Region:Europe

Author(s):Geetanshi

Product Code:KRAA1953

Pages:86

Published On:August 2025

By Type:The hazardous waste management market is segmented into industrial hazardous waste, medical and healthcare hazardous waste, electronic and e-waste, chemical waste (including solvents, pesticides, etc.), radioactive waste, construction and demolition hazardous waste, oil & gas industry waste, and others. Industrial hazardous waste includes by-products from manufacturing and heavy industry, while medical and healthcare hazardous waste comprises infectious and pharmaceutical materials. Electronic and e-waste covers obsolete electronics and batteries, chemical waste includes solvents and pesticides, radioactive waste is generated from energy and medical sectors, construction and demolition hazardous waste involves contaminated building materials, and oil & gas industry waste encompasses drilling fluids and refinery residues. The "others" category includes smaller streams such as laboratory and agricultural hazardous waste .

By End-User:The end-user segmentation of the hazardous waste management market includes manufacturing & heavy industry, healthcare & medical institutions, construction & infrastructure, energy & utilities, oil & gas sector, government & municipalities, and others. Manufacturing & heavy industry is the largest segment, generating waste from chemical processing, metallurgy, and machinery production. Healthcare & medical institutions produce infectious, pharmaceutical, and laboratory waste. Construction & infrastructure generate hazardous materials from demolition and renovation activities. Energy & utilities contribute radioactive and chemical waste, while the oil & gas sector produces drilling and refinery waste. Government & municipalities oversee regulatory compliance and public sector waste streams, and the "others" category includes research labs and agricultural operations .

The Russia Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as EcoSystem, RT-Invest, SUEK (Siberian Coal Energy Company), Vostokgazprom, Gazprom Neft, RUSAL, SIBUR, NLMK Group (Novolipetsk Steel), Severstal, Uralkali, Rosatom, Inter RAO, TGC-1, FGC UES (Federal Grid Company of Unified Energy System), and Russian Railways (RZD) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hazardous waste management market in Russia appears promising, driven by increasing industrial activity and a growing emphasis on sustainability. As the government continues to enforce stringent regulations, companies will likely invest in innovative waste management technologies. Additionally, the shift towards a circular economy will encourage recycling and waste-to-energy initiatives, creating new avenues for growth. The integration of smart waste management solutions will further enhance operational efficiency, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Hazardous Waste Medical and Healthcare Hazardous Waste Electronic and E-Waste Chemical Waste (including solvents, pesticides, etc.) Radioactive Waste Construction and Demolition Hazardous Waste Oil & Gas Industry Waste Others |

| By End-User | Manufacturing & Heavy Industry Healthcare & Medical Institutions Construction & Infrastructure Energy & Utilities Oil & Gas Sector Government & Municipalities Others |

| By Region | Central Federal District Northwestern Federal District Southern Federal District Siberian Federal District Far Eastern Federal District Ural Federal District Volga Federal District Others |

| By Application | Hazardous Waste Collection Hazardous Waste Transportation Hazardous Waste Treatment Hazardous Waste Disposal Recycling & Resource Recovery Waste-to-Energy Others |

| By Investment Source | Private Investment Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Subsidies Tax Incentives Grants Regulatory Support Others |

| By Technology | Incineration Secure Landfilling Chemical Treatment Biological Treatment Thermal Treatment (including pyrolysis, gasification) Physical Treatment (e.g., stabilization, encapsulation) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Hazardous Waste Management | 100 | Environmental Managers, Compliance Officers |

| Municipal Waste Management Practices | 60 | City Waste Management Directors, Policy Makers |

| Recycling and Recovery Operations | 50 | Operations Managers, Recycling Facility Supervisors |

| Hazardous Waste Treatment Technologies | 40 | Technical Directors, R&D Managers |

| Regulatory Compliance and Policy Impact | 70 | Legal Advisors, Environmental Consultants |

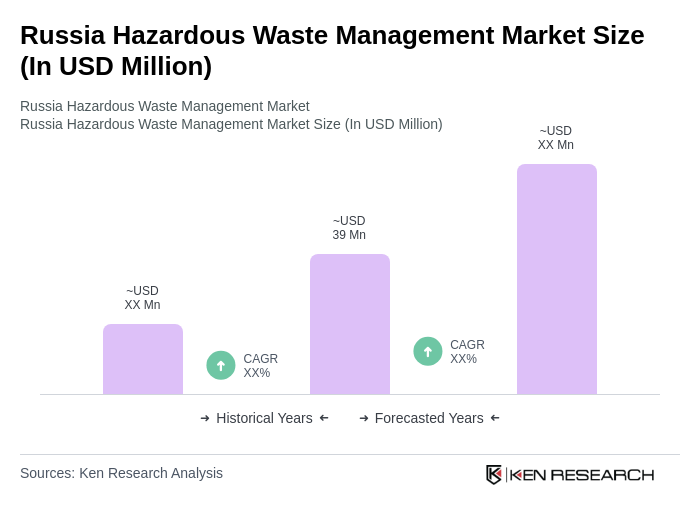

The Russia Hazardous Waste Management Market is valued at approximately USD 39 million, reflecting a five-year historical analysis. This growth is driven by increasing industrial activities, stricter environmental regulations, and heightened public awareness regarding sustainable waste management practices.