Region:Middle East

Author(s):Rebecca

Product Code:KRAE3247

Pages:83

Published On:February 2026

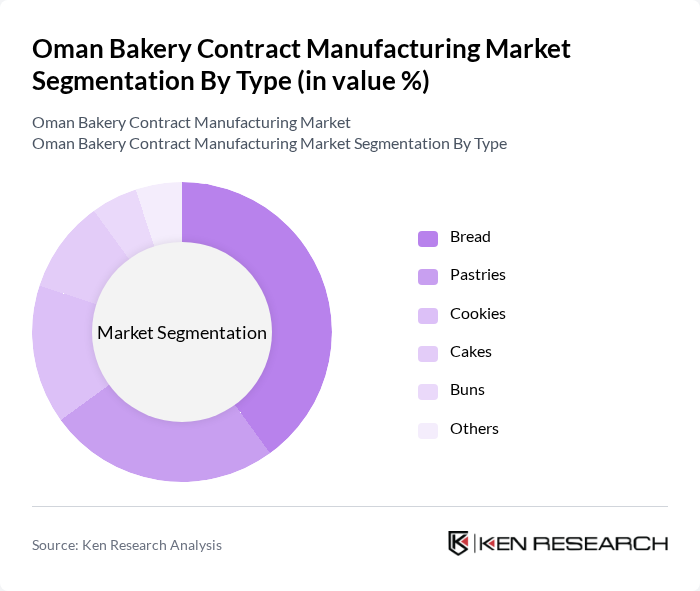

By Type:The bakery contract manufacturing market is segmented into various types, including Bread, Pastries, Cookies, Cakes, Buns, and Others. Among these, Bread is the leading sub-segment due to its staple status in the Omani diet and the increasing demand for artisanal and specialty breads. Pastries and Cookies are also gaining traction, particularly among younger consumers seeking convenient snack options. The trend towards healthier and organic ingredients is influencing the production of these baked goods, driving innovation and variety in the market.

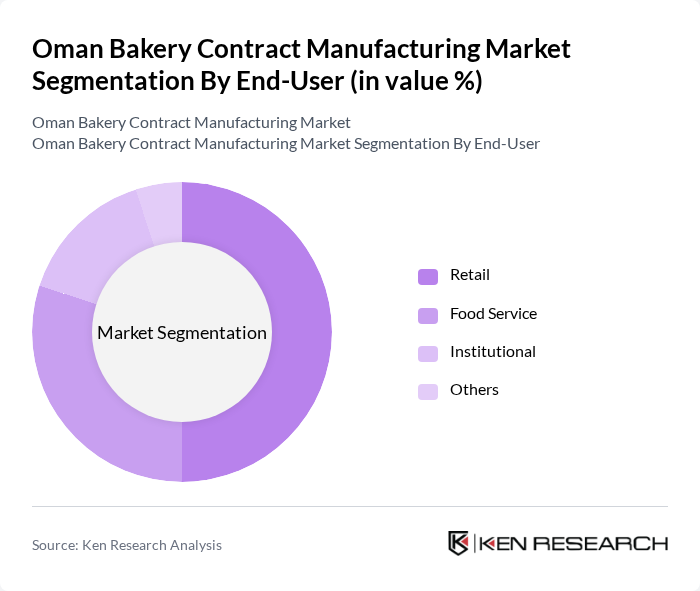

By End-User:The market is segmented by end-user into Retail, Food Service, Institutional, and Others. The Retail segment dominates the market, driven by the increasing number of supermarkets and convenience stores offering a wide range of bakery products. The Food Service sector is also significant, with restaurants and cafes expanding their menus to include more baked goods. Institutional buyers, such as schools and hospitals, are increasingly sourcing bakery products for their food services, contributing to the overall growth of the market.

The Oman Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlia Bakery, Muscat Bakery, Oman Flour Mills, Al Ameen Bakery, Al Mufeed Bakery, Al Muna Bakery, Al Shams Bakery, Al Waha Bakery, Al Noor Bakery, Al Fajr Bakery, Al Jazeera Bakery, Al Maktab Bakery, Al Ruwi Bakery, Al Saffar Bakery, Al Zawawi Bakery contribute to innovation, geographic expansion, and service delivery in this space.

The Oman bakery contract manufacturing market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-conscious trends continue to rise, manufacturers are likely to innovate with organic and natural ingredients. Additionally, the integration of technology in production processes will enhance efficiency and product quality. The expansion of e-commerce platforms will also facilitate greater market access, allowing manufacturers to reach a broader consumer base and adapt to changing market dynamics effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cookies Cakes Buns Others |

| By End-User | Retail Food Service Institutional Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Direct Sales Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Bulk Packaging Others |

| By Ingredient Type | Wheat Flour Sugar Yeast Additives Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Bakery Operations | 100 | Production Managers, Quality Control Supervisors |

| Retail Bakery Insights | 80 | Store Managers, Marketing Executives |

| Consumer Preferences in Bakery Products | 150 | End Consumers, Food Bloggers |

| Contract Manufacturing Partnerships | 70 | Business Development Managers, Procurement Officers |

| Distribution Channel Analysis | 90 | Logistics Coordinators, Supply Chain Analysts |

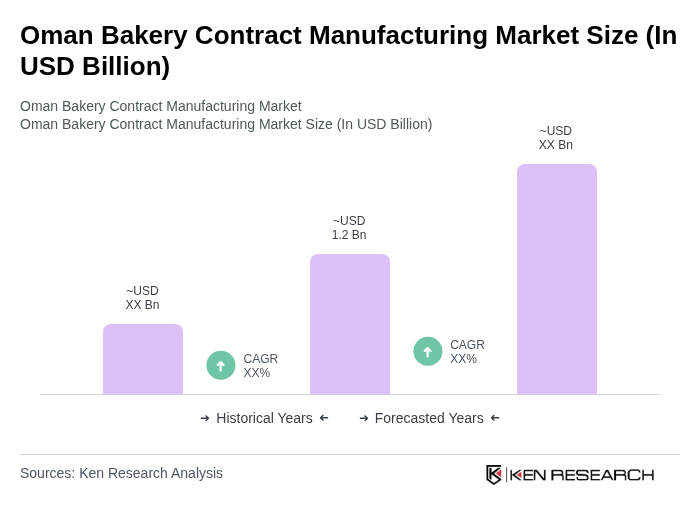

The Oman Bakery Contract Manufacturing Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for convenience foods and the expansion of retail and food service sectors.