Region:Asia

Author(s):Geetanshi

Product Code:KRAA4158

Pages:97

Published On:January 2026

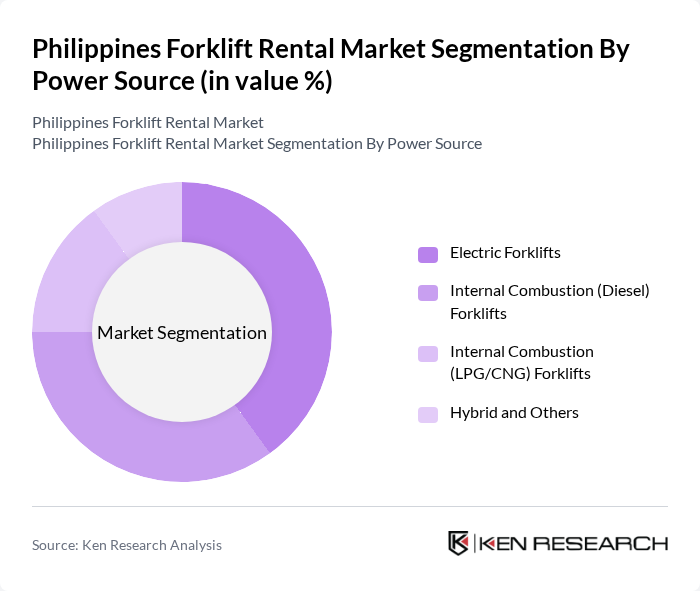

By Power Source:The forklift rental market can be segmented based on the power source of the equipment. The primary subsegments include Electric Forklifts, Internal Combustion (Diesel) Forklifts, Internal Combustion (LPG/CNG) Forklifts, and Hybrid and Others. Electric Forklifts are gaining traction due to their eco-friendliness, lower operational costs, and suitability for indoor warehouse applications, in line with global trends toward sustainable and low-emission material handling equipment. Internal Combustion Forklifts remain popular in heavy-duty and outdoor applications such as construction sites, ports, and large logistics yards, where higher load capacities and longer operating ranges are required.

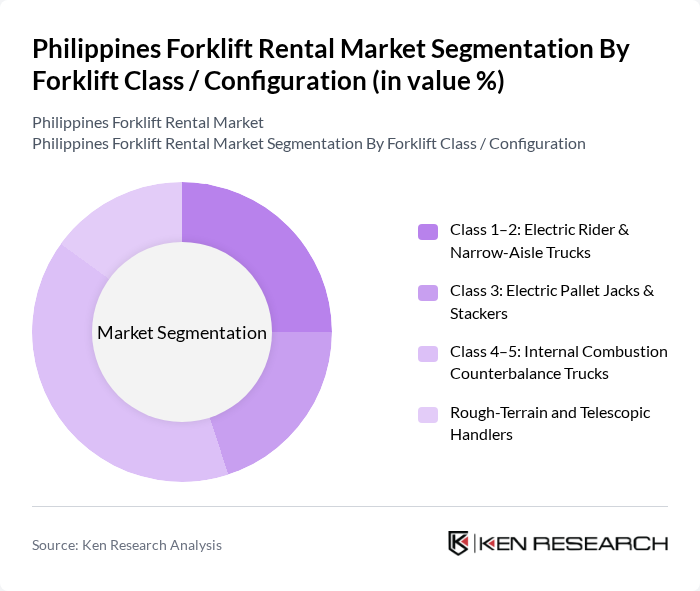

By Forklift Class / Configuration:This segmentation includes Class 1–2: Electric Rider & Narrow-Aisle Trucks, Class 3: Electric Pallet Jacks & Stackers, Class 4–5: Internal Combustion Counterbalance Trucks, and Rough-Terrain and Telescopic Handlers. The Class 4–5 segment is particularly dominant due to its versatility and higher load capacities, making it suitable for construction, outdoor logistics, and heavy manufacturing applications. Electric rider trucks (Class 1–2) and pallet trucks/stackers (Class 3) are increasingly adopted in warehouses and e-commerce fulfillment centers, where narrow-aisle storage, high throughput, and indoor emission standards are critical.

The Philippines Forklift Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Material Handling Philippines, Komatsu Forklift, Doosan Industrial Vehicle, Clark Material Handling Company, Crown Equipment Corporation, Hyster-Yale Group, KION Group (Linde, STILL, Baoli), Mitsubishi Logisnext (Mitsubishi, Nichiyu, UniCarriers), Hyundai Material Handling, JCB, Manitou Group, TCM Corporation, Local & Regional Rental Specialists (e.g., Mayon Machinery, Civic Merchandising, Others) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines forklift rental market is poised for significant growth, driven by increasing demand in logistics, e-commerce, and infrastructure development. As businesses seek cost-effective solutions, the trend towards rental services is expected to gain momentum. Additionally, advancements in technology and a shift towards sustainable practices will likely shape the market landscape. Companies that adapt to these trends and invest in operator training will be well-positioned to capitalize on emerging opportunities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Power Source | Electric Forklifts Internal Combustion (Diesel) Forklifts Internal Combustion (LPG/CNG) Forklifts Hybrid and Others |

| By Forklift Class / Configuration | Class 1–2: Electric Rider & Narrow-Aisle Trucks Class 3: Electric Pallet Jacks & Stackers Class 4–5: Internal Combustion Counterbalance Trucks Rough-Terrain and Telescopic Handlers |

| By Capacity (Load Class) | Up to 3 Tons –5 Tons –10 Tons Above 10 Tons |

| By Rental Contract Type | Short-Term / Spot Rentals (? 1 Month) Medium-Term Contracts (1–12 Months) Long-Term / Full-Service Leasing (> 12 Months) Rent-to-Own and Project-Based Rentals |

| By End-User Industry | Logistics, Warehousing & 3PL Manufacturing Construction & Infrastructure Retail & Modern Trade Ports, Terminals & Cargo Handling Others (Mining, Utilities, etc.) |

| By Region | Luzon (incl. NCR) Visayas Mindanao |

| By Service Offering | Bare Rental (Equipment Only) Rental with Maintenance Rental with Operator Value-Added Services (Telematics, Training, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Forklift Usage | 100 | Project Managers, Site Supervisors |

| Warehouse Operations and Equipment Rental | 80 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Sector Equipment Needs | 70 | Production Managers, Supply Chain Analysts |

| Retail Sector Forklift Utilization | 60 | Inventory Managers, Operations Directors |

| Rental Service Provider Insights | 90 | Business Development Managers, Sales Executives |

The Philippines Forklift Rental Market is valued at approximately USD 20 million, driven by increasing demand for efficient material handling solutions across logistics, manufacturing, and construction sectors, as well as the rise in e-commerce and infrastructure projects.