Region:Middle East

Author(s):Rebecca

Product Code:KRAD5007

Pages:87

Published On:December 2025

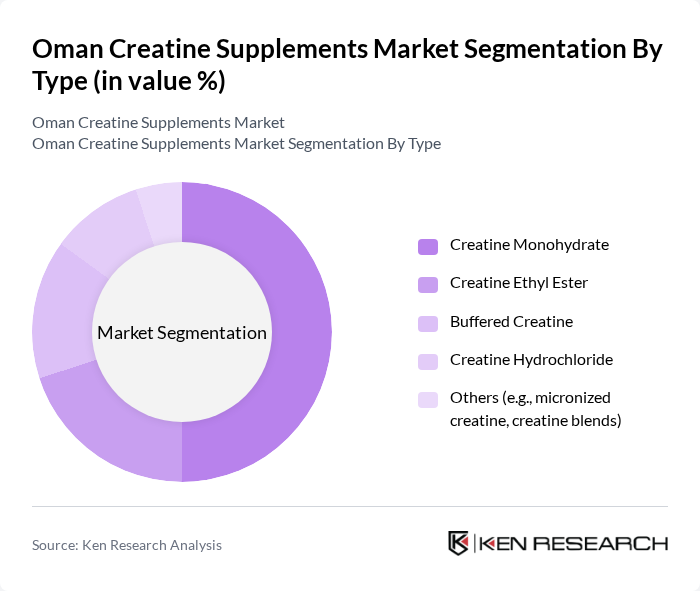

By Type:The market is segmented into various types of creatine supplements, including Creatine Monohydrate, Creatine Ethyl Ester, Buffered Creatine, Creatine Hydrochloride, and Others (e.g., micronized creatine, creatine blends). Creatine Monohydrate is the most popular format globally due to its strong clinical evidence base, high bioavailability, and affordability, and it similarly dominates product portfolios and retail shelves in Middle East markets. It is widely used by athletes and fitness enthusiasts for its ability to enhance performance, strength, and muscle mass. Demand for alternative forms such as Creatine Ethyl Ester, buffered creatine, and creatine hydrochloride is supported by consumer interest in perceived faster absorption, gentler gastrointestinal tolerance, and stackable formulations, often within pre-workout or intra-workout blends. The market is characterized by a trend towards innovative formulations (e.g., flavored powders, capsules, multi-ingredient blends) and clean-label products that cater to specific consumer needs, including vegans, women-focused performance products, and sugar-free variants.

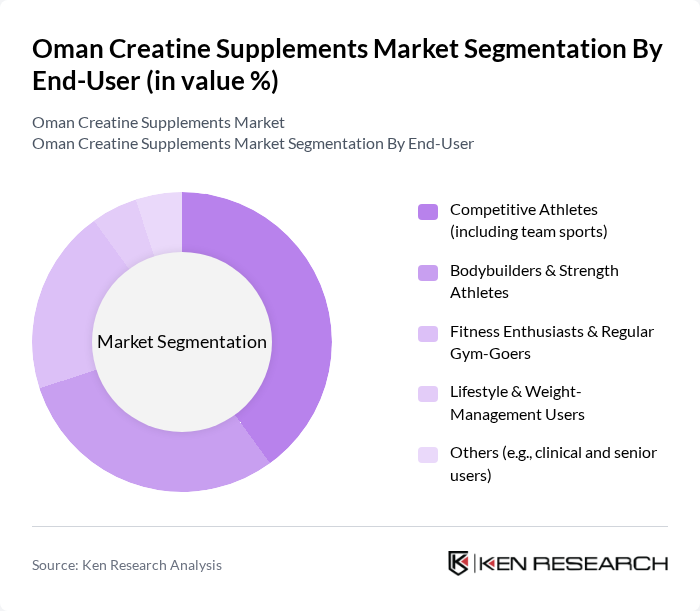

By End-User:The end-user segmentation includes Competitive Athletes (including team sports), Bodybuilders & Strength Athletes, Fitness Enthusiasts & Regular Gym-Goers, Lifestyle & Weight-Management Users, and Others (e.g., clinical and senior users). Competitive Athletes and organized team sports users represent a major segment in line with the global pattern of creatine adoption among high-intensity and power athletes for improved performance and recovery. Bodybuilders and strength athletes also significantly contribute to the market, as they rely on creatine to support progressive overload, muscle hypertrophy, and training volume. The increasing number of fitness enthusiasts and regular gym-goers in urban Oman, supported by the growth of commercial gym chains and online fitness culture, is further propelling the demand for creatine supplements as part of broader sports nutrition stacks aimed at improving workout results, body composition, and overall health.

