Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7148

Pages:88

Published On:December 2025

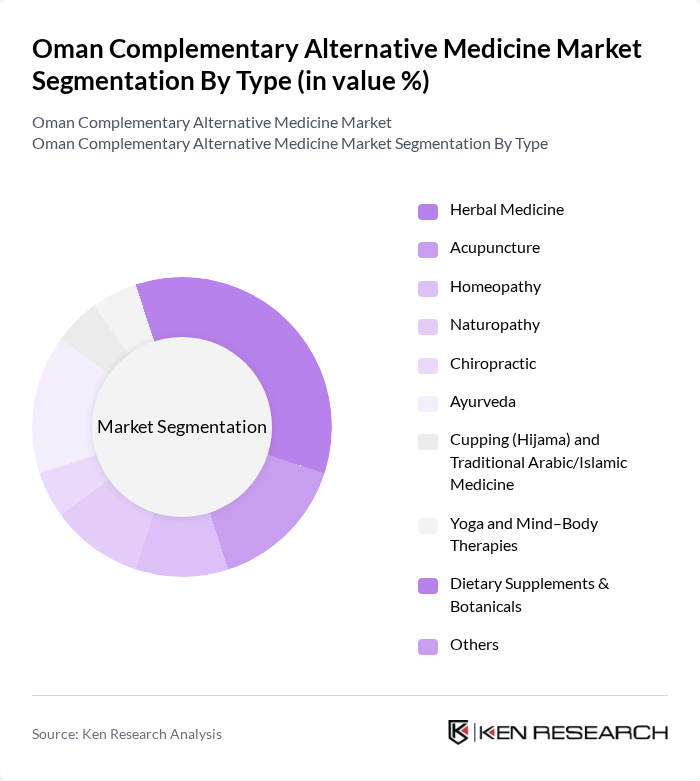

By Type:The market is segmented into various types of complementary and alternative medicine practices. The subsegments include Herbal Medicine, Acupuncture, Homeopathy, Naturopathy, Chiropractic, Ayurveda, Cupping (Hijama) and Traditional Arabic/Islamic Medicine, Yoga and Mind–Body Therapies, Dietary Supplements & Botanicals, and Others. Herbal Medicine, Cupping (Hijama) and Traditional Arabic/Islamic Medicine, and Ayurveda are particularly prominent, reflecting both religious and cultural traditions in Oman, as well as the regional preference for botanicals, herbal remedies, and body-based therapies for chronic disease management and wellness.

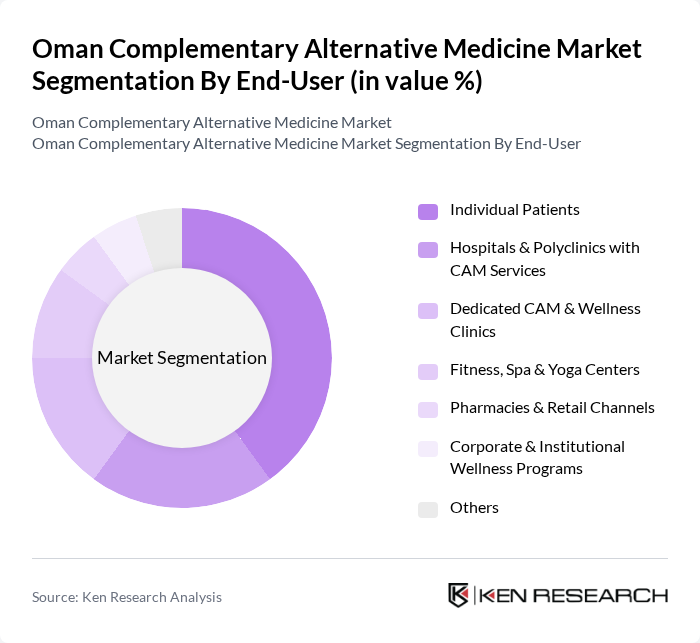

By End-User:The end-user segmentation includes Individual Patients, Hospitals & Polyclinics with CAM Services, Dedicated CAM & Wellness Clinics, Fitness, Spa & Yoga Centers, Pharmacies & Retail Channels, Corporate & Institutional Wellness Programs, and Others. Individual Patients represent the largest segment, driven by a growing preference for personalized and culturally familiar healthcare solutions, the high prevalence of lifestyle-related and chronic health issues, and increasing willingness to combine conventional care with herbal, religious, and mind–body therapies for integrated management of conditions such as cardiovascular diseases, diabetes, and stress-related disorders.

