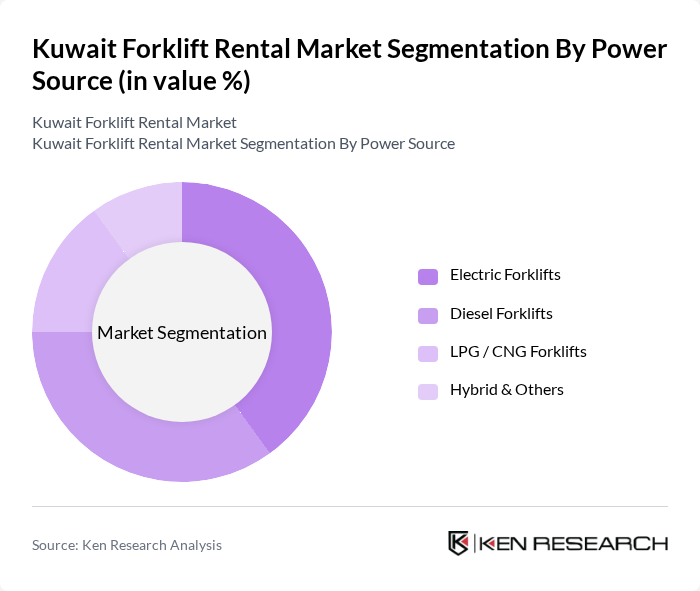

By Power Source:The forklift rental market is segmented by power source into Electric Forklifts, Diesel Forklifts, LPG/CNG Forklifts, and Hybrid & Others. Electric forklifts are gaining popularity due to their zero local emissions, lower energy and maintenance costs, and suitability for indoor warehousing and logistics environments, in line with a broader regional shift toward forklift electrification. Diesel forklifts remain favored for heavy-duty outdoor applications, construction sites, and oil and gas-related operations where high load capacity and durability are critical. LPG/CNG forklifts are also utilized for their lower emissions compared with diesel and their efficiency in indoor-outdoor operations, especially in distribution centers and food and beverage logistics. Hybrid and other alternative powertrain models, including advanced battery technologies, are emerging as versatile options for fleet owners seeking to balance performance, sustainability targets, and total cost of ownership in rental fleets.

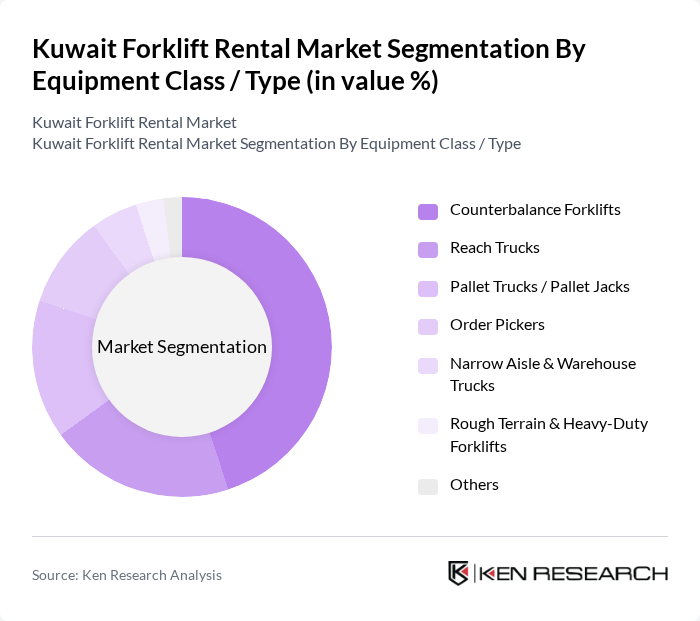

By Equipment Class / Type:The market is also segmented by equipment class into Counterbalance Forklifts, Reach Trucks, Pallet Trucks/Pallet Jacks, Order Pickers, Narrow Aisle & Warehouse Trucks, Rough Terrain & Heavy-Duty Forklifts, and Others. Counterbalance forklifts dominate the market due to their versatility, suitability for a wide range of lifting tasks, and extensive use across construction sites, manufacturing plants, ports, and general logistics operations. Reach trucks are preferred in warehousing and distribution centers for their ability to operate in high-rack, narrow-aisle storage environments, aligning with the development of modern, high-density warehouses in Kuwait. Pallet trucks and pallet jacks support short-distance material movement in warehouses and retail backrooms, while order pickers and narrow aisle trucks enable efficient piece-picking and space optimization. Rough terrain and heavy-duty forklifts serve construction, infrastructure, and oilfield environments where ground conditions and load requirements are more demanding.

The Kuwait Forklift Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Bahar (Kuwait – CAT Dealer & Equipment Rental), JTC – Jassim Transport & Stevedoring Co. K.S.C.P., United Gulf Equipment Rentals, Al-Sayer Heavy Equipment & Forklift Rental, Al-Mutawa Heavy Equipment & Forklifts, Integrated Logistics Company K.S.C., Mohammed Abdulmohsin Al-Kharafi & Sons Co. (Equipment Division), Gulf Equipment & Technology (GET), Al Mulla Group – Equipment & Commercial Vehicles, Alghanim Equipment Rental, Regional & International Players Active in Kuwait Forklift Rental, Other Local Forklift Rental Companies contribute to innovation, geographic expansion, and service delivery in this space, with fleets increasingly incorporating electric models, value-added services such as maintenance-inclusive rental, and operator training to support logistics, construction, and industrial clients.

The Kuwait forklift rental market is poised for significant growth, driven by advancements in technology and increasing demand for efficient material handling solutions. As businesses continue to embrace electric and hybrid forklifts, the market will likely see a shift towards more sustainable practices. Additionally, the integration of IoT in fleet management will enhance operational efficiency, allowing companies to optimize their rental fleets. This evolving landscape presents opportunities for innovation and improved service delivery in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Power Source | Electric Forklifts Diesel Forklifts LPG / CNG Forklifts Hybrid & Others |

| By Equipment Class / Type | Counterbalance Forklifts Reach Trucks Pallet Trucks / Pallet Jacks Order Pickers Narrow Aisle & Warehouse Trucks Rough Terrain & Heavy-Duty Forklifts Others |

| By End-User Industry | Construction & Infrastructure Manufacturing & Industrial Oil & Gas and Petrochemicals Warehousing & Logistics Retail, Wholesale & FMCG Government & Public Sector Others |

| By Rental Duration | Short-term Rentals (up to 1 month) Medium-term Rentals (1–12 months) Long-term Rentals (above 12 months) Project-based & Seasonal Rentals |

| By Payload Capacity | Up to 2 tons to 5 tons to 10 tons Above 10 tons |

| By Region | Capital Governorate Hawalli Governorate Ahmadi Governorate Farwaniya Governorate Jahra Governorate Others |

| By Customer Type | Small Enterprises Medium Enterprises Large Enterprises Government Entities Others |

| By Contract / Service Model | Dry Rental (Equipment Only) Wet Rental (Equipment with Operator) Full-Service Rental (Maintenance Included) Fleet Management & Long-Term Leasing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Forklift Usage | 100 | Project Managers, Site Supervisors |

| Warehouse Operations | 90 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Facility Rentals | 70 | Operations Managers, Production Supervisors |

| Retail and Distribution Centers | 60 | Supply Chain Managers, Inventory Control Specialists |

| Rental Company Insights | 50 | Business Development Managers, Fleet Managers |

The Kuwait Forklift Rental Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for material handling equipment across various sectors, including construction, logistics, and manufacturing.