Region:Asia

Author(s):Rebecca

Product Code:KRAE3250

Pages:95

Published On:February 2026

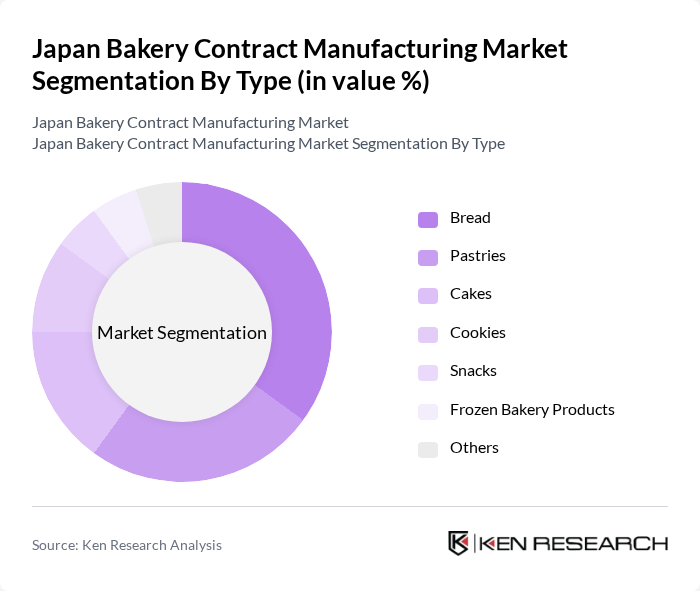

By Type:The bakery contract manufacturing market is segmented into various types, including Bread, Pastries, Cakes, Cookies, Snacks, Frozen Bakery Products, and Others. Among these, Bread and Pastries are the most dominant segments, driven by their widespread consumption and versatility in various culinary applications. The increasing trend of artisanal and specialty breads has also contributed to the growth of these segments.

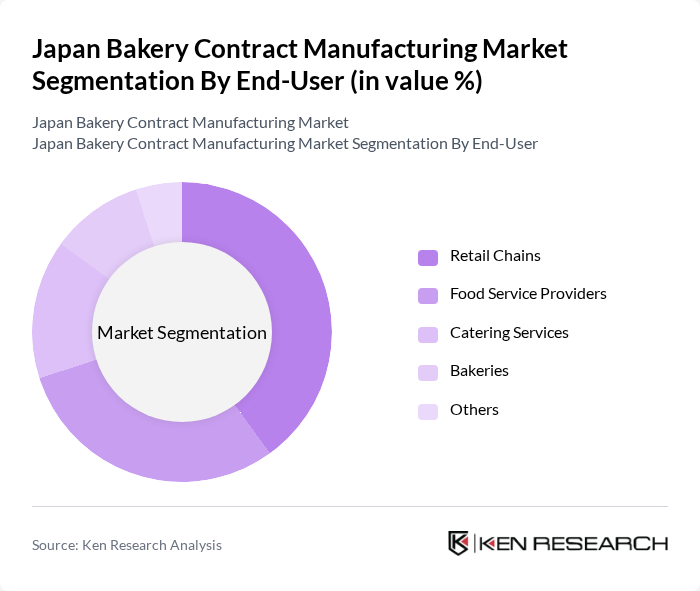

By End-User:The end-user segmentation includes Retail Chains, Food Service Providers, Catering Services, Bakeries, and Others. Retail Chains and Food Service Providers are the leading segments, as they account for a significant portion of bakery product sales. The growing trend of dining out and the expansion of retail outlets have fueled the demand for contract-manufactured bakery products.

The Japan Bakery Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yamazaki Baking Co., Ltd., A-1 Bakery Co., Ltd., Kameda Seika Co., Ltd., Kikkoman Corporation, Kanto Bakery Co., Ltd., Marubeni Corporation, Kuroda Seika Co., Ltd., Koshidaka Holdings Co., Ltd., Kawai Bakery Co., Ltd., Katsuya Co., Ltd., Kameido Bakery Co., Ltd., Koshin Seika Co., Ltd., Kanto Seika Co., Ltd., Kawai Seika Co., Ltd., Kuroda Seika Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan bakery contract manufacturing market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are expected to adopt eco-friendly practices and materials. Additionally, the integration of automation in production processes will enhance efficiency and reduce costs. These trends will likely lead to increased collaboration with food delivery services, further expanding market reach and catering to the growing demand for convenience and health-oriented products.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread Pastries Cakes Cookies Snacks Frozen Bakery Products Others |

| By End-User | Retail Chains Food Service Providers Catering Services Bakeries Others |

| By Distribution Channel | Direct Sales Online Sales Wholesale Supermarkets/Hypermarkets Others |

| By Product Form | Fresh Frozen Packaged Others |

| By Flavor Profile | Sweet Savory Spicy Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-friendly Packaging Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Contract Manufacturing for Bread Products | 100 | Production Managers, Quality Assurance Leads |

| Pastry and Confectionery Manufacturing | 80 | Product Development Managers, Marketing Directors |

| Health-Conscious Bakery Products | 70 | Nutritionists, R&D Specialists |

| Organic and Specialty Bakery Items | 60 | Supply Chain Managers, Procurement Officers |

| Distribution and Retail Partnerships | 90 | Sales Managers, Retail Buyers |

The Japan Bakery Contract Manufacturing Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by increasing consumer demand for convenience foods and specialty bakery products.