Region:Asia

Author(s):Rebecca

Product Code:KRAE3244

Pages:87

Published On:February 2026

By Product Type:The product type segmentation includes various categories such as bread, pastries, cakes, cookies, and others. Among these, bread is the leading sub-segment, driven by its staple status in Thai diets and the increasing demand for artisanal and specialty breads. Pastries and cakes also show significant consumer interest, particularly in urban areas where there is a growing trend for gourmet and premium baked goods. Cookies and other products are gaining traction, especially among younger consumers seeking convenient snack options.

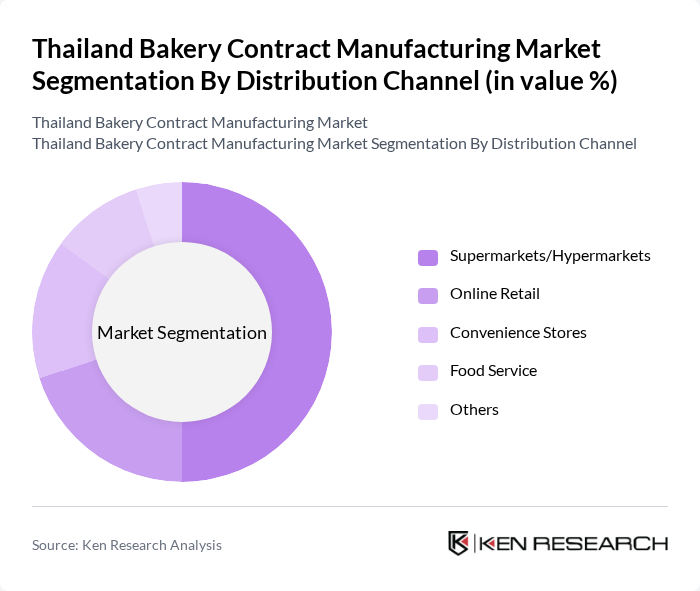

By Distribution Channel:The distribution channel segmentation encompasses supermarkets/hypermarkets, online retail, convenience stores, food service, and others. Supermarkets and hypermarkets dominate this segment due to their extensive reach and ability to offer a wide variety of bakery products under one roof. Online retail is rapidly growing, particularly among younger consumers who prefer the convenience of home delivery. Food service channels are also significant, as they cater to restaurants and cafes that require bulk bakery supplies.

The Thailand Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thai Bakery Co., Ltd., Bangkok Bakery Group, Charoen Pokphand Foods PCL, S&P Syndicate Public Company Limited, The Bakery Company, Srichand United Dispensary Co., Ltd., Patisserie de France, Boulangerie de Paris, Thai Flour Industry Co., Ltd., Bakeshop Thailand, The Baker's Dozen, Khaomak Bakery, Ploy Bakery, Sweet Treats Bakery, Artisan Bakery Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand bakery contract manufacturing market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for healthier and more diverse bakery products continues to rise, manufacturers are expected to invest in innovative production techniques. Additionally, the integration of automation and smart technologies will enhance efficiency and product quality, positioning companies to better meet consumer expectations and adapt to market changes effectively.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Bread Pastries Cakes Cookies Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Food Service Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Bulk Packaging Others |

| By Ingredient Type | Wheat Flour Sugar Fats and Oils Additives Others |

| By End-User Segment | Retail Consumers Food Service Providers Bakeries Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Northeastern Thailand |

| By Product Shelf Life | Short Shelf Life Medium Shelf Life Long Shelf Life Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Contract Manufacturing Firms | 100 | Operations Managers, Production Supervisors |

| Retail Bakery Outlets | 80 | Store Managers, Franchise Owners |

| Ingredient Suppliers | 60 | Sales Representatives, Product Development Managers |

| Consumer Preferences | 150 | Regular Bakery Customers, Health-Conscious Shoppers |

| Food Safety Compliance | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

The Thailand Bakery Contract Manufacturing Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer demand for convenience foods and health-conscious eating habits.