Region:Asia

Author(s):Rebecca

Product Code:KRAE3245

Pages:97

Published On:February 2026

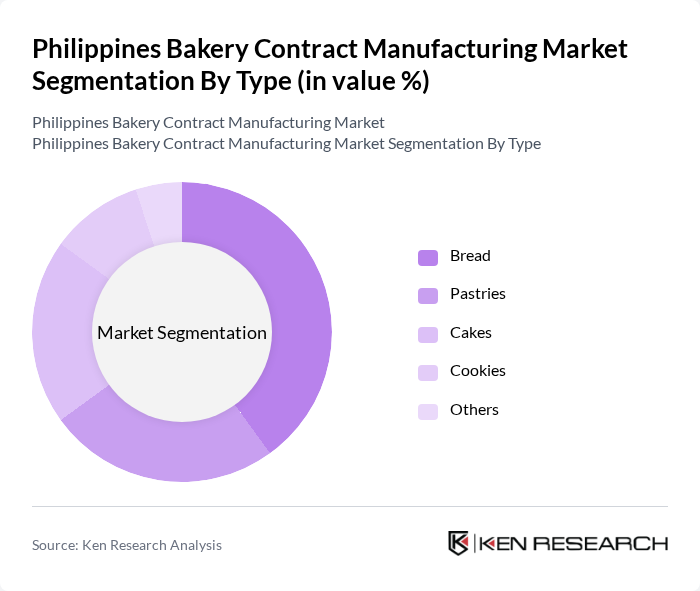

By Type:The bakery contract manufacturing market can be segmented into various types, including Bread, Pastries, Cakes, Cookies, and Others. Among these, Bread is the most dominant segment due to its staple status in Filipino diets and the increasing demand for artisanal and specialty breads. Pastries and Cakes also hold significant market shares, driven by the growing trend of baked goods in celebrations and events.

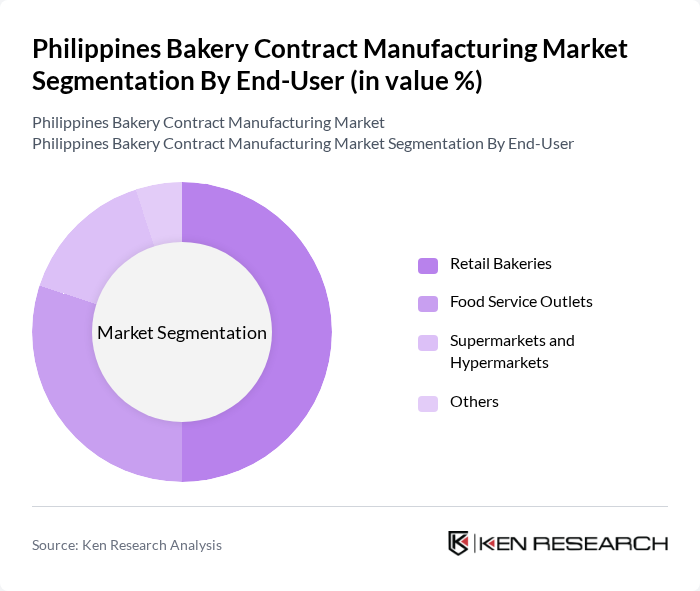

By End-User:The end-user segmentation includes Retail Bakeries, Food Service Outlets, Supermarkets and Hypermarkets, and Others. Retail Bakeries are the leading segment, as they cater directly to consumer preferences for fresh and locally made baked goods. Food Service Outlets, including restaurants and cafes, are also significant contributors, driven by the increasing trend of dining out and the demand for high-quality baked products.

The Philippines Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gardenia Bakeries Philippines, Inc., Monde Nissin Corporation, Universal Robina Corporation, Purefoods Hormel Company, Inc., Bounty Fresh Food, Inc., Del Monte Philippines, Inc., San Miguel Foods, Inc., M.Y. San Corporation, CDO Foodsphere, Inc., The Purefoods-Hormel Company, Hizon’s Catering, Red Ribbon Bakeshop, Inc., Goldilocks Bakeshop, Inc., Jollibee Foods Corporation, Figaro Coffee Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines bakery contract manufacturing market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for healthier and specialty products continues to rise, manufacturers are likely to invest in innovative baking technologies and sustainable practices. Additionally, the integration of digital platforms for distribution will enhance market accessibility, allowing businesses to reach a broader audience. This dynamic environment presents opportunities for growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Others |

| By End-User | Retail Bakeries Food Service Outlets Supermarkets and Hypermarkets Others |

| By Distribution Channel | Direct Sales Online Sales Wholesale Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Others |

| By Ingredient Type | Flour Sugar Fats and Oils Others |

| By Product Form | Frozen Fresh Others |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Contract Manufacturing Firms | 100 | Operations Managers, Production Supervisors |

| Retail Bakery Outlets | 80 | Bakery Owners, Store Managers |

| Ingredient Suppliers | 60 | Sales Representatives, Product Development Managers |

| Food Safety Regulators | 50 | Compliance Officers, Quality Assurance Managers |

| Consumer Focus Groups | 75 | Regular Bakery Consumers, Health-Conscious Shoppers |

The Philippines Bakery Contract Manufacturing Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for baked goods and the expansion of the food service industry.