Region:Europe

Author(s):Geetanshi

Product Code:KRAA2053

Pages:85

Published On:August 2025

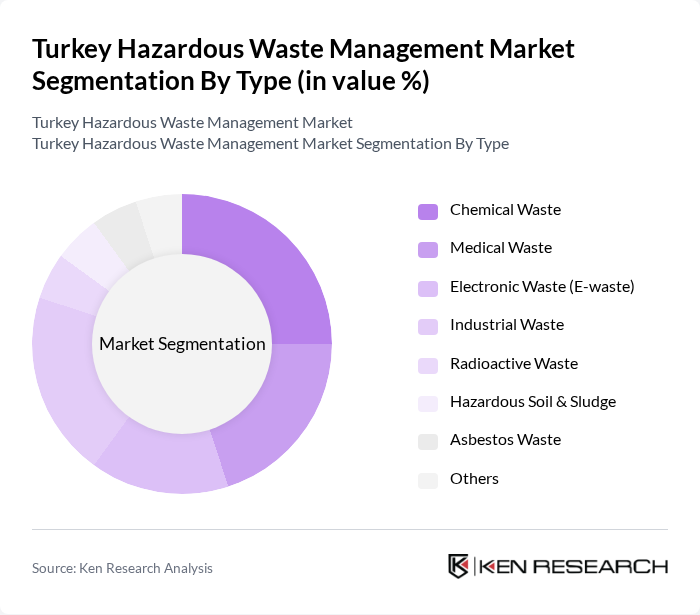

By Type:The hazardous waste management market in Turkey is segmented into Chemical Waste, Medical Waste, Electronic Waste (E-waste), Industrial Waste, Radioactive Waste, Hazardous Soil & Sludge, Asbestos Waste, and Others. Each segment presents unique challenges, requiring tailored management strategies to ensure safe disposal and compliance with regulatory standards. Chemical Waste is prevalent due to its widespread use in manufacturing and agriculture, while Medical Waste is driven by the expanding healthcare sector. Electronic Waste is increasing in volume as digitalization and consumer electronics adoption rise.

TheChemical Wastesegment dominates the market due to the extensive use of chemicals in manufacturing, agriculture, and industrial processes. Compliance with strict disposal regulations has led to increased investment in chemical waste treatment technologies.Medical Wastefollows, driven by the expansion of healthcare services and the need for safe disposal to prevent health hazards. TheElectronic Wastesegment is growing, supported by rising awareness and regulatory initiatives for e-waste recycling.

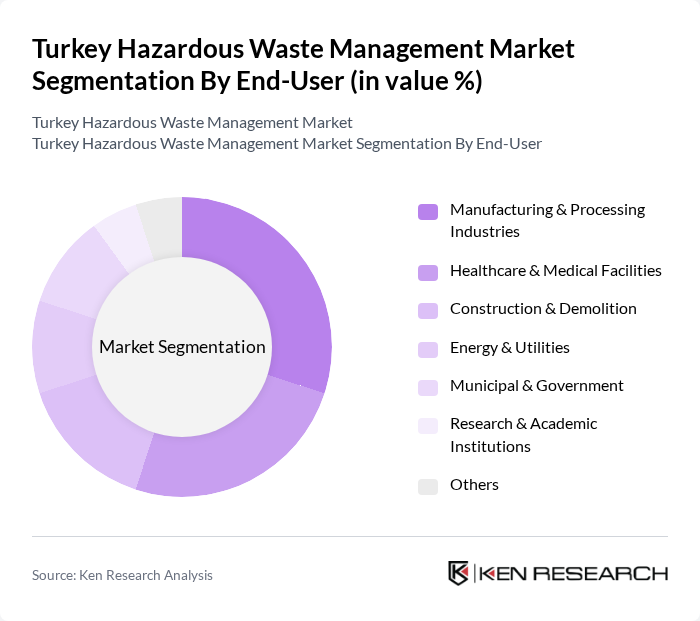

By End-User:The hazardous waste management market is also segmented by end-user, including Manufacturing & Processing Industries, Healthcare & Medical Facilities, Construction & Demolition, Energy & Utilities, Municipal & Government, Research & Academic Institutions, and Others. Each category has distinct waste management requirements and regulatory obligations. Manufacturing & Processing Industries generate the highest volume of hazardous waste, followed by Healthcare & Medical Facilities, which require specialized handling and disposal due to infection risks. Construction & Demolition is expanding, driven by urbanization and infrastructure development.