The Oman Creatine Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optimum Nutrition (Glanbia Performance Nutrition), MuscleTech, MyProtein, Dymatize Nutrition, Cellucor (Nutrabolt), Universal Nutrition, GNC (General Nutrition Corporation), BSN (Bio-Engineered Supplements and Nutrition), JYM Supplement Science, Applied Nutrition, Olimp Sport Nutrition, Muscletech & Six Star (Iovate Health Sciences), Kevin Levrone Signature Series, Warrior & Other Regional Middle East Brands, Leading Omani Importers & Distributors of Sports Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The Oman creatine supplements market is poised for significant growth, driven by increasing health consciousness and the expansion of e-commerce. As consumers become more aware of the benefits of creatine, particularly among athletes and fitness enthusiasts, demand is expected to rise. Additionally, the trend towards personalized nutrition and clean-label products will likely shape the market landscape, encouraging brands to innovate and cater to evolving consumer preferences, ultimately enhancing market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Creatine Monohydrate Creatine Ethyl Ester Buffered Creatine Creatine Hydrochloride Others (e.g., micronized creatine, creatine blends) |

| By End-User | Competitive Athletes (including team sports) Bodybuilders & Strength Athletes Fitness Enthusiasts & Regular Gym-Goers Lifestyle & Weight-Management Users Others (e.g., clinical and senior users) |

| By Distribution Channel | Online Retail (marketplaces & brand webstores) Supermarkets/Hypermarkets Pharmacies & Drug Stores Gyms, Health Clubs and Specialty Nutrition Stores Others (e.g., direct sales, nutrition practitioners) |

| By Packaging Type | Bottles Sachets / Single-Serve Stick Packs Tubs / Jars Pouches / Refill Packs Others (e.g., blister packs for capsules/tablets) |

| By Formulation | Powder (unflavoured & flavoured) Capsules Tablets Liquid & Ready-to-Drink (RTD) Others (e.g., gummies, effervescent) |

| By Age Group | 24 Years 34 Years 44 Years Years and Above Others (e.g., under-18 under supervision) |

| By Price Range | Value / Economy Mid-Range Premium & Imported Brands Others (e.g., subscription and bundle pricing) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Center Users | 140 | Regular gym-goers, Personal trainers |

| Nutritionists and Dieticians | 90 | Health professionals, Sports nutrition experts |

| Retailers of Sports Supplements | 60 | Store managers, Sales representatives |

| Online Health Product Consumers | 110 | Frequent online shoppers, Fitness bloggers |

| Sports Coaches | 50 | Team coaches, Athletic trainers |

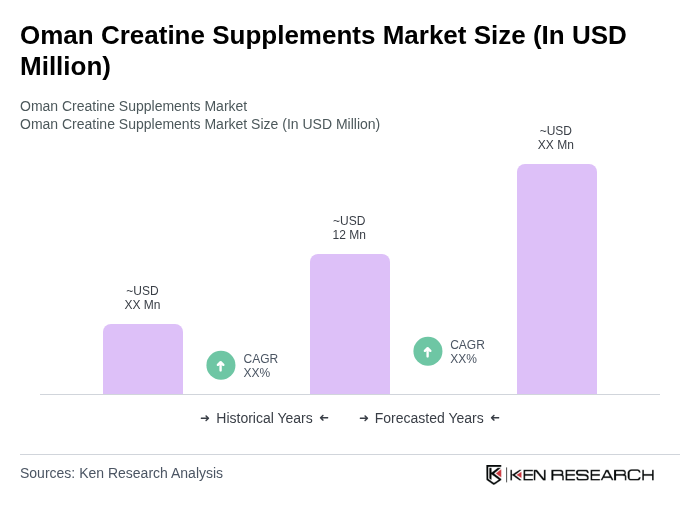

The Oman Creatine Supplements Market is valued at approximately USD 12 million, reflecting a growing trend in health consciousness and increased participation in fitness activities, particularly among the youth and fitness enthusiasts in urban areas.