Region:Middle East

Author(s):Rebecca

Product Code:KRAE3246

Pages:83

Published On:February 2026

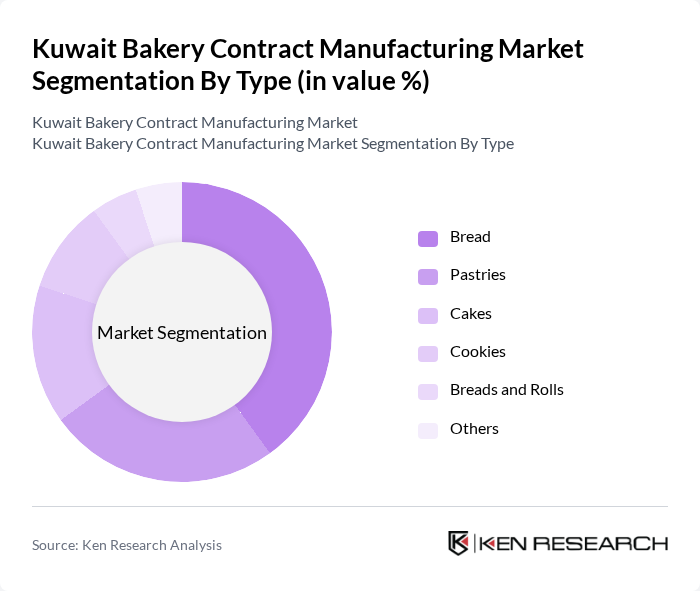

By Type:The market is segmented into various types of bakery products, including bread, pastries, cakes, cookies, breads and rolls, and others. Among these, bread is the most consumed product, driven by its staple status in the Kuwaiti diet. Pastries and cakes are also popular, particularly during festive occasions and celebrations. The demand for cookies and specialty baked goods has been rising, reflecting changing consumer preferences towards indulgent treats.

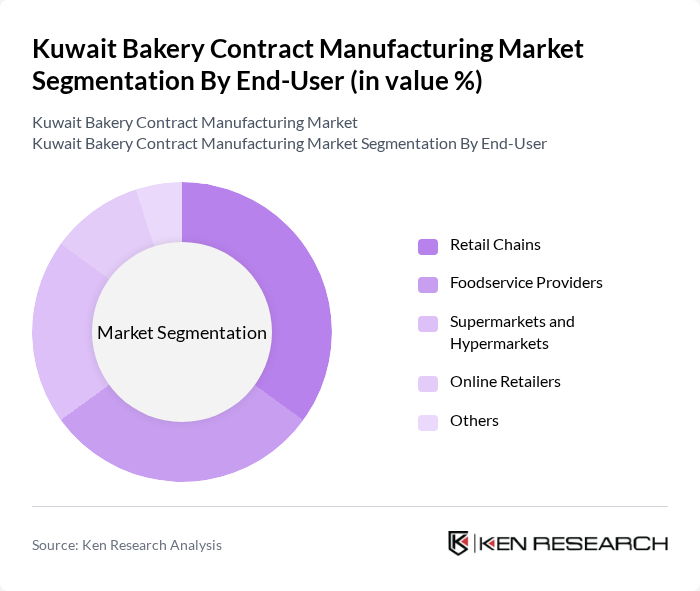

By End-User:The end-user segmentation includes retail chains, foodservice providers, supermarkets and hypermarkets, online retailers, and others. Retail chains and foodservice providers dominate the market due to their extensive distribution networks and ability to cater to large consumer bases. Supermarkets and hypermarkets also play a significant role, offering a wide variety of bakery products, while online retailing is gaining traction as consumer preferences shift towards convenience.

The Kuwait Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Maeda Bakery, Al-Bahar Bakery, Al-Qusai Bakery, Al-Sultan Bakery, Al-Fawaz Bakery, Al-Mansour Bakery, Al-Khalij Bakery, Al-Jazeera Bakery, Al-Rai Bakery, Al-Hamra Bakery, Al-Mohalab Bakery, Al-Safwa Bakery, Al-Nasr Bakery, Al-Masafi Bakery, Al-Mahabba Bakery contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait bakery contract manufacturing market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for healthier and more convenient bakery products continues to rise, manufacturers are likely to invest in innovative production techniques. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and product quality. This dynamic environment presents opportunities for growth, particularly in niche markets such as gluten-free and organic products, which are gaining traction among health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Breads and Rolls Others |

| By End-User | Retail Chains Foodservice Providers Supermarkets and Hypermarkets Online Retailers Others |

| By Distribution Channel | Direct Sales Wholesalers E-commerce Distributors Others |

| By Packaging Type | Plastic Packaging Paper Packaging Glass Packaging Metal Packaging Others |

| By Ingredient Type | Wheat Flour Sugar Yeast Fats and Oils Others |

| By Product Form | Frozen Fresh Dried Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bakery Outlets | 100 | Store Managers, Franchise Owners |

| Wholesale Bakery Distributors | 80 | Distribution Managers, Sales Representatives |

| Food Service Providers | 70 | Procurement Managers, Catering Directors |

| Consumer Preferences Survey | 150 | General Consumers, Food Enthusiasts |

| Bakery Equipment Suppliers | 60 | Sales Managers, Technical Support Staff |

The Kuwait Bakery Contract Manufacturing Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for convenience foods and the expansion of the foodservice sector.