The Oman Complementary Alternative Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as National Center for Traditional, Complementary and Alternative Medicine (MOH Oman), Royal Oman Police Hospital – Ayurveda & CAM Clinic, KIMS Oman Hospital – Integrative & Ayurveda Services, Burjeel Hospital Muscat – Wellness & CAM Services, Badr Al Samaa Group – Alternative & Holistic Medicine Units, Starcare Hospital Muscat – Homeopathy & CAM Services, Al Raffah Hospital – Wellness & Complementary Medicine, Al Hayat International Hospital – Integrative Medicine & Rehabilitation, Muscat Homeopathy Clinic, Al Shifa Natural Herbal & Hijama Center, Al Nahda Ayurveda Center, Muscat, Wellness & Health Spa at Al Bustan Palace, Muscat, Ananda Spa and Wellness Center, Muscat, Lulu Hypermarket & Oman Pharmacy Chain (Herbal & Nutraceutical Retail), Omantel & Corporate Wellness Program Partners (Yoga, Mind–Body & CAM Services) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Complementary Alternative Medicine market appears promising, driven by increasing consumer demand for holistic health solutions and the integration of technology in healthcare. As the government continues to support CAM practices, we can expect a rise in educational initiatives aimed at standardizing practices. Furthermore, the collaboration between conventional healthcare providers and CAM practitioners is likely to enhance treatment options, fostering a more inclusive healthcare environment that prioritizes patient-centered care.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbal Medicine Acupuncture Homeopathy Naturopathy Chiropractic Ayurveda Cupping (Hijama) and Traditional Arabic/Islamic Medicine Yoga and Mind–Body Therapies Dietary Supplements & Botanicals Others |

| By End-User | Individual Patients Hospitals & Polyclinics with CAM Services Dedicated CAM & Wellness Clinics Fitness, Spa & Yoga Centers Pharmacies & Retail Channels Corporate & Institutional Wellness Programs Others |

| By Treatment Duration | Single-Session / Episodic Treatments Short-term Treatment Plans (< 3 months) Long-term Treatment Plans (? 3 months) Chronic/Ongoing Maintenance Programs Others |

| By Demographics | Children & Adolescents (0–17 years) Adults (18–44 years) Middle-aged (45–64 years) Elderly (65+ years) By Gender By Income/Socioeconomic Tier Others |

| By Geographic Distribution | Muscat Governorate Dhofar (Salalah) & Southern Regions Interior & Northern Governorates Border & Special Economic Zones (e.g., Duqm, Sohar) Others |

| By Product Formulation | Tablets & Capsules Powders & Granules Syrups & Liquid Extracts Oils, Balms & Topical Preparations Teas, Infusions & Functional Beverages Others |

| By Policy Support | Ministry of Health Regulations for TCAM Licensing & Accreditation Framework for CAM Providers Public Hospital Integration & Referral Pathways Research, Education & Training Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Herbal Medicine Practitioners | 100 | Herbalists, Traditional Medicine Experts |

| Acupuncture Clinics | 80 | Acupuncturists, Clinic Managers |

| Homeopathy Centers | 70 | Homeopaths, Patient Coordinators |

| Wellness Retreats | 60 | Wellness Coaches, Retreat Managers |

| Patients Utilizing CAM Services | 120 | CAM Users, Health Enthusiasts |

The Oman Complementary Alternative Medicine market is valued at approximately USD 160 million, reflecting its share within the broader Middle East complementary and alternative medicine market, which is estimated at around USD 12.26 billion.