Region:Asia

Author(s):Geetanshi

Product Code:KRAD4785

Pages:92

Published On:December 2025

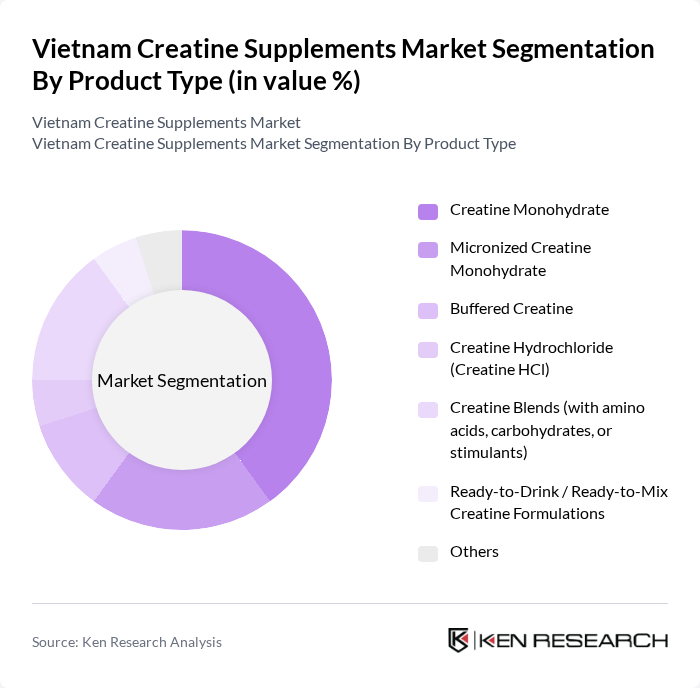

By Product Type:The product type segmentation includes various forms of creatine supplements that cater to different consumer preferences and needs. The subsegments are Creatine Monohydrate, Micronized Creatine Monohydrate, Buffered Creatine, Creatine Hydrochloride (Creatine HCl), Creatine Blends (with amino acids, carbohydrates, or stimulants), Ready-to-Drink / Ready-to-Mix Creatine Formulations, and Others. Among these, Creatine Monohydrate is the most popular due to its proven effectiveness, extensive clinical backing, and affordability, making it a preferred choice for both casual users and serious athletes and aligned with global creatine market patterns where monohydrate remains the dominant form.

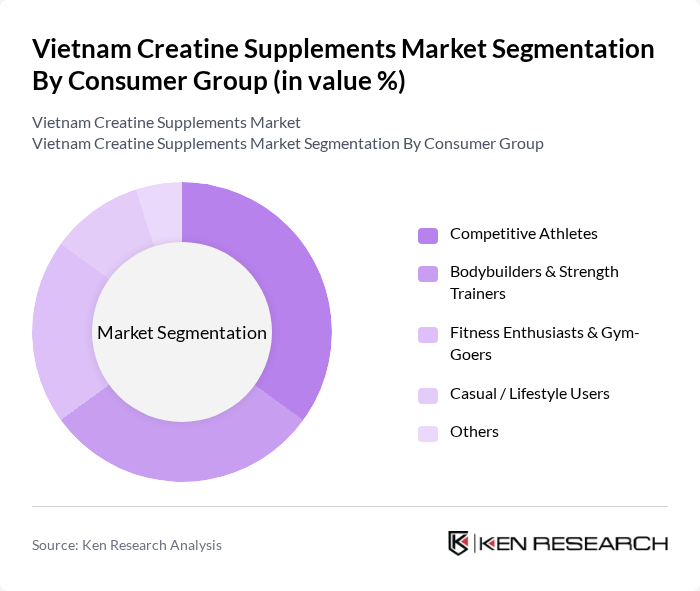

By Consumer Group:The consumer group segmentation includes Competitive Athletes, Bodybuilders & Strength Trainers, Fitness Enthusiasts & Gym-Goers, Casual / Lifestyle Users, and Others. Competitive Athletes represent the largest segment, as they are more likely to invest in supplements to enhance their performance and recovery, reflecting broader sports supplement usage patterns in Vietnam where athletes and performance-focused users drive demand. Bodybuilders and strength trainers also significantly contribute to the market, driven by their focus on muscle gain, strength improvement, and structured supplementation protocols, while an expanding base of fitness enthusiasts and lifestyle users is gradually broadening the consumer profile for creatine.

The Vietnam Creatine Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optimum Nutrition (Glanbia Performance Nutrition), MuscleTech (Iovate Health Sciences), MyProtein (THG plc), Dymatize Nutrition, Cellucor (Nutrabolt), BSN (Bio-Engineered Supplements and Nutrition), Evlution Nutrition, Kaged, Universal Nutrition, GNC (General Nutrition Centers), Th?c Ph?m Dinh D??ng Nutricare, Công Ty C? Ph?n Th?c Ph?m Dinh D??ng NutiFood, Công Ty TNHH Th?c Ph?m Danh Tính (Nam Viet Nutrition), Công Ty TNHH TMDV Th? Hình Elipsport (Elip Sport Nutrition), Công Ty TNHH Th??ng M?i & D?ch V? Th? Hình FitStore Vi?t Nam contribute to innovation, geographic expansion, and service delivery in this space, leveraging both offline specialty retail and rapidly growing e-commerce channels for sports nutrition and supplements in Vietnam.

The Vietnam creatine supplements market is poised for dynamic growth, driven by increasing health consciousness and a burgeoning fitness culture. As more consumers prioritize physical fitness, the demand for effective nutritional supplements will likely rise. Innovations in product formulations, particularly plant-based options, and the expansion of online sales channels will further enhance market accessibility. Additionally, collaborations with fitness influencers can effectively bridge the gap between consumers and brands, fostering trust and encouraging product adoption in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Creatine Monohydrate Micronized Creatine Monohydrate Buffered Creatine Creatine Hydrochloride (Creatine HCl) Creatine Blends (with amino acids, carbohydrates, or stimulants) Ready-to-Drink / Ready-to-Mix Creatine Formulations Others |

| By Consumer Group | Competitive Athletes Bodybuilders & Strength Trainers Fitness Enthusiasts & Gym-Goers Casual / Lifestyle Users Others |

| By Distribution Channel | Online Retail & Marketplaces (Tiki, Shopee, Lazada, etc.) Supermarkets/Hypermarkets Specialty Nutrition & Supplement Stores Gyms, Fitness Centers & CrossFit Boxes Pharmacies & Drugstores Others |

| By Packaging Type | Tubs & Canisters Bottles Sachets / Stick Packs Pouches Others |

| By Price Positioning | Premium Imported Brands Mid-range (Mix of Imported and Local Brands) Economy / Value Brands Private Label & Bulk Packs |

| By Form | Powder Capsules / Tablets Ready-to-Drink (RTD) & Liquid Shots Others |

| By Region | Northern Vietnam (including Hanoi) Southern Vietnam (including Ho Chi Minh City) Central Vietnam (including Da Nang) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Creatine Supplements | 120 | Retail Managers, Store Owners |

| Consumer Usage Patterns | 150 | Athletes, Fitness Enthusiasts |

| Health and Nutrition Expert Insights | 60 | Nutritionists, Dietitians |

| Market Trends and Preferences | 90 | Gym Owners, Personal Trainers |

| Distribution Channel Effectiveness | 80 | Wholesalers, Distributors |

The Vietnam Creatine Supplements Market is valued at approximately USD 40 million, reflecting a significant growth trend driven by increasing health consciousness and the rising popularity of fitness and bodybuilding among consumers.