Region:Middle East

Author(s):Shubham

Product Code:KRAA8564

Pages:83

Published On:November 2025

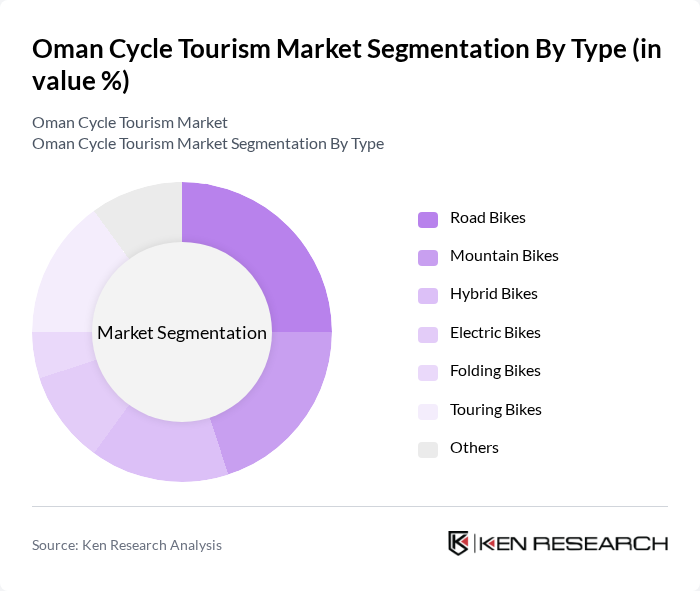

By Type:The market is segmented into road bikes, mountain bikes, hybrid bikes, electric bikes, folding bikes, touring bikes, and others. Each bicycle type addresses distinct consumer preferences and cycling experiences, shaping market dynamics. Road bikes are preferred for speed and efficiency on paved routes, mountain bikes for off-road adventure, hybrid bikes for versatility, electric bikes for accessibility, folding bikes for portability, and touring bikes for long-distance travel.

Road bikes remain the dominant sub-segment, accounting for a significant portion of the market. This is driven by the increasing number of cycling events and competitions in Oman, which attract both local and international cyclists. Road bikes are favored for their speed and efficiency on Oman’s scenic paved routes. The growing trend of fitness and outdoor activities among the population further supports the popularity of road biking.

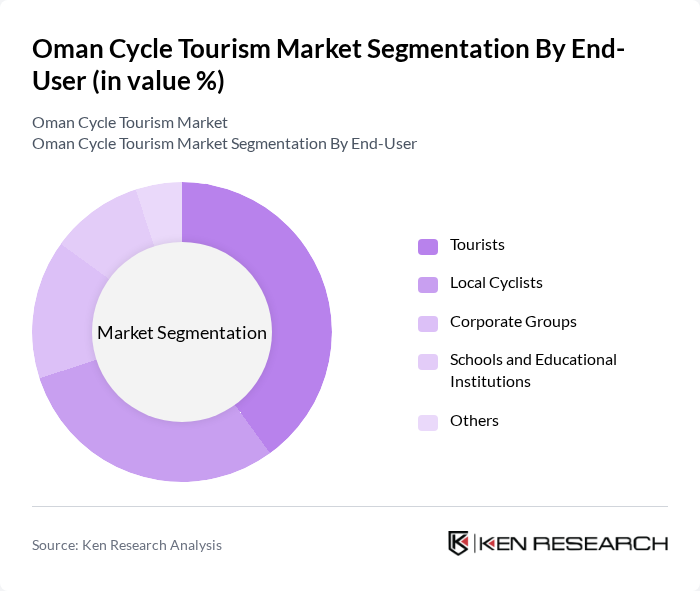

By End-User:The market is segmented by end-users: tourists, local cyclists, corporate groups, schools and educational institutions, and others. Each segment has distinct needs and preferences, influencing their cycling experiences. Tourists are drawn by Oman’s unique landscapes and cultural offerings, local cyclists by health and fitness trends, corporate groups by team-building activities, and schools by physical education initiatives.

Tourists constitute the largest end-user segment in the Oman Cycle Tourism Market, propelled by the country’s diverse landscapes and cultural experiences. The influx of international visitors seeking adventure and eco-friendly travel options has significantly boosted this segment. Local cyclists contribute substantially, motivated by health and fitness trends, while corporate groups and schools increasingly participate in cycling activities for team-building and educational purposes.

The Oman Cycle Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Cycling Association, Adventure Oman, Oman Bike Tours, Muscat Cycling Club, Salalah Cycling Tours, Oman Eco Tours, Cycle Oman, Oman Adventure Centre, Al Hoota Cave Tours, Omran Group (Oman Tourism Development Company), Oman Cycling Events, Muscat Bike Rentals, Oman Outdoor Adventure, Oman Cycling Federation, Zahara Tours contribute to innovation, geographic expansion, and service delivery in this space.

The future of cycle tourism in Oman appears promising, driven by increasing global interest in adventure and eco-friendly travel. As the government continues to invest in infrastructure and promote cycling events, the market is likely to attract a diverse range of tourists. Additionally, the integration of technology in cycling experiences, such as mobile apps for route planning, will enhance the overall tourist experience, making Oman a competitive destination for cycling enthusiasts in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Bikes Mountain Bikes Hybrid Bikes Electric Bikes Folding Bikes Touring Bikes Others |

| By End-User | Tourists Local Cyclists Corporate Groups Schools and Educational Institutions Others |

| By Region | Muscat Salalah Nizwa Sohar Others |

| By Tour Type | Guided Tours Self-Guided Tours Adventure Tours Family Tours Others |

| By Duration | Day Trips Weekend Getaways Week-long Tours Custom Tours Others |

| By Service Type | Bike Rentals Guided Tours Support Services Maintenance Services Others |

| By Customer Segment | Adventure Seekers Family Groups Corporate Clients Casual Riders Others |

| By Group Type | Groups/Friends Couples Family Solo |

| By Age Group | to 30 Years to 50 Years Above 50 Years |

| By Booking Channel | Direct Travel Agent Marketplace Booking |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Local Tour Operators | 60 | Business Owners, Tour Managers |

| Cycling Enthusiasts | 100 | Tourists, Local Cyclists |

| Hotel and Accommodation Providers | 50 | Hotel Managers, Front Desk Staff |

| Government Tourism Officials | 40 | Policy Makers, Tourism Development Officers |

| Event Organizers for Cycling Events | 45 | Event Coordinators, Marketing Managers |

The Oman Cycle Tourism Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by increased interest in cycling as a recreational activity and government initiatives promoting sustainable tourism.