Region:Africa

Author(s):Geetanshi

Product Code:KRAA7871

Pages:89

Published On:September 2025

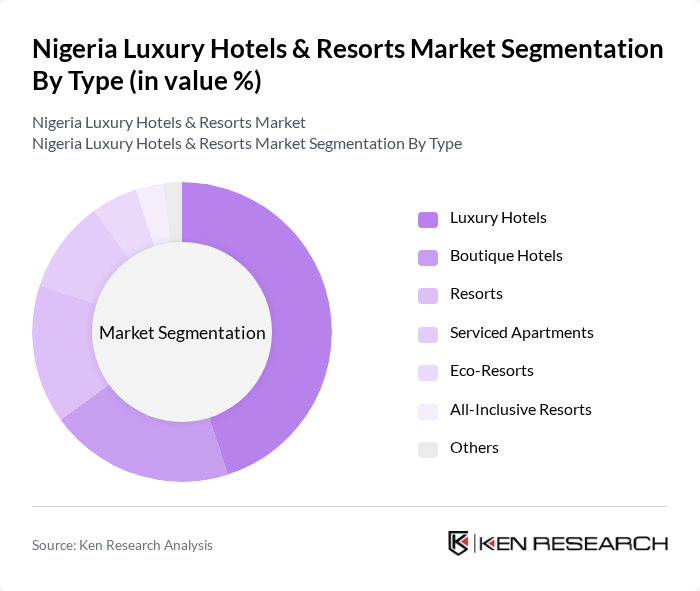

By Type:The luxury hotels and resorts market can be segmented into various types, including Luxury Hotels, Boutique Hotels, Resorts, Serviced Apartments, Eco-Resorts, All-Inclusive Resorts, and Others. Among these, Luxury Hotels are the most dominant segment, driven by the increasing demand for high-end accommodations that offer premium services and amenities. Boutique Hotels are also gaining popularity due to their unique offerings and personalized experiences, appealing to travelers seeking distinctiveness.

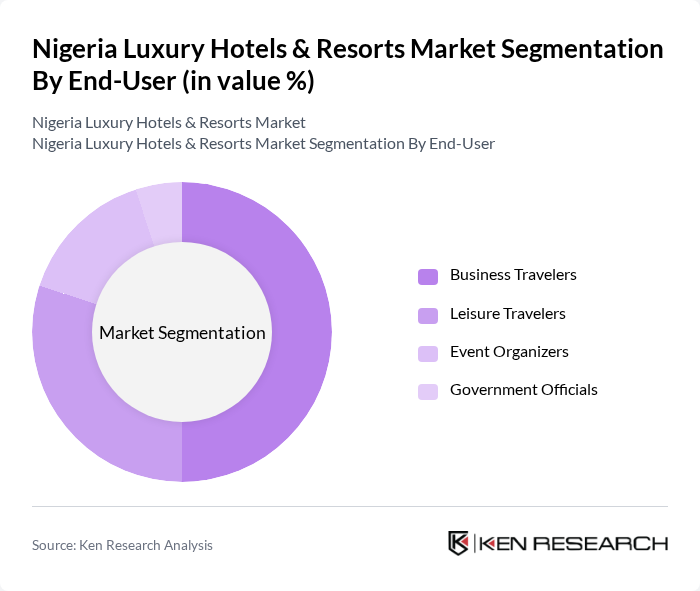

By End-User:The market can also be segmented based on end-users, including Business Travelers, Leisure Travelers, Event Organizers, and Government Officials. Business Travelers represent the largest segment, as the growing corporate sector in Nigeria drives demand for luxury accommodations for meetings and conferences. Leisure Travelers are also significant, with an increasing number of Nigerians and international tourists seeking luxury experiences during vacations.

The Nigeria Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eko Hotels & Suites, The Wheatbaker, Radisson Blu Anchorage Hotel, InterContinental Lagos, Four Points by Sheraton Lagos, Lagos Continental Hotel, Sheraton Abuja Hotel, Transcorp Hilton Abuja, The George Lagos, The Nook Hotel, Le Meridien Ogeyi Place, The Radisson Collection Hotel, Lagos, The Bungalow Restaurant & Hotel, The Monarch Hotel, The Federal Palace Hotel contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's luxury hotel market appears promising, driven by increasing disposable incomes and a growing interest in unique travel experiences. As infrastructure improvements continue, accessibility to luxury accommodations will enhance. Additionally, the rise of wellness tourism and eco-friendly resorts is expected to attract a new demographic of travelers. With strategic partnerships and investments, the market is poised for growth, despite existing challenges, creating a dynamic environment for luxury hospitality.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Boutique Hotels Resorts Serviced Apartments Eco-Resorts All-Inclusive Resorts Others |

| By End-User | Business Travelers Leisure Travelers Event Organizers Government Officials |

| By Price Range | Budget Luxury Mid-Range Luxury High-End Luxury |

| By Location | Urban Areas Coastal Regions Tourist Attractions |

| By Amenities Offered | Spa Services Fine Dining Conference Facilities Recreational Activities |

| By Customer Loyalty Programs | Membership Programs Reward Points Systems Exclusive Offers |

| By Distribution Channel | Direct Booking Online Travel Agencies Travel Agents Corporate Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Management | 100 | General Managers, Operations Directors |

| Travel Agency Insights | 80 | Luxury Travel Advisors, Sales Managers |

| Affluent Traveler Preferences | 120 | High-Net-Worth Individuals, Frequent Travelers |

| Tourism Board Perspectives | 60 | Policy Makers, Tourism Development Officers |

| Market Trends Analysis | 90 | Market Analysts, Industry Consultants |

The Nigeria Luxury Hotels & Resorts Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased disposable income, rising domestic and international tourism, and the expansion of the middle class seeking luxury accommodations.