Region:North America

Author(s):Dev

Product Code:KRAA0435

Pages:81

Published On:August 2025

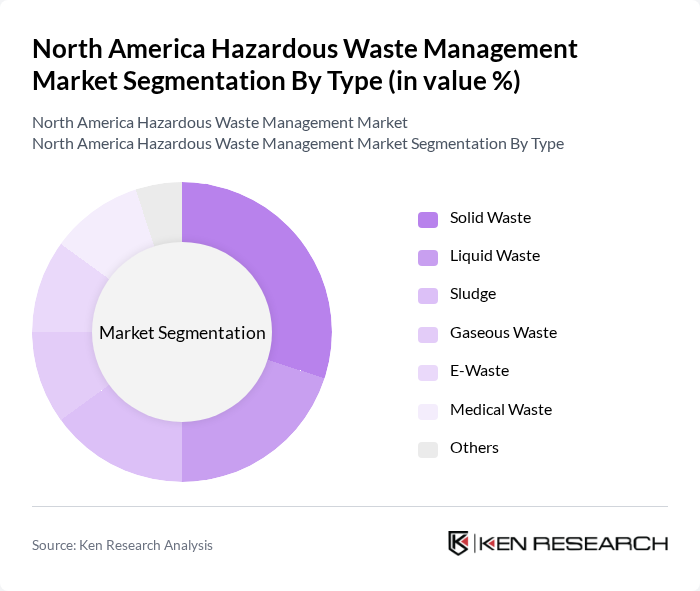

By Type:The hazardous waste management market can be segmented into various types, including solid waste, liquid waste, sludge, gaseous waste, e-waste, medical waste, and others. Among these, solid waste and medical waste are particularly significant due to their high generation rates in industrial and healthcare sectors, respectively. The increasing focus on recycling, resource recovery, and waste-to-energy initiatives is also shaping the dynamics of these segments .

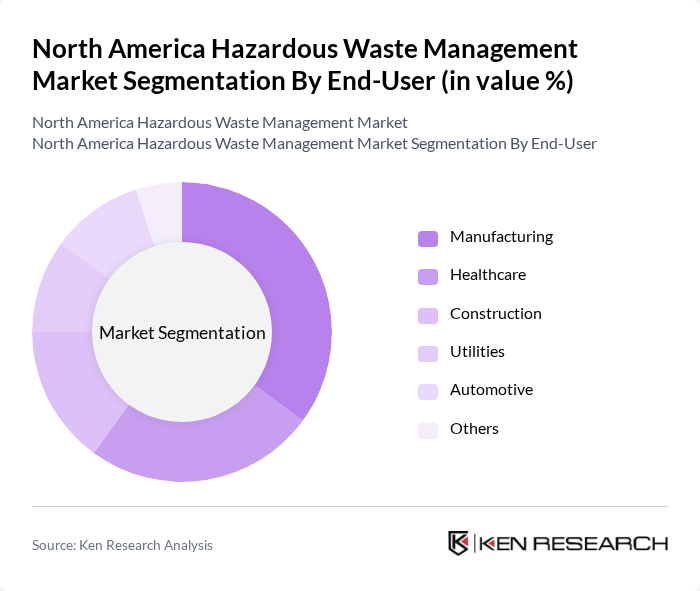

By End-User:The end-user segmentation includes manufacturing, healthcare, construction, utilities, automotive, and others. The manufacturing and healthcare sectors are the largest contributors to hazardous waste generation, driven by their operational processes and regulatory requirements. The increasing emphasis on sustainability, circular economy practices, and waste reduction in these industries is influencing their waste management practices .

The North America Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waste Management, Inc., Republic Services, Inc., Clean Harbors, Inc., Stericycle, Inc., Veolia North America, Covanta Holding Corporation, GFL Environmental Inc., US Ecology, Inc., Heritage Environmental Services, LLC, Recology, Inc., Waste Connections, Inc., SUEZ North America, Casella Waste Systems, Inc., Clean Earth, Inc., Tervita Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the hazardous waste management market in North America appears promising, driven by increasing environmental awareness and technological advancements. As industries strive for sustainability, the adoption of circular economy principles is expected to gain traction, promoting waste reduction and recycling initiatives. Additionally, government incentives aimed at enhancing waste management infrastructure will likely foster innovation and investment, creating a more resilient market landscape that prioritizes environmental protection and resource conservation.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid Waste Liquid Waste Sludge Gaseous Waste E-Waste Medical Waste Others |

| By End-User | Manufacturing Healthcare Construction Utilities Automotive Others |

| By Waste Treatment Method | Incineration Landfilling Recycling Chemical Treatment Biological Treatment Physical Treatment Others |

| By Source of Waste | Industrial Commercial Residential Agricultural Others |

| By Geographic Region | United States Canada Mexico Others |

| By Service Type | Collection Transportation Treatment Disposal Remediation Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Hazardous Waste Management | 100 | Environmental Managers, Compliance Officers |

| Healthcare Waste Disposal | 60 | Hospital Waste Coordinators, Safety Officers |

| Construction and Demolition Waste | 50 | Project Managers, Site Supervisors |

| Electronic Waste Recycling | 40 | Recycling Facility Managers, Sustainability Coordinators |

| Municipal Solid Waste with Hazardous Components | 50 | City Waste Management Officials, Policy Makers |

The North America Hazardous Waste Management Market is valued at approximately USD 17 billion, driven by regulatory pressures, industrial activities, and environmental sustainability awareness. This market is expected to grow as effective waste disposal solutions and advanced technologies are increasingly implemented.