TheManufacturing & Processing Industriessegment leads the market due to the high volume of hazardous waste generated from production and industrial processes.Healthcare & Medical Facilitiesare significant contributors, necessitating stringent protocols for medical waste disposal.Construction & Demolitionis a growing segment, reflecting increased urbanization and infrastructure projects.

The Turkey Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as T.C. Çevre, ?ehircilik ve ?klim De?i?ikli?i Bakanl???, ?STAÇ A.?., Ekol Lojistik, Çevre Koruma ve Kontrol A.?., TÜB?TAK Marmara Ara?t?rma Merkezi (TÜB?TAK MAM), Ayd?nlar Group, Kocaeli Büyük?ehir Belediyesi, Eren Holding, S?f?r At?k Vakf?, Ekol Geri Dönü?üm, Türev Geri Dönü?üm, Ege Çevre ve Kültür Platformu (EGEÇEP), Mavi Geri Dönü?üm, ÇEVKO Çevre Koruma ve Ambalaj At?klar? De?erlendirme Vakf?, Gersan Geri Dönü?üm Sanayi ve Ticaret A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hazardous waste management market in Turkey appears promising, driven by increasing industrial activity and a growing emphasis on sustainability. As the government continues to enforce stringent regulations, companies will likely invest in innovative waste management technologies. Additionally, the shift towards a circular economy will encourage businesses to adopt recycling and waste-to-energy solutions, fostering a more sustainable approach to hazardous waste management in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Waste Medical Waste Electronic Waste (E-waste) Industrial Waste Radioactive Waste Hazardous Soil & Sludge Asbestos Waste Others |

| By End-User | Manufacturing & Processing Industries Healthcare & Medical Facilities Construction & Demolition Energy & Utilities Municipal & Government Research & Academic Institutions Others |

| By Disposal Method | Incineration Secure Landfilling Recycling & Resource Recovery Chemical/Physical/Biological Treatment Export for Disposal Others |

| By Collection Method | Scheduled Collection On-Demand Collection Drop-off Centers Mobile Collection Units Others |

| By Region | Marmara Aegean Mediterranean Central Anatolia Eastern Anatolia Southeastern Anatolia Black Sea Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| By Investment Source | Private Investment Government Funding International Aid Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Waste Management | 100 | Environmental Managers, Compliance Officers |

| Medical Waste Disposal | 80 | Hospital Administrators, Waste Management Coordinators |

| Electronic Waste Recycling | 70 | Operations Managers, Recycling Facility Supervisors |

| Hazardous Waste Treatment Technologies | 50 | R&D Managers, Technology Providers |

| Policy and Regulation Impact | 60 | Regulatory Affairs Specialists, Industry Analysts |

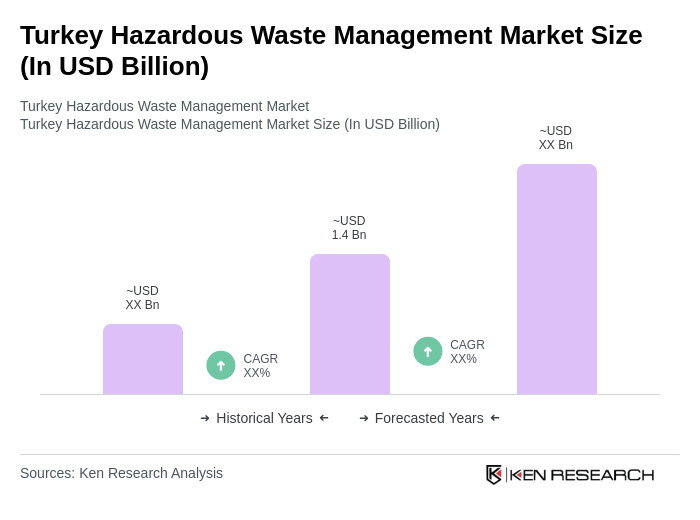

The Turkey Hazardous Waste Management Market is valued at approximately USD 1.4 billion, driven by increasing industrial activities, stricter environmental regulations, and heightened public awareness regarding waste management practices.