Region:Asia

Author(s):Geetanshi

Product Code:KRAA4162

Pages:97

Published On:January 2026

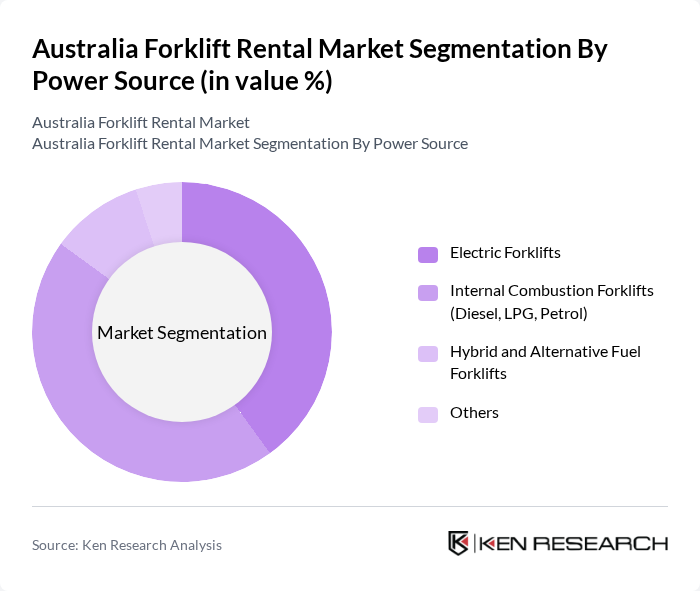

By Power Source:The market is segmented into four primary power sources: Electric Forklifts, Internal Combustion Forklifts (Diesel, LPG, Petrol), Hybrid and Alternative Fuel Forklifts, and Others. Electric Forklifts are gaining traction due to their zero local emissions, lower noise levels, and reduced operating and maintenance costs, particularly in indoor warehousing and logistics environments where electric models are the fastest-growing segment of the broader forklift market. Internal Combustion Forklifts remain popular for heavy-duty and outdoor applications, including construction sites, ports, and mining-related logistics, where higher capacities and extended runtimes are required. Hybrid and Alternative Fuel Forklifts, including models powered by LPG and advanced engines, are emerging as a sustainable option appealing to businesses focused on reducing emissions while maintaining performance and refuelling flexibility. The Others category includes specialized forklifts such as rough?terrain, narrow?aisle, and high?capacity models that cater to niche applications in construction, ports, and specialized warehousing.

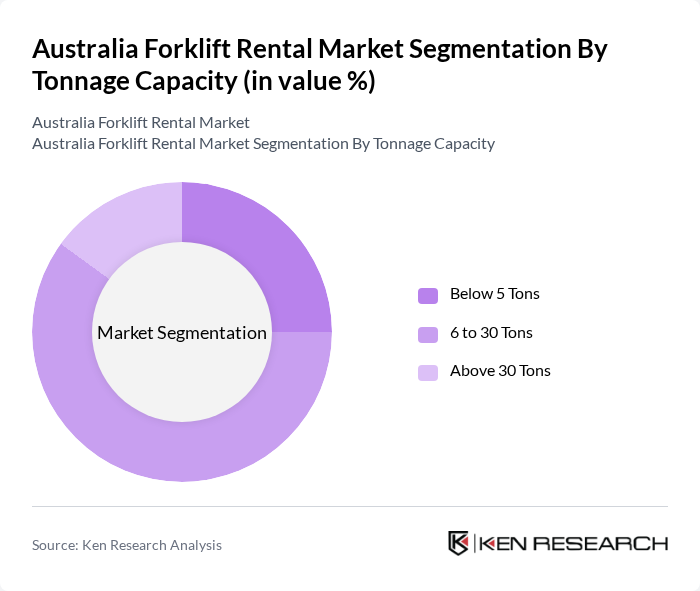

By Tonnage Capacity:The market is categorized based on tonnage capacity into Below 5 Tons, 6 to 30 Tons, and Above 30 Tons. Forklifts with a capacity of 6 to 30 Tons are important for heavy industrial users such as ports, steel, and mining, but rental demand in Australia is particularly strong in the Below 5 Tons segment, which aligns with the operational requirements of warehousing, retail, and light manufacturing and accounts for around half of national rental volume. Below 5 Tons forklifts are popular among small and medium businesses and in urban settings where space is limited and maneuverability and narrow?aisle capability are critical. The Above 30 Tons category caters to heavy industries, ports, and resource projects requiring high-capacity lifts for containers, steel coils, and prefabricated modules, although it represents a smaller segment of the overall rental market and is concentrated in resource-rich states such as Western Australia and Queensland.

The Australia Forklift Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coates Hire, Kennards Hire, United Forklift and Access Solutions, Lencrow Forklifts, Adaptalift Group, Clark Equipment Australia, All Lift Forklifts & Access Equipment, Toyota Material Handling Australia, Crown Equipment Pty Ltd (Australia), Hyster-Yale Group (Australia), Manitou Australia, AUSA Australia, Fork Force Australia, Auslift Equipment, Other Prominent Regional Players contribute to innovation, geographic expansion, and service delivery in this space.

The Australia forklift rental market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The shift towards electric and hybrid forklifts is expected to gain momentum, aligning with sustainability goals. Additionally, the integration of IoT in fleet management will enhance operational efficiency and safety. As businesses increasingly favor rental services over ownership, the market will likely see a rise in on-demand rental solutions, catering to the dynamic needs of various sectors, including e-commerce and construction.

| Segment | Sub-Segments |

|---|---|

| By Power Source | Electric Forklifts Internal Combustion Forklifts (Diesel, LPG, Petrol) Hybrid and Alternative Fuel Forklifts Others |

| By Tonnage Capacity | Below 5 Tons to 30 Tons Above 30 Tons |

| By Equipment Type | Counterbalance Forklifts Reach Trucks and Narrow Aisle Forklifts Rough Terrain Forklifts & Telehandlers Pallet Jacks and Walkie Stackers Others |

| By End-Use Industry | Warehouse & Logistics Construction & Infrastructure Manufacturing Retail & E-commerce Mining & Resources Others |

| By Rental Duration | Short-Term Rentals (Less than 1 Month) Medium-Term Rentals (1 to 12 Months) Long-Term Rentals (More than 12 Months) |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others (Tasmania, ACT, Northern Territory) |

| By Customer Type | Small and Medium Enterprises Large Enterprises Government and Public Sector Third-Party Logistics Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Equipment Rental | 120 | Project Managers, Equipment Rental Coordinators |

| Warehouse Operations | 90 | Warehouse Managers, Logistics Supervisors |

| Manufacturing Sector Forklift Usage | 80 | Production Managers, Safety Officers |

| Retail Sector Forklift Rental | 70 | Store Operations Managers, Supply Chain Analysts |

| Event and Exhibition Rentals | 60 | Event Coordinators, Facility Managers |

The Australia Forklift Rental Market is valued at approximately AUD 130 million, driven by increasing demand for efficient material handling solutions across various industries, including construction, logistics, retail, and manufacturing.